Having been in development for more than two years, what promises to be the first proper decentralized Bitcoin exchange is set to officially launch next Wednesday.

Bitsquare, an open source project led by the Austrian-born Manfred Karrer, allows anyone to trade Bitcoin for fiat currency as well as altcoins, without requiring a company, central intermediary or permission from anyone.

Karrer:

“Bitcoin’s reliance on centralized exchanges is diametrically opposed to its principles. I hope Bitsquare will solve that problem.”

Decentralization

Karrer began working on Bitsquare back when Bitcoin trading was mostly centralized in one big player: Mt.Gox. But even today, long after Mt.Gox collapsed and the trading ecosystem is significantly more diverse, Karrer believes the heavy reliance on centralized exchanges is problematic.

“Exchanges provide a valuable service, as they are a bridge between Bitcoin and fiat currency, which is still very much needed,” Karrer explained. “But it's a double-edged sword: Virtually everyone who wants to use Bitcoin must go through these centralized and often strictly regulated companies, which makes them the effective gatekeepers of the system.”

Karrer believes this is a fundamental problem for Bitcoin. Of course, customers who store funds on these exchanges risk losing their bitcoins overnight, as Mt.Gox proved. But even if an exchange is solvent, or users don't keep their bitcoins on the exchange, there are other ‒ potentially even bigger ‒ problems, Karrer thinks.

“AML/KYC type of compliance, in combination with the transparent nature of Bitcoin's blockchain, represents a significant loss of privacy,” he said. “By piecing together the data collected by these exchanges, it can become trivial to figure out how much someone earns, or saves, or spends, and often even what the money is spent on. That’s not just inconvenient; it really makes Bitcoin unsuitable for all sorts of transactions ‒ including perfectly legal ones.”

And Karrer says privacy itself might not even be the biggest problem. An even more significant issue is fungibility: the concept that one unit of a money must be interchangeable for any other unit of that money, and carry the same value.

Karrer:

“Exchanges and large Bitcoin companies are already applying all sorts of coin tracing techniques. As a result, some have now begun to distinguish between 'clean' bitcoins with a known history and bitcoins used for illegitimate purposes, or even with an unknown history. If customers deposit such bitcoins, some exchanges ask quite intrusive questions, or outright block accounts. Over time, this could actually make these bitcoins less valuable, as they are harder to exchange for fiat. That’s a threat to Bitcoin’s viability as money. Users must be able to trust that any bitcoin received as payment is as valuable as any other bitcoin.”

He added:

“Even the most regulation-friendly Bitcoiners should be uncomfortable with this path we're on; it’s ultimately bad for user adoption. And that’s not even taking the added costs of this type of compliance into account. As a community, we must provide decentralized alternatives. I hope Bitsquare will be such an alternative.”

In Practice

Bitsquare ‒ in short ‒ works as follows.

To start, a user must download and install the Bitsquare software on his computer.

Once installed and opened, the software connects to other Bitsquare users through a peer-to-peer network over Tor. All these nodes will immediately send and forward their trading offers to the newly connected user. These offers are locally accumulated into a single order book, where they are categorized and sorted by price, payment method and more.

If the user sees an offer he likes, he can choose to accept it. If the user doesn't see an offer he likes, he can create a new offer, which is also sent and forwarded to all nodes on the network, and appears in their order books. As long as the user (or: his Bitsquare software) is online and connected to other nodes, his offer remains visible in all order books. (But if he closes Bitsquare, the offer disappears.)

Once a match is made, a series of steps is set in motion, most of which are automated by the Bitsquare software.

First, both parties in the deal appoint a mutually agreed on third party arbitrator ‒ or they simply accept the arbitrator that is appointed by default. (More on arbitrators in a bit.)

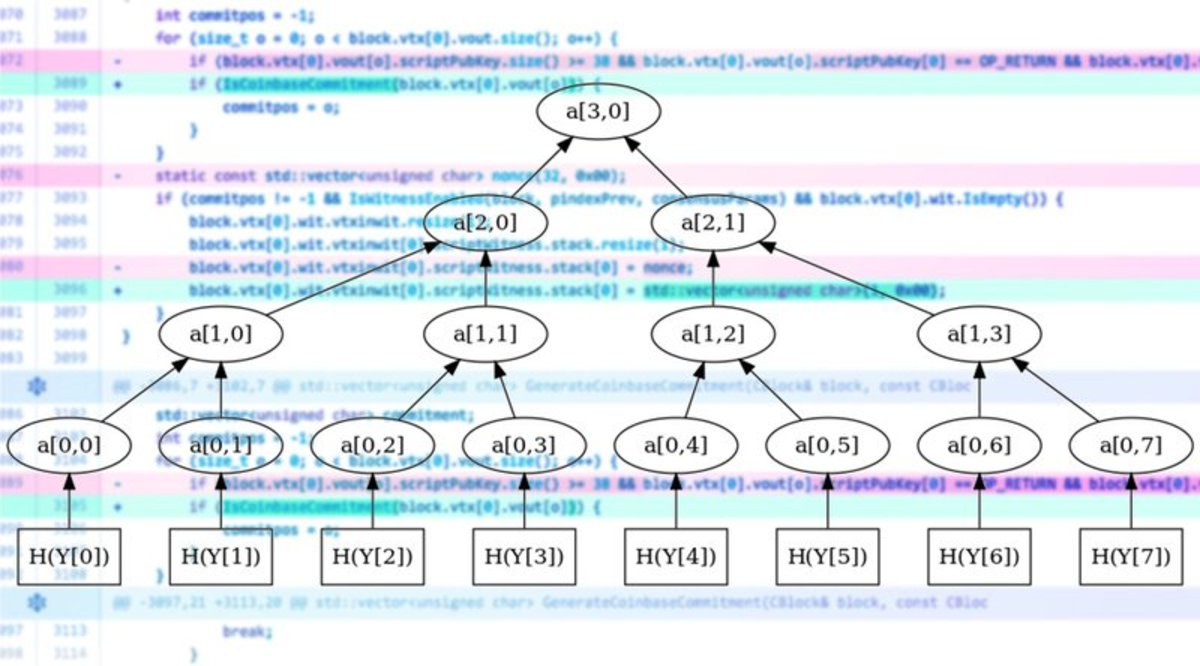

Second, both trading partners deposit bitcoins into a newly generated 2-of-3 multi-signature (“multisig”) address. Specifically, the seller deposits the bitcoins he's selling, while both trading partners include an additional security deposit. One of the keys of the multisig address is held by the buyer, one of the keys is held by the seller, and the third key is given to the arbitrator. As such, both trading partners need to agree before bitcoins can be spent from the address ‒ or one of the trading partners requires help from the arbitrator to do so.

Both trading partners also pay a small trading fee to Bitsquare’s stakeholders. (More on stakeholders in a bit as well.)

Third, the buyer sends his payment to the seller, outside of Bitsquare. This can be done in a number of ways, including bank wire transfers, several payment systems and various altcoins. When done, he confirms the payment on Bitsquare. This also signs his half of a transaction from the multisig address, which pays both trading partners their share of the locked up bitcoins. (This transaction now has one of two required signatures.)

Fourth and last, the seller receives the payment, and he confirms this through Bitsquare as well. This signs his part of the transaction, meaning two of the three signatures are included. The transaction is broadcast, and both parties are paid their share from the multisig address.

If all goes well, the arbitrator never comes into play.

Arbitration

It becomes a bit more complicated when not all goes well, for instance because the buyer never sends his payment, or the seller never confirms it, either party can call the arbitrator into play.

Karrer, explaining what the arbitration process will look like:

“If a dispute arises, the arbitrator first tries to get tamper-proof evidence created through tools like PageSigner, or perhaps a signed bank statement. If the users cannot or will not provide that, the dispute resolution process continues through more traditional methods, like ID verification and interaction over video chat.”

Based on the evidence provided, the arbitrator will ultimately unlock the multisig address along with the trading partner he believes was right. The two of them create a transaction to send that trading partner the bitcoins he deserves. And, as payment for his own effort, the arbitrator also gets to keep the security deposit of the party that violated the deal – if any party did.

These payments for dispute resolution should also serve as an incentive for Bitsquare users to step up and offer to be arbitrators for other deals ‒ though this option will not be available right from the start.

“In the long-run there will be a fully decentralized arbitration system, where anyone can become an arbitrator,” Karrer said. “To provide sufficient security, that arbitrator needs to pay a large deposit into a multisig address controlled by the arbitrators with the highest reputation. That system requires a few months of work, and is not in place quite yet, but it’s on the roadmap.”

In the short term, therefore, Karrer takes a bit more of a pragmatic approach.

“At first, I will be the only arbitrator,” he explained. “I think that makes sense, since users will already trust me to some degree as they are using software I wrote. More importantly, I have worked on this project for over two years, and I don’t want it to fail, so I have most to lose if users have a bad experience. I also expect most issues in the early days to be software bugs and usability issues, so it’s useful if I arbitrate these, to get direct feedback.”

Trade-offs

Compared to a centralized exchange, Bitsquare does include several trade-offs.

For one, trading on Bitsquare will typically be a bit slower. Where centralized exchanges allow users to get “in and out of Bitcoin” in a matter of seconds, trades on Bitsquare can take a day or more for fiat to be transferred from one user to another via wire transfers. Additionally, the barrier of entry to trade on Bitsquare will also be a bit higher in some ways, as users need to download and install the software and deposit some bitcoins as security. And, of course, there is always a risk of trades going wrong, as trading partners require each other to act swiftly and honestly for a smooth experience.

Karrer believes the trade-offs will be worth it for many users, however.

“It’s true that Bitsquare is not really designed for day-traders using wire transfers. Bitsquare more closely resembles something like LocalBitcoins in that regard. But note that some payment methods are instant, or at least much faster than wire transfers, in which case trades take as little time as a blockchain confirmation. And yes, there are some barriers of entry. But on the other hand, users don’t need to submit any ID-documents, there is no waiting period to be approved, or anything like that. It also removes barriers.”

And, addressing the risks of trading partners not acting properly:

“I believe the incentives align for everyone to be honest. The only real risk is probably fiat charge-backs due to hacked bank accounts. After a trade is closed and the bitcoins are sent to the scammer, a bank chargeback can leave the seller with nothing. To mitigate this risk, Bitsquare will limit wire transfer trades to 0.5 bitcoin for now; at such low limits Bitsquare will probably not be the preferred option for fraudsters looking to abuse hacked bank accounts. And if this type of fraud does ever become a problem, we can solve it with time-locked payout transactions, so arbitrators can step in after a fiat chargeback, if needed.”

Organization

On the other hand, Bitsquare also offers several benefits compared to centralized exchanges. Most obviously, Bitsquare users do not run any risk of the exchange abusing their funds or customer data: Bitsquare holds neither. In fact, Bitsquare is not even a registered company: it doesn't have employees, and Karrer emphasizes he is not its CEO.

Karrer:

“Bitsquare is an open source project; that's very important from a regulatory perspective. Like Bitcoin itself, there should be no central party to shut down or pressure into compliance. Even if I personally get harassed in some way or another, Bitsquare holds no customer data or funds. And the software is open source: anyone can verify it, use it, fork it ... it's out there and cannot be shut down, not even by me.”

Furthermore, Karrer intends to increasingly distribute control over the project. He wants Bitsquare to evolve into a DAO; a decentralized autonomous organization that will lead its own life.

“Bitsquare will be owned by shareholders, that through a voting system decide on virtually all of Bitsquare’s policies, including the issuance of new shares. These shareholders will also earn money from trading fees ‑ Bitsquare’s revenue source,” Karrer explained.

“I am currently the top shareholder myself, simply by the fact that I did most of the development. But I want to decentralize this ownership by paying shares to other contributors. I really hope that Bitsquare becomes a community project much like Bitcoin itself, where over time it no longer matters who created it.”

For more information on Bitsquare, visit bitsquare.io or read the project white paper for technical details. Karrer will also be presenting Bitsquare in a Bitcoin Meetup tour through Amsterdam, Arnhem, Barcelona, Berlin, London, Madrid, Milan, Prague, Tel Aviv, Vienna and more over the next weeks.