The Federal Reserve balance sheet increased by $300 billion in one week, leading to debate about...

While many bitcoin investors look for the asset to behave as a safe haven, bitcoin typically...

How many bitcoin users are there? How should we define a bitcoin user? An analysis for...

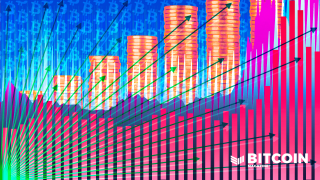

Everyone is waiting for the next big breakout or breakdown before allocating again. Compressed historical volatility...

One of the most important factors in the market is liquidity. The global reduction in liquidity...

September’s CPI release comes in hot and sparks one of the most volatile days we’ve seen...

Markets await the highly anticipated September consumer price index data release. A higher CPI could easily...

Central banks are trying to keep yields from exploding higher while they hike rates to fight...

Bear market rallies look to be playing out for both the S&P 500 Index and bitcoin....

The Luna Foundation Guard was forced to send a majority of its holdings to exchanges as...

As the Terra stablecoin becomes increasingly depegged from the U.S. dollar, the biggest buyer of bitcoin...

The strengthening of the U.S. dollar and the growth deterioration across major global economies will likely...

It’s possible that equities volatility has yet to peak this year and further volatility spikes could...

The trend of falling hash price will force weaker miners to unplug, find more efficient energy...

Bitcoin is a historic opportunity for retail and individual investors to access assets and economic wealth...

Last month, the top public bitcoin miners increased their hash rates and bitcoin holdings.

As a violent credit unwinding seems inevitable, on-chain data suggests bitcoin holders remain convicted.

Looking at current bitcoin market values over historical percentiles to show when the market is bottomed,...

We look to be headed toward a trend of increased BTC holder accumulation following a local...

January once again saw the bitcoin holdings and hash rates of publicly-traded bitcoin miners go “up...