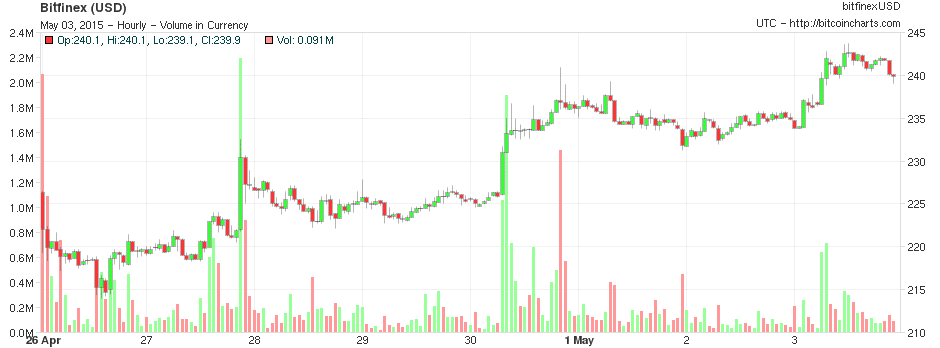

Cryptocurency markets have been very promising this week. Bitcoin started out at $220 and has crept up to approximately $240, making for a net gain of 9.5% for the week.

Also Read: Last Week’s Market Wrap Up

Volume has remained fairly level this week, currently sitting just under $18 million — a healthy sign of natural trading without whale influence.

The market graph shows a “tick-tock” pattern where the price will peak, move sideways, and then peak again. After the second peak, the pattern repeated, shown by both the seven day and one day market graphs. The one-day chart is seen above while the seven-day graph is seen below.

A possible catalyst of this growth was Circle’s announcement of the $50 million it received from Goldman Sachs and the venture group IDG Capital. Not only does this move give Circle with more money to improve its services, it also increases Circle’s overall valuation to this brings Circles valuation $200 million USD.

Seeing this kind of money flow into Bitcoin from such a reputable firm will certainly increase confidence in buyers, as well as improve Bitcoin’s reputation.

Circle is a currently one of the most well-funded companies in the Bitcoin sector, raising $27 million last year from investors such as Pantera Capital.

Altcoin Market Analysis

Litecoin’s price chart mimicked Bitcoin last week, suggesting that the price of the two currencies are still correlated after all.

The Litecoin price started the week at 0.0061 BTC, where it then spiked to a price of .00629 BTC and promptly leveled off. All in all, Litecoin had an 8.19% increase over the course of the week.

Litecoin’s trading volume was also relatively consistent throughout the week, staying below or just above the $2 million mark.

Vericoin had a solid performance this week as well. The coin has increased by nearly 100% in the last week, rising 28% at press time alone. Volume is approaching $20,000. However, this kind of rapid growth is often an indicator of market manipulation.![]()

The market graph shows too smooth of a line to be organic; there are no erratic spikes up or down which are common in a typical cryptocurrency trading environment.

However, Vericoin is rolling out its Proof of Stake Time (PoST) soon, which may be providing needed for whales to inflate the price. According to Vericoin’s website, PoST is “The next generation of the Proof-of-Stake protocol. This enhanced PoS method (PoST) will make stake distribution more fair and increase overall network security.”

Whoever is behind the sudden price increase in Vericoin will be the ones that dictate how long the uptrend lasts, and how much price will fall after the sell-off.

Compared with last week’s market wrap up, Bitcoin looks much healthier. If the trend increases to break through $260 and $270, evaluate the situation much more seriously. While growth is good, Bitcoin has a reputation for moving sideways, which it has been doing for weeks now.

Do you think the current trading situation will hold? What triggered the bump in price? Let us know in the comments below!

Media Sources: YouTube, CMC, BitcoinCharts

This author’s views do not necessarily reflects those of Bitcoinist.net