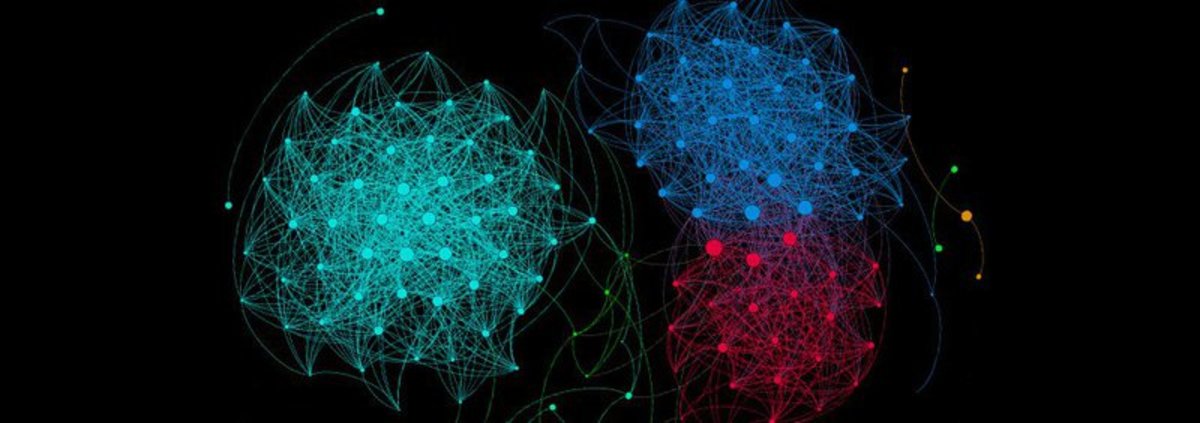

At the crux of the block-size limit debate in Bitcoin is an argument between scaling and securing the network. Although raising the block-size limit would allow more transactions to be processed in each block, it could also limit the ability for individuals in some parts of the world to run a full node or participate in the mining process. This problem would arise due to the increased costs of processing a greater number of transactions every 10 minutes as a full node.

Blockstream co-founder and President Adam Back recently discussed the security vs. scalability debate on an episode of Epicenter Bitcoin, noting that increased centralization due to a raised block-size limit could be even more problematic when factoring in all of the other forms of centralization that already exist in the digital cash system:

“One of the challenges we’re facing right now with the block size is that decentralization is already under stress. There’s a certain amount of centralization that’s crept in — sort of boiling the frog.”

Back, who created Hashcash (the proof-of-work system used by Bitcoin), then pointed to three specific areas of Bitcoin that already are experiencing problems related to centralization.

Mining Pools

The problems associated with the centralization of Bitcoin mining pools are generally known by the overall Bitcoin community. Whenever a mining pool gets close to 51 percent of the overall network hashrate, there are usually more than a few panic-induced posts on various Bitcoin forums warning of a possible 51 percent attack.

When it comes to the fundamental problems associated with large mining pools owning a majority of the network hashrate, Back seems concerned about the ability of those pools to introduce restrictions on certain types of transactions on the Bitcoin network. He stated the following during his interview:

“There are a number of quite high percentage hashrate pools and vertically integrated miners such that, arguably, it would only take a policy decision by maybe three to six of them to fairly, practically implement a policy.”

Back also was quick to note that such a policy implementation would not be completely successful due to the reality that the nefarious mining pools would not be mining every single block on the blockchain:

“Part of the way that Bitcoin achieves policy neutrality is that there are different people who process the transactions, so potentially even if 75 percent of the hashrate wanted to freeze or block a Bitcoin payment — let’s say Wikileaks had received a payment and someone wanted to stop them spending it — still, the remaining 25 percent would eventually process the transaction. So, it would just be delayed, not blocked. Nevertheless, there is a degree of centralization there.”

ASIC Mining Hardware Manufacturers

Another problem Back sees for Bitcoin in terms of centralization has to do with the companies building the hardware that people use for bitcoin mining:

“Another kind of metric is the number of ASIC manufacturers that are selling direct to the public or to small businesses or people that would buy $10,000 or $100,000 worth of mining equipment and put it in a small warehouse or garage or something. The number of independent ASIC manufacturers is, I think, decreasing. There are still a couple that will sell to the public, but there are also more that have turned their attention to vertical integration or have merged or been bought and a few that have gone bankrupt through poor timing in the market.”

One of the key issues here is that the most efficient mining equipment is becoming centralized in fewer and fewer hands. The fear is that it is becoming much more difficult for the average person to get involved in securing the Bitcoin network through mining — even if they’re willing to put up the relatively large amount of capital needed to build a mining facility. This could eventually lead to issues similar to the policy-related problems covered by Back when referring to mining pools.

Lack of Full Nodes

The third type of centralization that Back sees in Bitcoin is the dwindling number of full nodes. A full node is a node that enforces all rules of the Bitcoin protocol and contains a full copy of the blockchain. Back explained that these nodes are helpful in keeping miners honest:

“Another very interesting one that people are, I think, largely not aware of — which is behind some differences in opinion, I think, at the protocol level — is this concept of running a full node (sort of an auditing node). The percentage of economic interest in the network that is validating transactions that it receives via its own full node — I think we’re seeing evidence that that is falling as well. That is an interesting and necessary part of the Bitcoin security picture — that the proportion of economic interest in the network that is relying on a full node that is under its control or is trusted by it should be relatively high. If it falls too low, there is no longer a security assurance for users because the miners are providing a service to users — particularly for SPV users. If there are no auditors, there’s no kind of checkpoint; there’s only miners balanced against other miners.”

When asked to define Bitcoin at the start of the Epicenter Bitcoin interview, Back was sure to make the point that decentralization is the core value proposition of the peer-to-peer cash system. Censorship resistance is what separates Bitcoin from other online payment systems, such as e-gold and PayPal, so it’s easy to see why Back believes the preservation of decentralization is of the utmost importance.