Bitcoin company Circle Internet Financial has completed a funding round of $50 million with help from banking firm Goldman Sachs and venture group IDG Capital Partners. Circle is also updating its core services to enable the transfer and storage of US dollars, which are insured by the FDIC and not subject to bitcoin’s volatility. These functions run parallel to Circle’s existing infrastructure and expand its scope of financial services.

Also Read: Wall Street and Silicon Valley Aren’t Investing in Bitcoin, They’re Investing in Bitcoin Business

Entrepreneur Jeremy Allaire launched Circle in October 2013 to make bitcoin “as easy to use as Gmail, Skype, and other consumer services on the Internet today,” according to The Boston Globe. The startup quickly became one of the most well-funded companies in the digital currency space, raising $27 million by mid-2014 from investors including Breyer Capital, Accel Partners, General Catalyst Partners and Pantera Capital.

Major Players Enter the Game

Now that pool of venture capitalists have returned in 2015 for another massive funding round — this time co-led by banking behemoth Goldman Sachs and China-based IDG Capital Partners. This brings the total investment in Circle to $77 million, and it places the startup’s overall valuation at around $200 million. According to one Goldman representative, Circle has immense potential in the global payments space.

“As the financial services industry continues to become more digital and open, we see significant opportunities in companies and solutions that have the promise to transform global markets through technical innovation,” says Tom Jessop, managing director of Goldman’s strategic investment group. “We think that Circle’s product vision and exceptional management team present a compelling opportunity in the digital payments space.”

The hope is that by utilizing ultra-cheap transactions on the bitcoin blockchain, Circle can provide instant and free transfers of money across the world. Company executives seem to be effectively communicating that vision to major investors on Wall Street and abroad. Now IDG Capital Partners — previously funders of successful Chinese startups Baidu and Xiaomi — will be helping Circle as it branches into Asia.

“Consumer finance is undergoing a profound transformation with the rise of mobile payment applications and a growing appetite for financial products from non-traditional providers,” says Quan Zhou, Circle board member and managing director of IDG. “We feel that Circle is strongly positioned to capitalize on these trends.”

New Features Add Fiat Support Alongside Bitcoin

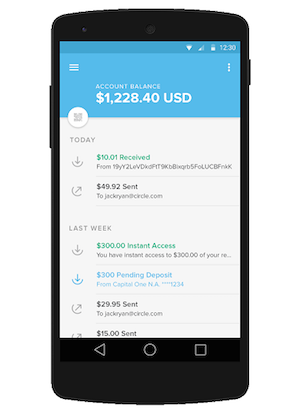

In addition to the $50 million funding round, Circle announced the rollout of new features that will allow users to interact solely with US dollars. It will be possible to hold, send and receive USD instantly and without fees — while at the same time being protected by FDIC insurance and the dollar’s stable value. This transforms Circle from simply a bitcoin company into a more direct competitor with PayPal and traditional banks.

“We’ve always preached this idea of the hybrid digital economy where fiat currencies can move frictionlessly around the world using bitcoin as the free Internet payment network,” chief executive Jeremy Allaire told the Wall Street Journal in an interview. He hopes that by partnering with foreign firms like IDG, Circle can eventually offer financial services for people who use fiat money like Chinese yuan and Japanese yen.

Those foreign advancements are further off, though, partly because of China’s complicated regulatory structure around payment systems. For now, the young startup is focusing on establishing its functionality for the United States dollar. The ability to store, send and receive USD is gradually rolling out to American accounts over the next few weeks.

This development will further blur the line between fiat and digital currency, while retaining the best features of both systems. Users who choose to hold their funds in dollars will be protected from loss by the FDIC-insured Silicon Valley Bank, and shielded from the wild price swings that digital currency is known for. At the same time, USD holders will be able to seamlessly pay anyone who accepts bitcoin.

“They can do this without knowing anything about Bitcoin and without exposing themselves to price volatility,” Allaire said in a statement to TechCrunch. “We really think of Bitcoin as a global interoperable payment network instead of a store of value.”

Innovative companies like Circle are continuing to leverage the bitcoin blockchain as a global financial system, and now that potential is grabbing the attention of major institutional investors like IDG and Goldman Sachs. With the addition of fiat storage and payments alongside the existing bitcoin infrastructure, Circle is gradually making its mark on the very definition of money.

What kind of impact will Circle’s evolution and expansion have on the digital payments arena? Let us know what you think in the comments below!

Photo Sources: Jin Lee/Bloomberg via Getty images, BitPost, Let’s Talk Payments