This is an opinion editorial by Shane Neagle, the editor-in-chief of “The Tokenist.”

Time and time again, we see the mainstream media taking advantage of Bitcoin’s perceived exploit: energy consumption. For the Bitcoin network, this path has become all too familiar.

Just look at what happened in May 2021, when Elon Musk effectively “broke” bitcoin’s price as Tesla announced it would no longer accept BTC as payment, citing environmental concerns. The price of a single bitcoin dropped by nearly $8,000 in the two hours following the announcement. There are countless similar cases as well.

But the takeaway is this: It’s very clear that the perception of Bitcoin’s fundamentals goes far beyond the security of the network, the soundness of the code and the asset’s limited supply. Bitcoin’s energy consumption plays a role, too. So big of a role, that it significantly impacts not just the price of bitcoin, but its regulatory framework as well. For better or for worse, this really can’t be argued.

But what if Bitcoin’s energy consumption was actually a good thing? What if Bitcoin functioned as a “store of energy” that provides a superior alternative to any monetary system we’ve ever seen?

Fortunately, the concept of an energy-backed currency is not as radical or novel as people may think — it has been around for more than a century. But the necessary conditions (i.e., the technology) did not yet exist to facilitate such a game-changing development for civilization.

That technology now exists, however, and it’s called Bitcoin. Let me explain.

Money And ‘Life Energy’

The evolution of human civilization largely centers upon the resolution of one key question: How do we appraise the true value of goods and services?

More specifically, how do we assess such value in the most uniform and effortless manner possible?

Consider the era of ancient barter systems, when a uniform system of fiat currency had yet to be conceived. Exchanging crops or livestock for services was commonplace. However, this system was fraught with inefficiencies, as it was heavily reliant on the mutual coincidence of wants. Consider a fisherman looking to trade his fish — but only for salt which he needed to preserve his future catch from spoiling. Any individual looking to trade for fish, must now have precisely what the fisherman wanted: salt.

In such a scenario, it’s easy to see how the principle of supply and demand is skewed.

Determining an equitable exchange for unique, non-fungible items poses a distinctive challenge. How do we ensure that both parties are duly rewarded for the energy they’ve invested — their “life energy” — in producing the product or service they’re selling?

This concept of “life energy” refers to the time, effort and creative energy that individuals pour into their work. Every human has a finite time span that they convert into tangible, productive output — a measurable form of energy.

But in this system of bartering, life energy isn’t appropriately accounted for. Rather, external factors heavily influence the value of a product or service — frequently to the detriment of the life energy devoted to its production.

Ideally, we need a system that allows for the accumulation and storage of this expenditure of energy — which we can refer to as “surplus energy” — and its associated value.

The advantages here go far beyond the individual who expended such energy. The metaphorical lifeblood of any economy is this concept of “surplus energy.” If this flow is impeded or clots, it leads to a less vibrant, stagnant economy. If it’s properly stored and fluid, it can lead to innovation and breakthroughs which benefit the society at large.

If we don't establish accurate mechanisms, capturing and storing surplus energy or value becomes impossible.

Hence, it becomes vital to measure this energy output in the most streamlined manner possible, to ensure fair compensation for — and ability to capitalize on — the energy expended. In this respect, a significant landmark in civilization’s journey was the evolution from bartering to commodity money, eventually leading to the use of portable, interchangeable and standardized metal coins.

A Historical Devaluation Of Life Energy

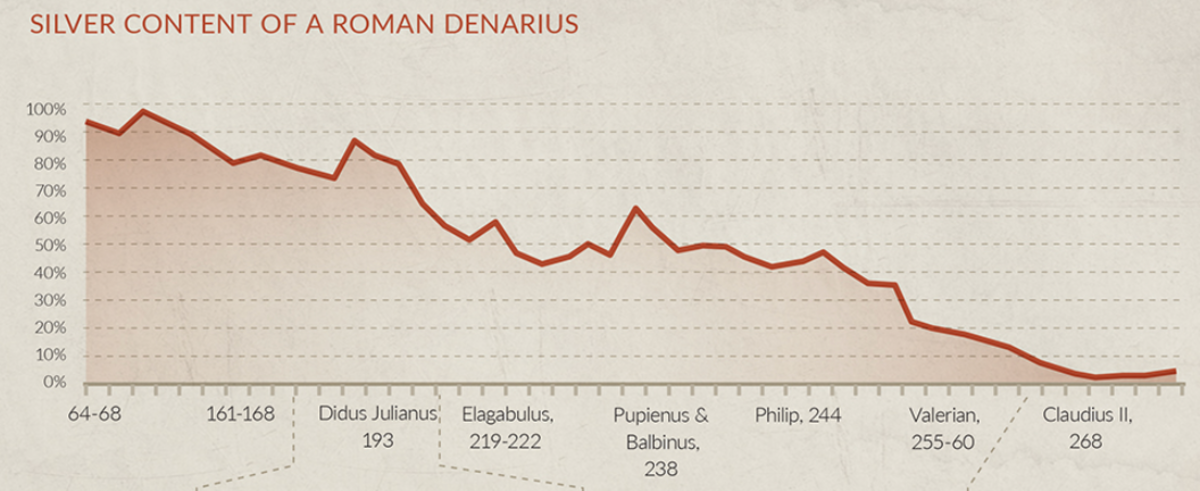

The Roman Empire built itself on economic efficiency by minimizing money friction. Its blood was the denarius currency, molded out of the limited supply of precious metals. The limited nature of the denarius allowed for it to serve as a store of value.

Concurrently, the denarius’ portability as a store of value allowed it to spread across every corner of the empire, easily transported and traded by various merchants. Consequently, the economic circulatory system overflowed with energy. As the friction within the exchange of goods and services was minimized, new specialized labor markets could form, which increased productivity and innovation.

In monetary terms, all was good. The Roman civilization achieved a commodity currency which facilitated economic expansion. Such a standardized currency, portable and limited as it was, stored and efficiently captured Roman energy into productivity and economic growth.

Until it didn't, by decree.

As each Roman emperor desired to expend more energy than the currency allowed, they started to erode the denarri’s store of value.

The denarius remained portable and fungible, yet it began to falter in its ability to accurately represent people's life energy outputs. The silver content of each denarius became smaller and smaller, eroding the currency’s ability to maintain value and, ultimately, purchasing power.

Eventually, denarii became solidi, with no silver at all. Image source.

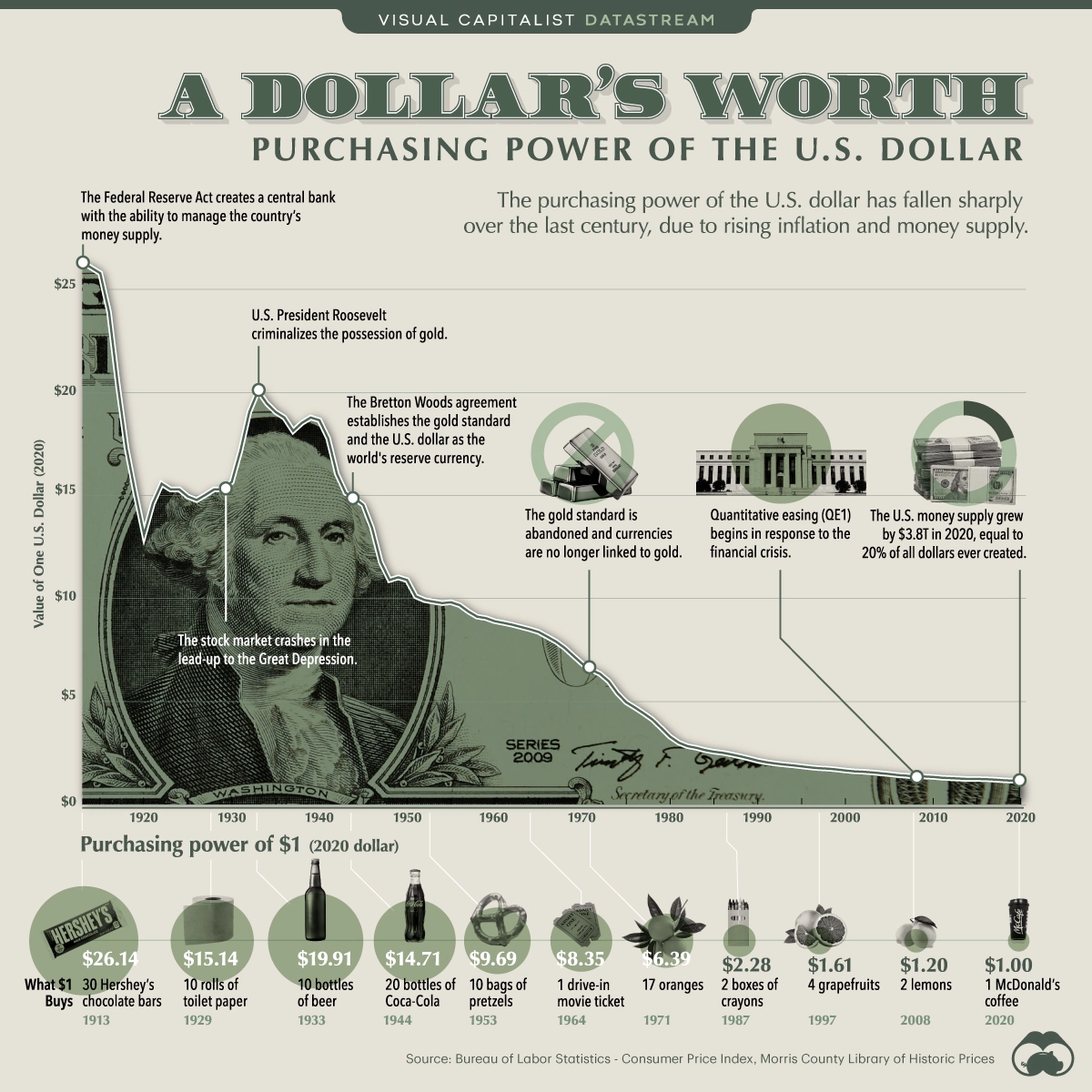

Today, we understand this as inflation. With each currency debasement cycle, people lost confidence that their life’s energy output was properly measured, quite similar to what’s happening today:

The United States is in a peculiar historic position in which it can export domestic inflation thanks to the status of the dollar as the global reserve currency (GRC). Therefore, wages can keep growing at an inflationary pace. But, as debt ceilings have become debt ladders, no one knows for sure for how long this will be sustainable.

And it is definitely not sustainable in many other countries with double- and even triple-digit inflation rates.

Money: What Needs To Be Fixed?

So, what patterns can we observe from our monetary history?

First, to properly measure life’s energy outputs, the gauge needs to be fungible and standardized, facilitating a feasible calculation of the value of nonfungible goods and services. Second, the gauge needs to simultaneously store value and be portable.

These baseline elements provide people with a tool to accurately transform their limited time and energy — life energy — into a productive, well-compensated energy output.

When we look at all modern fiat currencies, their stores of value rest on shaky grounds. The problem is, central banks have replaced emperors — but their decrees are no less disruptive.

At a fundamental level, the exchange of funds between employers and employees is the exchange of energy. But neither employers nor employees control this compensatory energy’s current(cy). That energy’s current is provided through currency — and it’s entirely controlled by central banks.

Thus, it is central banks that uniquely possess the authority to modify that energy current over time, echoing the practice of ancient Roman emperors.

The biggest influence on a currency’s store of value is its supply and issuance schedule. Central banks and Roman emperors alike have had a tendency to radically change available supply, negatively impacting this attribute.

In turn, this negatively impacts people’s ability to capitalize on their expended energy.

Energy Currency As New Milestone Technology

From bartering and commodities, to metal coins and fiat paper currency, history’s monetary experiments have delivered actionable conclusions.

Alongside portability, maintaining the integrity of the currency’s store of value is of the utmost importance. For this to be achievable, it must not rely on arbitrary decrees.

And this is precisely the revolution Satoshi Nakamoto brought with his Bitcoin white paper. The trust must be removed from the centralized entities which have complete control over monetary systems — and the ability for individuals to capitalize on their expended energy through labor: “an electronic payment system based on cryptographic proof instead of trust,” as Nakamoto put it.

The question then shifts to: How do we secure that new component of trust?

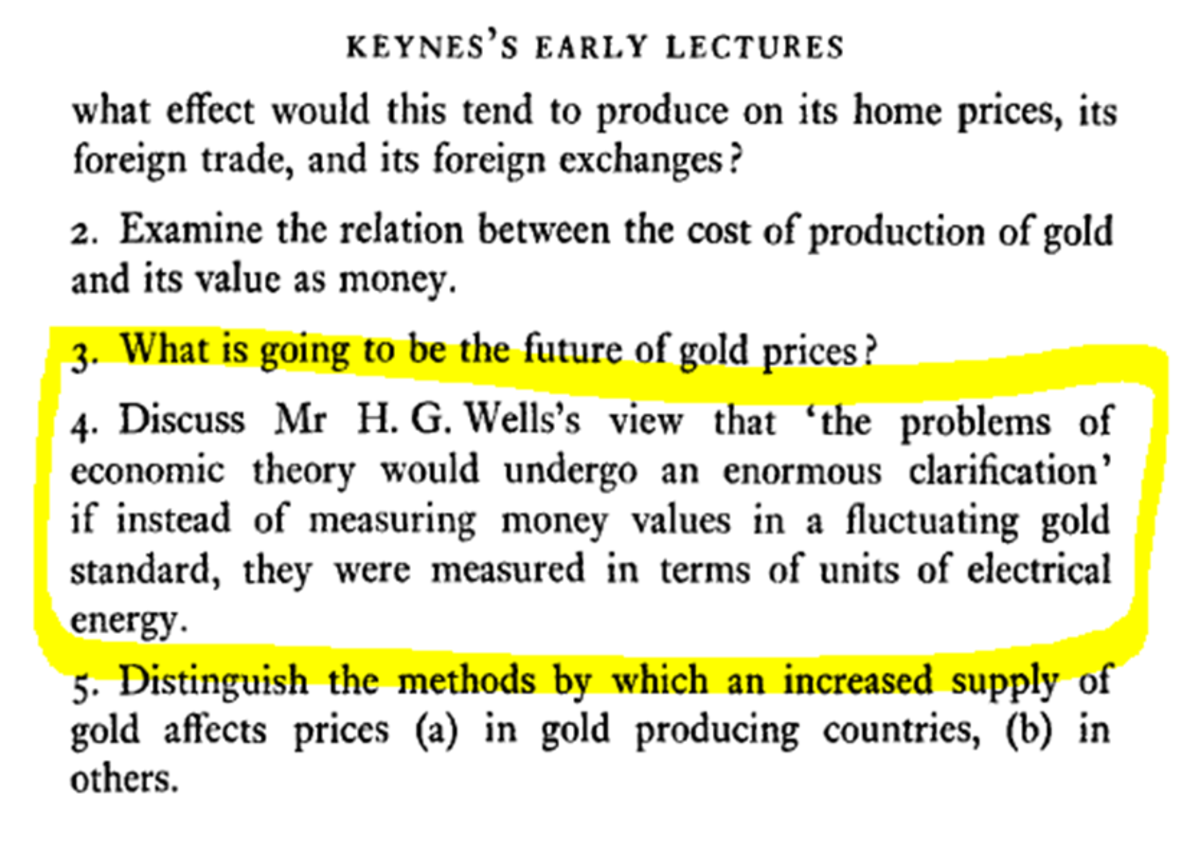

Past intellectuals have argued for backing money with units of energy. Namely, in John Maynard Keynes’ lectures of 1912 to 1913, which provided the intellectual framework for a means of measuring money “in terms of units of electrical energy.”

Image courtesy of Twitter.

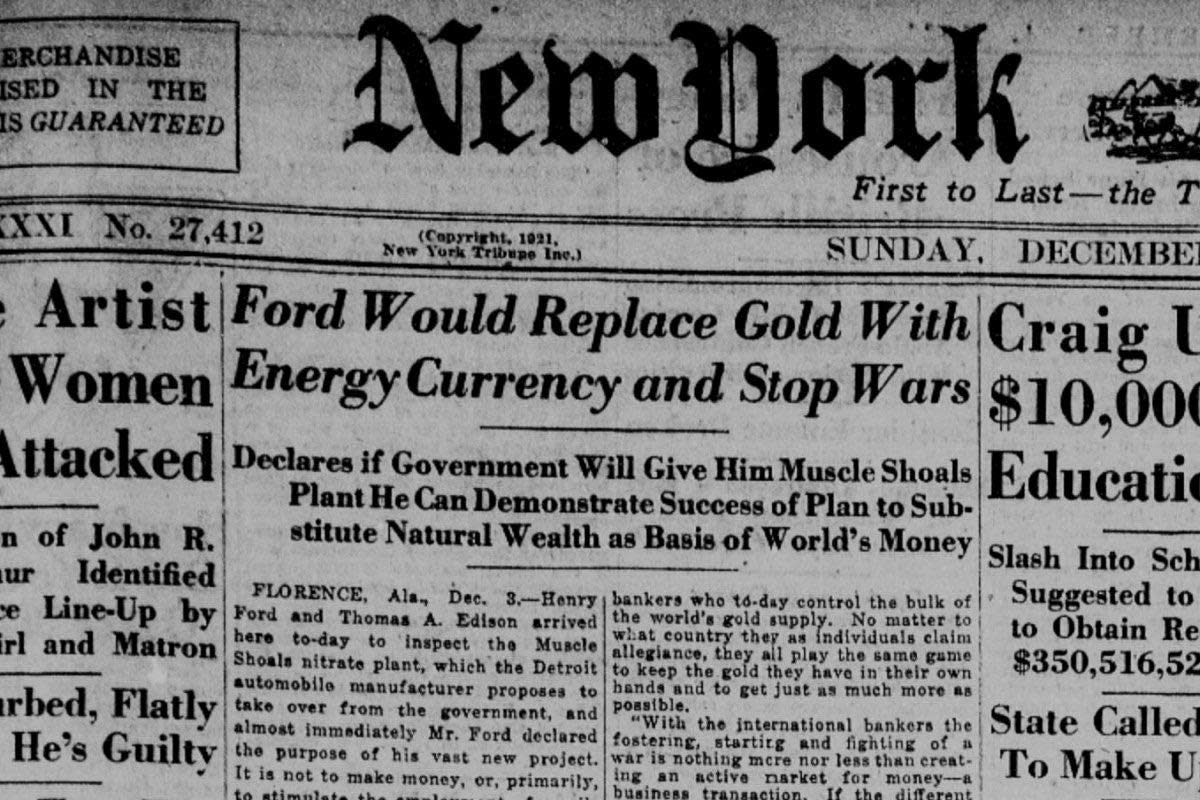

Ever ahead of the times, American industrialist titan Henry Ford actually proposed an energy currency soon after, in 1921. Ford’s “units of power,” generated from the world’s largest power plant, were to solve the problem of “the international banking group to which we have grown so accustomed that we think there is no other desirable standard.”

Image courtesy of the Library of Congress.

Bitcoin: An Energy-Secured System Of Energy Transference

In the case of Bitcoin, that new component of trust is secured through energy.

Bitcoin is not only portable but digitally portable, complementing our digital era. It’s not merely scarce, but its scarcity is defined in an energy-agnostic way. This links back to Ford’s dream of an energy-backed currency, but with a fundamental difference. Ford’s envisioned energy currency, tied to the world’s largest power plant, would have been susceptible to vulnerabilities associated with centralization. In contrast, Bitcoin leverages energy from any source available.

The decentralized nature of computing power creates a resilient and robust system. It is through this energy itself that the Bitcoin network secures this new component of trust — cryptographic proof.

In this light, it is no coincidence that Michael Saylor paints the vision of Bitcoin as the solution to the problem of how to store energy over time and across space.

Returning to one of the first points mentioned, where Bitcoin’s perception goes beyond its own fundamentals, two questions remain: How durable should Bitcoin be to external factors? Are there any legitimate threats out there?

Just look at new technology which is developing at breakneck speeds. Artificial intelligence (AI) is anticipated to heavily impact the finance world — from long-term investing and portfolio management to shorter-term options trading. Yet with the development and mass integration of AI, reality and illusion will become intertwined. Separating the two will become an arduous task.

How will such significant innovations impact Bitcoin?

Bitcoin is poised to endure such technological revolutions. The immutable nature of the blockchain allows for a degree of verifiability which the development of AI will create a greater need for. Yet even more importantly, Bitcoin advocates see how Bitcoin represents something of a vocation, rather than an asset merely for speculation and profit. This type of “larger than life” support will only help Bitcoin to endure life-changing innovations, political regime changes or any other existential “threat” that may arise in the future.

Yet there remains an ongoing absence of the proper framework when it comes to Bitcoin’s energy consumption, as I’ve tried to articulate here.

According to a recent poll, for example, 76% of investors want BTC to be more “environmentally friendly” — which misses the mark when it comes to the relationship between Bitcoin’s energy use (or, in other words, its means of securing the network) and our ability to effectively capitalize on the life energy we devote.

With its distinctive ability to store and transfer energy, the Bitcoin network fixes this dilemma.

Not only is the network secured by energy, but it has the potential to effectively enable individuals to properly capitalize on the use of their life energy. This means Bitcoin has already ventured into the unprecedented territory of an energy currency — not just for the benefit of the individual, but of society at large.

History is here and the journey has just begun.

This is a guest post by Shane Neagle. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.