This is an opinion editorial by Level39, a researcher focused on Bitcoin, technology, history, ethics and energy.

On December 14, the U.S. Senate Committee on Banking, Housing & Urban Affairs received inaccurate testimony regarding Bitcoin from actor Ben McKenzie and Professor Hillary J. Allen. The hearing, entitled "Crypto Crash: Why the FTX Bubble Burst and Harm to Consumers," had all the markings of political theater and provided a stage to misinform senators and the public. It coincided with Elizabeth Warren's new financial surveillance bill, which is a disaster for privacy and civil liberties. On December 18, the Senate Banking Committee Chair Senator Sherrod Brown divulged on “Meet The Press” that the hearing was intended to “educate the public” on the dangers of cryptocurrencies and floated the idea of banning them altogether.

Mr. McKenzie Goes To Washington

Actor Ben McKenzie, who has starred in “The O.C.,” “Gotham” and “Southland,” lacks the qualifications and expertise one would expect for being called before the U.S. Senate Banking Committee to testify on the inner workings of financial technology. It should therefore come as no surprise that he made basic errors in his testimony, and could have been avoided altogether had witnesses with actual expertise been called. According to Mr. McKenzie:

"Bitcoin cannot work as a medium of exchange because it cannot scale. The Bitcoin network can only process 5 to 7 transactions a second. By comparison, Visa can handle tens of thousands. To facilitate that relatively trivial amount of transactions, Bitcoin uses an enormous amount of energy. In 2021, Bitcoin consumed 134 TWh in total, comparable to the electrical energy consumed by the country of Argentina. Bitcoin simply cannot ever work at scale as a medium of exchange.

–Written testimony of Ben McKenzie Schenkkan, December 14, 2022, U.S. Senate Banking Committee

McKenzie’s testimony leaves one with the impression that he intentionally sought out the most biased and unreliable sources to confirm his own predetermined conclusions. Unfortunately, it was false information.

Leaving aside the fact that he referenced Digiconomist, an unreliable, exaggerated and seriously flawed electricity consumption estimate from a Dutch central bank employee's personal blog that lacks peer review (Cambridge University’s data is well respected and estimates that Bitcoin consumed 105 terawatt hours (TWh), or roughly 22% less energy than Digiconomist estimated, for 2021), McKenzie is effectively comparing a car engine to a wheel and not realizing how they relate to each other.

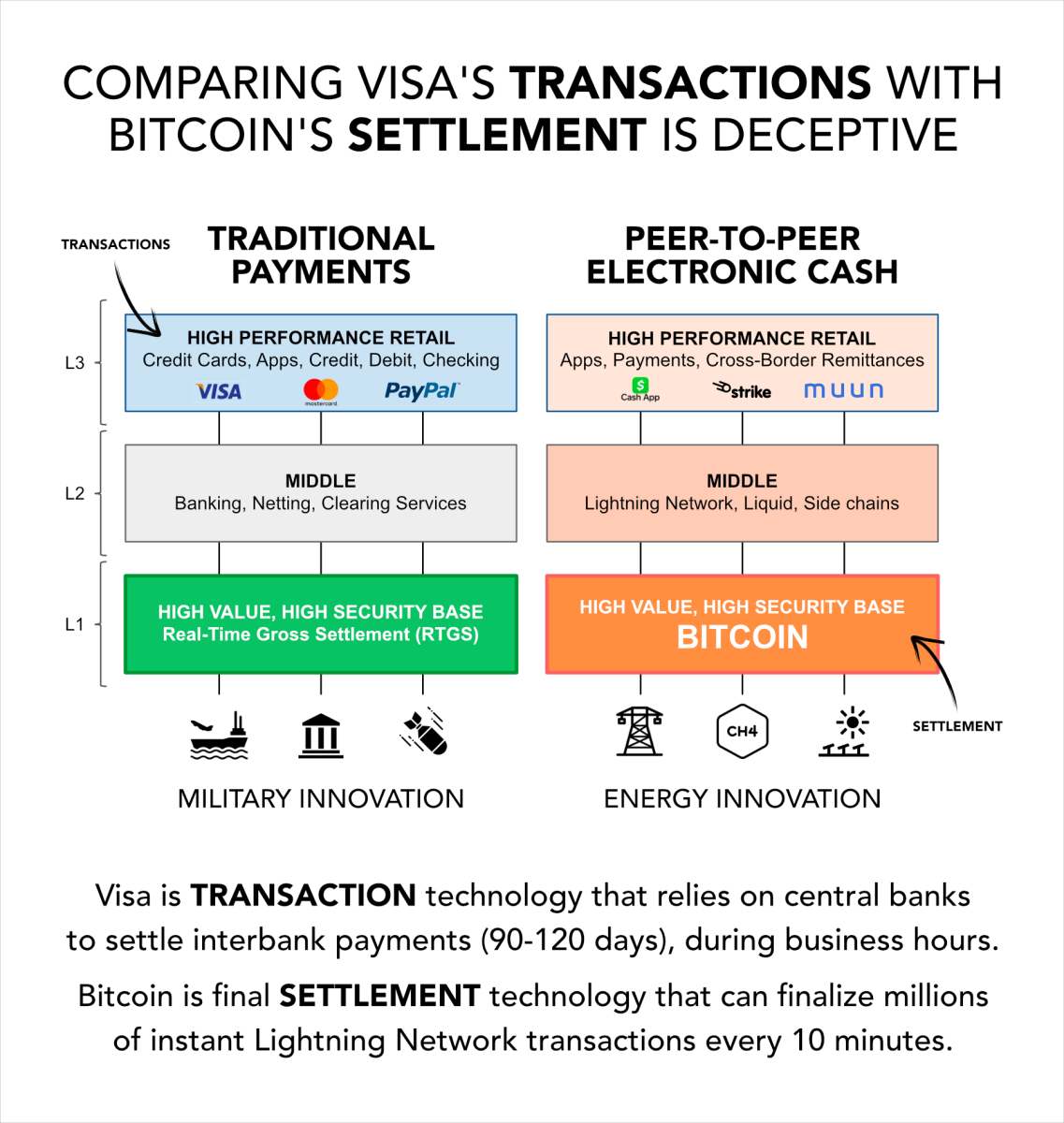

In technical terms, McKenzie conflated Visa’s transaction network with Bitcoin’s final settlement network, to make the illogical claim that Bitcoin cannot scale. This is a novice mistake. One could use the same faulty logic to make the erroneous claim that millions of retail payments within the banking system should be impossible because banks typically wait until the end of the business day to settle funds with each other. That, of course, is not true, as gross settlement is precisely how high-volume retail payments are batched between banks.

Visa is a credit-based transaction network. It’s not a financial institution, so it does not actually transfer money and cannot perform final settlement like Bitcoin can. Visa is effectively an IT company that informs its member banks how to clear and perform gross settlement with each other during business hours. If you’ve ever waited a few days for a check to clear, you know that payments between two bank accounts are not instantaneous. Credit card transactions take one to three days to post. And 90 to120 days to settle.

The Visa system works well and offers services such as risk assessment, fraud prevention and clawbacks, but can incur high fees from the banks and intermediaries along the way. Member banks aren’t actually sending each other tens of thousands of payments every second. Instead, they batch millions of transactions together into a small number of final settlement payments. The settlements are typically routed through lower-volume real-time gross settlement (RTGS) networks operated by central banks, such as Fedwire in the U.S. or TARGET2 in the EU.

Source: Level39. Original from Donald McIntyre.

Bitcoin and Fedwire can perform about the same number of transactions per year. In December of 2020, Bitcoin performed 26 million transfers (counting multiple outputs) across 9.6 million transactions, while Fedwire settled 18 million transactions during the same time period. Just as Visa operates on transactional layers that batch transactions into gross settlement layers, Bitcoin is designed to scale in a similar manner.

Bitcoin’s Lightning Network was formally theorized as a scaling solution at MIT in 2016 and today is a burgeoning Layer 2 open payments protocol, layered on top of Bitcoin. The Lightning Network enables instant payments, and micropayments down to a fraction of a penny, and can scale up to the entire world. Micropayments alone could change e-commerce and the internet itself as we know it. Imagine machines or people streaming fractions of pennies for content or APIs and you can already begin to see a new future for the internet emerging. Traditional finance simply cannot achieve this.

The Lightning Network allows high throughput Layer 3 retail payment apps and services such as Cash App, Strike and many other apps to efficiently batch transactions into Bitcoin's "blocks" for final settlement. Services on Layer 3 can offer the same protections we are used to in the legacy financial system, but anyone can freely access Bitcoin’s Layer 2 or Layer 1 whenever they want.

"While it would require time and investment, Visa’s payment network could sit on top of the bitcoin network to fulfill payments much the same way it sits on top of the existing banking system."

While Fedwire adheres to limited operating hours, shutting down on weekends and holidays, Bitcoin never shuts down and it continues settling transactions roughly every 10 minutes — 24 hours a day, seven days a week, 365 days a year. Bitcoin has achieved a similar uptime to Fedwire since Bitcoin's inception and has demonstrated better uptime than Fedwire since 2013. Fedwire experienced a major outage in 2021.

There is no doubt that the larger cryptocurrency industry has become rife with fraud, scams and deception and it's commendable that McKenzie makes an effort to warn the public about those dangers. However, in his haste to condemn the entire industry, he failed to fundamentally understand what sets Bitcoin apart from the seemingly endless “crypto” scams and fraud that have sprung up around Satoshi Nakamoto’s invention.

Bitcoin's Lightning Network has a theoretical throughput of 40 million transactions per second. Just as the internet took more than a generation to achieve today's levels of connectivity and reach, the Lightning Network would need time to grow its liquidity for it to achieve this theoretical maximum throughput. The performance of the Lightning Network is already astounding and is faster than traditional contactless payments. Thus, the testimony McKenzie provided to the U.S. Senate Banking Committee that, "Bitcoin simply cannot ever work at scale as a medium of exchange" was not only misleading, it was false.

Bitcoin uses multi-layered architecture, modeled after the existing financial system and banking systems going back to at least the 15th century. Layered architecture is an ideal pattern for well-built information technology systems — including mobile networks and the internet itself. This kind of deliberate and intelligent architecture is what enables Bitcoin to become a decentralized medium of exchange for the entire planet.

In his written testimony, McKenzie highlighted the issues plaguing El Salvador’s Bitcoin banking system, Chivo — a privately-built, government-controlled Layer 3 system that plugs into the Lightning Network. However, he failed to inform senators that users in El Salvador are free to use high-quality open-source wallets, such as Muun or Bitcoin Beach wallet and a wide range of others. More importantly, the technology is starting to make a difference in the lives of those who would otherwise be unbanked, as journalist Sharyn Alfonsi of “60 Minutes” discovered on a visit to El Salvador earlier this year.

McKenzie, who after getting high one evening decided to write a book on the rampant fraud in the crypto industry, has since begun a collaboration with journalist Jacob Silverman on the endeavor. McKenzie earned his bachelor of arts degree from the University of Virginia in 2001, majoring in foreign affairs and economics. That the U.S. Senate Banking Committee felt that an actor with an atrophied undergraduate degree in economics would somehow make an expert witness for a particularly complicated financial innovation suggests that the hearing was solely intended as political theater.

Senators Regurgitate Ben McKenzie’s Fallacious Testimony

When it was Senator Mark Warner’s turn to ask questions, he remarked:

“I do think it’s curious that China made the decision to basically take that kind of risk, to ban crypto, because of their, at least, risk/reward analysis... The clunkiness of the technology behind Bitcoin, it could never go to scale no matter what! If you can only do 5 or 6 transactions per second, that is not a scalable tool and obviously a technology at a power and environmental cost. It just doesn’t make sense to me.”

Ignoring for a moment that Senator Warner thought it was “curious” that an authoritarian country made the risk/reward calculation to ban free speech of code and software — which is protected under the First Amendment — McKenzie’s false testimony had misinformed the senator into thinking that Bitcoin cannot scale when it is in fact already rapidly scaling.

The Energy Debate

Earlier this year, McKenzie toured Riot Blockchain’s Whinstone U.S. — North America's largest Bitcoin mining facility, located about an hour outside Austin, Texas. When it was Senator Tina Smith's turn to ask questions, she turned to McKenzie and, doing her best to act confused, asked what appeared to be a series of pre-scripted questions:

SMITH: As I understand it, crypto mining is built on a process that becomes more and more energy intensive, over time. Is that correct?

MCKENZIE: Yes.

SMITH: So, it's inherently inefficient. Is that correct?

MCKENZIE: The technology is bad.

SMITH: And so, where is the benefit of this kind of innovation? How should we think about the impacts when it comes to the climate and energy impacts? Because when crypto mines are located in communities, those communities often see their energy prices go up — their energy rates go up — is that correct?

MCKENZIE: That's right. I visited the largest crypto mine in the country, Whinstone, which is in Rockdale, Texas, just outside of my hometown of Austin, Texas. Local citizens are upset. It raises the cost of electricity for all citizens. And it also uses an enormous amount of energy. It took over a former Alcoa aluminum smelting plant that had been abandoned and now we are using it to mine ephemeral digital assets of no productive value.

While it's convenient that McKenzie just happened to have visited a mining operation and could provide Smith with the exact answers that confirmed her biases, unfortunately he has zero expertise on energy markets, demand response programs, power engineering or mining and has no qualifications to inform congress or policy on the matter.

The idea that Bitcoin mining is an "inefficient" technology and therefore needs the government to reign it in is nonsensical. If it were as inefficient as claimed, there would be no need to stop it, since more efficient technologies would be able to outcompete it and easily replace it. This is precisely the reason we have markets — to let the most efficient and cheapest technologies win over the inefficient and expensive technologies that will fail. Those who are willing to take the risk on those technologies are either rewarded or bear the consequences.

McKenzie doesn't divulge that ERCOT, the Texas grid, is isolated and therefore is required to have excess dispatchable energy for extreme weather events. That excess energy needs to be consumed by large scale flexible customers who are willing to pay for it is an open market when it’s not needed. Buying energy that would otherwise go wasted, for computation, keeps dispatchable energy profitable and officially classifies Bitcoin miners as beneficial large flexible loads (LFLs) by the ERCOT grid. A recent ERCOT study showed miners are essential to its demand response strategy.

As demand response consumers, miners purchase wholesale energy in advance and buy private insurance products that incentivize them to turn off their machines when prices rise during periods of increased consumer demand — thus balancing the grid and its prices, while increasing grid reliability. The idea that McKenzie or any critic could isolate escalating power prices to a single consumer in a deregulated wholesale market is extremely dubious. Such a claim ignores the recent tripling in natural gas prices, as well as the recent build out of over 10 gigawatts of solar power and Texas load growth from non-mining customers, such as the Tesla Gigafactory.

While the Tesla Gigafactory may be considered a more productive use of energy, it is not nearly as flexible at demand response as miners. Miners de-risk excess renewable power and will instantly shut down for high consumer demand when prices rise. In fact, contrary to what McKenzie claims, The U.S. Department of Energy explains that demand response technologies are beneficial for "balancing supply and demand" and says "such programs can lower the cost of electricity in wholesale markets, and in turn, lead to lower retail rates."

While McKenzie may have come across local residents of Rockdale, Texas who were "upset" about the Whinstone mining operation replacing the town's abandoned Alcoa aluminum plant. In reality, the new mining facility is a net positive for the struggling community, boosting its economy, local tax collection and grid stability.

Senator Smith and McKenzie's suggestion that mining becomes "more and more energy intensive over time" is highly misleading and shows a lack of understanding of the technology. Like any publicly-traded commodity such as bitcoin, the energy required is economically linked to the public's demand for its declining issuance, and unfolds in a highly-competitive open energy market. There is nothing about the technology that requires the consumption of more and more energy over time. Bitcoin's four-year "halving" cycle reduces the rewards that miners receive to purchase energy. In fact, Bitcoin's critics claim that miners may not be able to afford to buy as much energy, decades from now — a topic which is hotly debated. Eventually, critics will need to get their stories straight. Either miners will have the money to purchase energy in the future or they won’t, however, both outcomes cannot be true.

Using energy to remove the need for equity-based governance is not “bad.” Equity-based governance was a common criticism of proof-of-stake "crypto" networks in the hearing. Using energy for issuance and security is breakthrough technology that has many applications for energy innovation that we are only just beginning to discover.

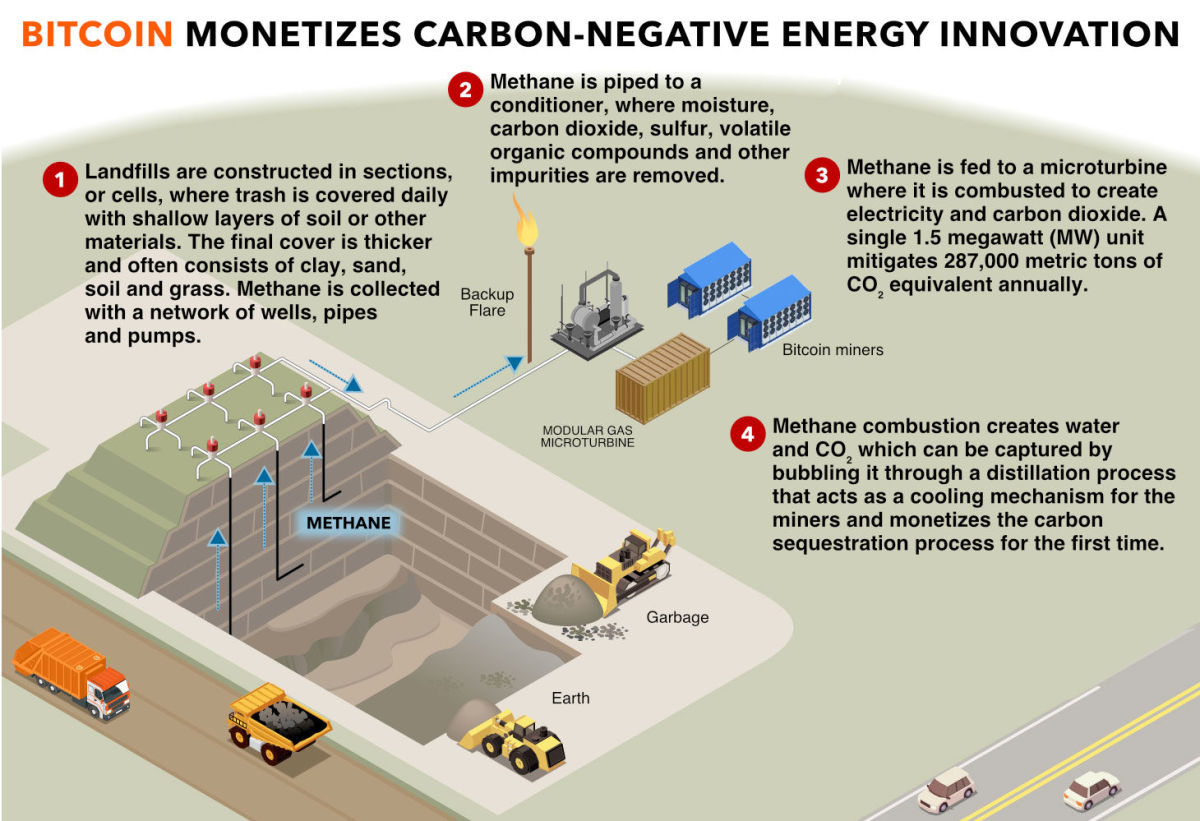

None of the witnesses or senators were even aware, or cared, that Bitcoin is on track to becoming CO₂e carbon negative by 2024, by mitigating CH₄ methane emissions. Nor were they aware that Bitcoin can monetize new sources of carbon-negative energy production, such as monetizing landfill gas and carbon capture. Or that Bitcoin can bring clean baseload power to one billion people in developing nations by monetizing stranded pilot plants that would be too expensive to test, prove and scale on a highly-competitive grid. In time, these stranded sources of energy will merge with our future grid.

Source: Level39. Original sourced from “Inside Climate News”

The Senate’s thespians don't care that Bitcoin mitigates waste methane emissions from oil and natural gas exploration where there is no other use for waste CH₄, which would otherwise be vented into the atmosphere and would heavily contribute to warming forces. To them, Bitcoin is "bad" simply because people having the voluntary option for a digital sound money, without counterparty risk, threatens their politics.

Professor Allen Fails Bitcoin 101

Professor Allen, an associate professor at American University Washington College of Law, made a fallacious claim about Bitcoin’s decentralization during her testimony:

"It's not decentralized... Bitcoin is controlled by a few core software developers — fewer than 10. And they can make changes to the software and that software is implemented by mining pools and there's just a few of them."

Allen's assertion is factually incorrect and shows a fundamentally flawed understanding of how Bitcoin works and why it is valued for being extremely difficult to change. Even if you believe that the project's maintainers, who have the elevated commit and publishing privileges, could persuade the largest mining pools to support their own whims, they would still need to persuade a majority of the world's independent miners to stay loyal to existing mining pools. Creating new competing pools is trivial and any software update supported by pools that miners disagreed with could easily be avoided by creating new pools for defectors to join.

And what if miners unanimously supported a software update that users didn't want? In 2017, 83% of the global hash rate attempted to force an update to increase Bitcoin's block size and failed because the users, who are actually responsible for propagating and interacting with the Bitcoin network through their own full nodes, refused to install the new software. The Bitcoin network simply doesn't exist or propagate without the user nodes, so miners defecting to their own network is pointless unless they convince users to come with them. The history of this critical test for Bitcoin was carefully documented by Jonathan Bier in his book, "The Blocksize War: The Battle Over Who Controls Bitcoin’s Protocol Rules."

Running a full node is fairly easy. At minimum, all it takes is a hard drive, a Raspberry Pi and an internet connection. Since Bitcoin updates with soft forks (backwards-compatible software updates), users who find themselves in the minority always have the right to dissent and oppose contentious updates by just continuing to run the software with the rules they signed up for. Additionally, even if the entire Bitcoin Core team went rogue, users would be able to install alternative competing clients in their nodes, without forking the blockchain.

Other so-called innovative “crypto” projects use coercive techniques to force updates while they try to rapidly innovate like software companies. No other project offers the kind of user rights that Bitcoin offers. As such, there is no incentive for Bitcoin users to run a fork that fundamentally changes Bitcoin's properties — its resistance to change is the core value proposition that its users are drawn to and demand.

Is it plausible that Bitcoin could be tested again and fail the same test in the future? Of course. But for Professor Allen to ignore the fact that users ultimately decide Bitcoin's fate — as well as its well-documented history proving its resilience to unwanted changes from miners and developers — shows Allen was either woefully unprepared to be discussing such technical aspects of Bitcoin or is intentionally misleading senators and the public with her testimony.

A Performance Of Misinformation

If anything was evident from the hearing, it was that there was zero effort to ascertain nuance or truth — the hearing was political theater. Unfortunately, having an undergraduate degree in economics, or reaching the higher echelons of Bitcoin-resenting academia, does not automatically qualify one to have the expertise to inform the Senate on how Bitcoin works. If only it were that easy. Understanding Bitcoin requires an open, multidisciplinary mind and hours upon hours of research just to begin scratching the surface. Perhaps Kanye West's recent public statement on Bitcoin could have gone a long way for McKenzie and Allen.

"As far as Bitcoin, I'm just not knowledgeable enough to speak on that subject."

Warren's rapid-fire question and answer session with Allen showed Allen nervously reading, verbatim, pre-scripted answers to Warren's questions. McKenzie on the other hand had the discipline to memorize and perform his lines with poise and confidence. If only they each had the expertise required to address the U.S Senate Banking Committee on Bitcoin — a technology that quite literally enables self custody and solves the breaches of trust that the hearing was ostensibly concerned with.

While Allen, McKenzie and the senators who invited them to testify were eager to perform their anti-technology, anti-free speech propaganda, the rest of the world is capitalizing Bitcoin for energy innovation. Just last week, Japan's TEPCO announced it is mining Bitcoin with surplus energy. And now Russia is set to pass a bill to legalize Bitcoin mining. Meanwhile, a distinguished U.S. national defense fellow is advising the White House on the strategic benefits of Bitcoin.

Whether the hearings participants realized they were being manipulated by politicians or not, participating in political theater means they are normalizing the loss of privacy rights as they lobby for legislation to limit the right to self custody digital property and one's identity. Such action not only empowers governments to enact greater monitoring controls, install social credit systems and strip personal freedoms, but it also exposes consumers to the prying eyes of corporations and any hackers that can infiltrate highly-centralized data. Ironically, such restrictions will empower their political opponents when our political pendulums invariably swing in the other direction.

While those unfamiliar with Bitcoin may believe they are siding with a morally superior government, Satoshi Nakamoto's invention is seen by many as American technology that digitally enshrines personal freedoms afforded to Americans by the Founding Fathers.

Meanwhile, Warren is headed in the opposite direction. She recently introduced a bipartisan bill with Senator Roger Marshall to aggressively close crypto money laundering loopholes by imposing Orwellian controls on all users. The bill seeks to make self-custody technology illegal — a dangerous policy that would expose Americans to mandated government surveillance and only increase the chances of the fraud that FTX committed against its users when funds were rehypothecated and stolen through their custodial platform. Stopping this kind of fraud was what the hearing was supposed to be about and is exactly the kind of protection that Bitcoin already empowers through self custody.

Warren argues that “rogue nations, oligarchs and drug lords are using crypto to launder billions, evade sanctions and finance terrorism.” This is fear mongering. The reality is that public, immutable ledgers are too transparent for most crimes. Physical cash is far better. Firms that do on-chain analysis for law enforcement have documented that cryptocurrency usage for criminal activity is rather low and is trending downwards. Warren’s eagerness to make self-custody technology illegal would be like banning the internet because phishing scams exist.

"Regardless, the good news is two-fold: Cryptocurrency-related crime is falling, and it still remains a small part of the overall cryptocurrency economy."

However, this is not to say that crypto doesn’t have a problem with fraud. To Allen and McKenzie's credit, 99.99% of the "crypto" market is indeed scams, and they should be commended for calling them out. Yet, to blindly call Satoshi Nakamoto's invention a scam shows a lack of critical thinking and expertise. To attack Bitcoin — an open, global and neutral economic protocol layer for the internet with no issuer and no central control — simply because one does not like it or understand it, shows a lack of humility and unwillingness to recognize real-world benefits with an open mind.

If they are willing to engage in thoughtful and meaningful discussion, Professor Allen and Mr. McKenzie would likely find a lot of common ground with members of the Bitcoin community, who commonly criticize the scams as well as the lack of ethics and integrity that pervade the industry. If not, it suggests they have an agenda.

If the U.S. Senate Banking Committee has any desire to preserve freedoms and keep the United States from falling behind other nations, it would do well to seek out actual experts who work in Bitcoin mining, energy markets and those who are using its layered payments architecture to build the next generation of commerce. Political theater will only cause the U.S. to fall further behind the rest of the world in all of these areas.

Alas, the U.S. Senate Banking Committee, led by Warren’s disdain for technology, seems more interested in preserving the power of big banks and mandating government surveillance. Progressives, such as Warren, should love Bitcoin as an open payment rail that empowers the freedom of economic expression, financial inclusion and circumvents predatory banking practices — something that progressives might one day find themselves in need of.

Instead, they appear to be flirting with the authoritarian playbook of China and its social credit system. Perhaps it’s just as well that the committee was misinformed by its unqualified witnesses, as they now have no idea how to stop a technology that manifests itself as free speech. Information wants to be free, a lesson the United States and its misinformed senators will need to learn one way or another.

This is a guest post by Level39. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.