Contrary to popular media, Bitcoin does not need an ETF to remain relevant or to succeed. An ETF brings a large liquidity pool of money to the digital currency, but Bitcoin was never meant to be confined to rules and regulations. Unsurprisingly, SEC denial of the ETF was a large news event which allowed for easy selling pressure, down 25% on the day in an otherwise overbought market. Even without the ETF, Bitcoin gained large coverage on several news and media outlets that would not have otherwise covered digital currency — and there’s no such thing as bad press.

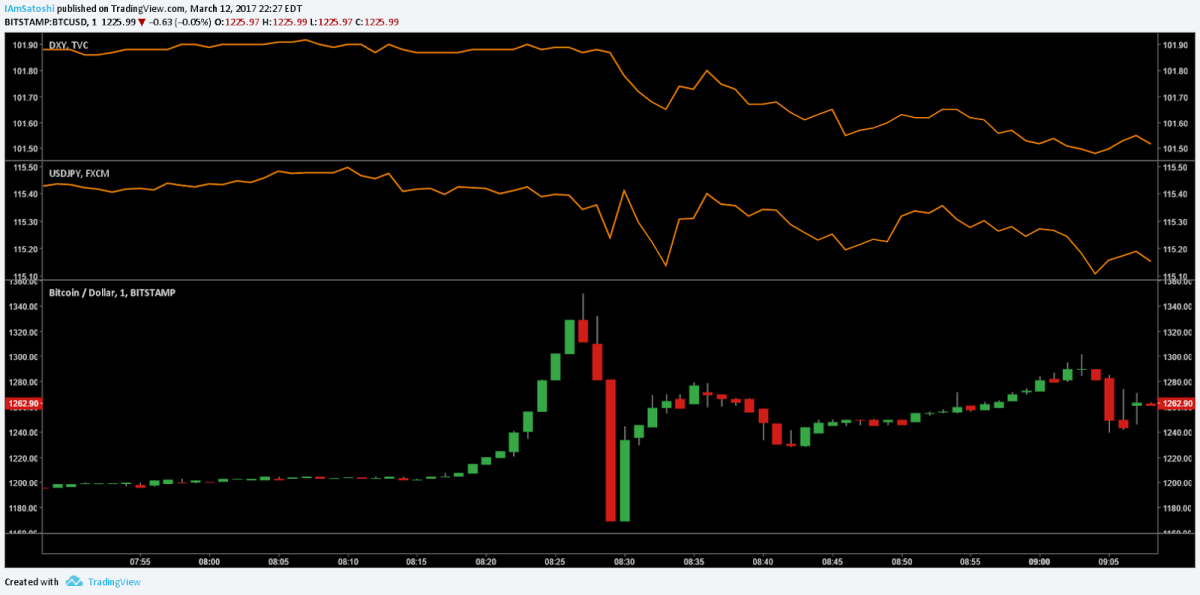

After any large price drop or spike, two things tend to happen. First, price attempts to retrace to 50% of the move. This is referred to as Dow Theory. It happens so frequently that many traders, use a buy low and sell at the 50% retracement strategy. Price convincingly broke the 50% retracement level just over 10 hours after the drop.

Second, depending if the price movement is in the direction of the overall trend, price tries to retrace the entire move. This is referred to as Filling The Gap. This occurs because after a large move, there is little to no immediate support or resistance preventing the price from returning to its previous position. Gap filling occurs more frequently when it is supported by an active trend, as is the case currently with the bullish Bitcoin trend.

There is also an active chart pattern on low timeframes, the bull flag, which has a probability of continuation over reversal. The predicted move can be measured from the bottom of the pole to the top of the pole, projected upward from the tip of the triangle. This yields a target of ~$1278, thus filling the gap and treating the SEC decision as though it never happened.

Recently, Bitcoin’s large price movements have been driven by things like PBoC announcements, but that certainly isn’t always the case. One can argue whether or not fundamental events move price more than technical indications; however, it can be preferable to focus on the technical aspect because it is more predictable than say, a random PBoC announcement in the middle of the day.

Bitcoin continues to snake through gold parity, which is largely meaningless aside from an ideological standpoint. The gold vs. bitcoin debate will continue to play itself out in due time.

Even more interesting than the SEC decision was a price spike earlier Friday morning at 8:30AM EST, which coincided with the U.S. jobs report. In Forex, this is referred to as Nonfarm payroll (NFP). These scheduled news events are almost guaranteed to cause price volatility. During this period, Bitcoin also made a new all-time high of ~$1320 on index and $1350 on Bitstamp, which was overshadowed by the ETF announcement.

Bitcoin’s reaction to NFP, which has occurred a few times in the past, gives evidence for Bitcoin being watched by legacy traders and algo bots. Whether Bitcoiners like it or not, the Bitcoin market will slowly begin to be increasingly influenced by external market forces and macro news events.

Summary

1. The SEC denial of the bitcoin ETF was a predictably bearish news event which dropped the price 25% in an already overbought market.

2. Typically, after a large price movement has completed, the next two targets are the 50% and 100% retracement levels.

3. Bitcoin has shown that even without regulatory oversight, it has begun to be incorporated into the fold of legacy traders and bots with reaction to news events like NFP.

Trading and investing in digital assets like bitcoin is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTCMedia related sites do not necessarily reflect the opinion of BTCMedia and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.