In an episode of Bitcoin Spaces Live, released by Bitcoin Magazine on November 3 2021, Michael Saylor made the claim that bitcoin is going to “demonetize” index funds.

“The war is bitcoin versus gold and bitcoin versus index funds… the war is against weak assets, and bitcoin is going to demonetize $100 trillion of them next.”

What does it mean to demonetize an asset? It means to take away it’s status as money. Not good for owners of these assets. In this article, I am going to focus on the potential for bitcoin to eat the lunch of index funds.

How can you “demonetize” index funds if, after all, they are … funds? The answer is that index funds are used as money in the broad sense. The larger ones, such as those that track the Standard & Poor's 500 index, are a de facto store of value for retirement savers. Therefore, there is a monetary premium placed on these products that goes beyond pure investment for the holders of them. This is one reason why Saylor calls index funds “weak assets” whose value will be transferred to bitcoin.

There are advantages to index funds, but I think their dominance is unsustainable over the long run. Bitcoin is here as the ideal alternative.

The Advantages Of Index Funds

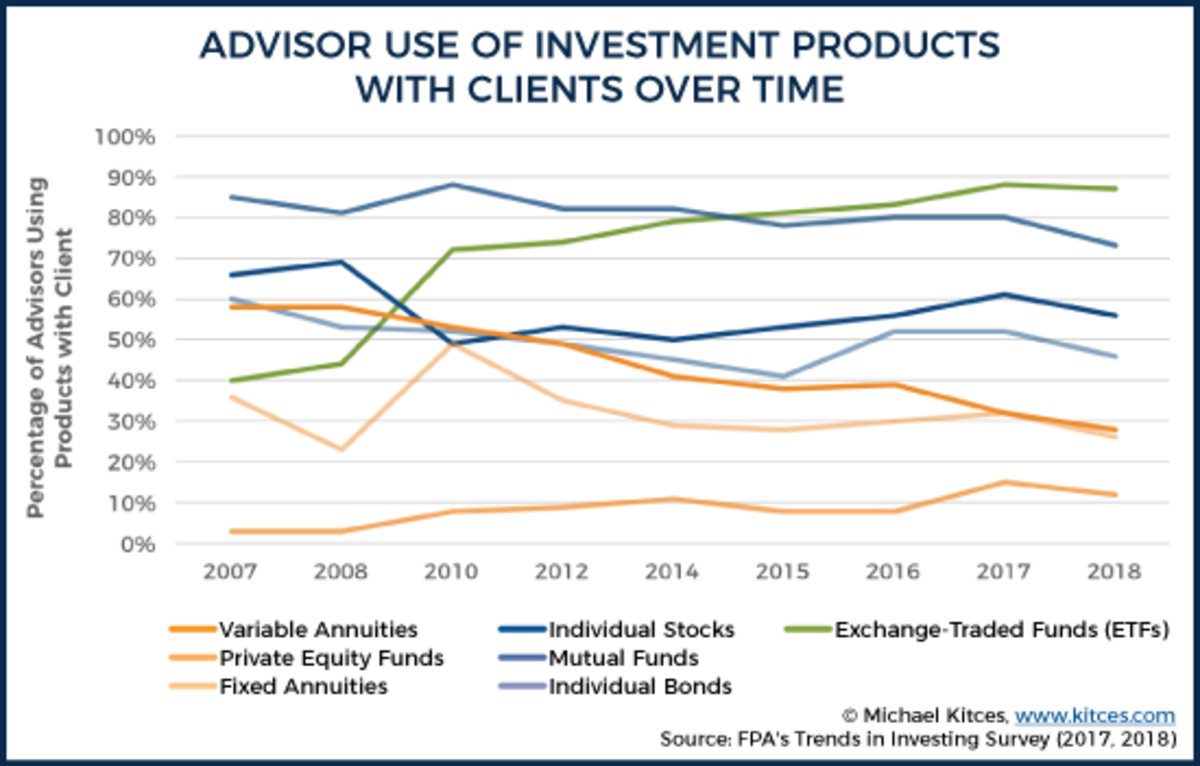

In over a decade as a financial advisor, clients have looked to me to point them in the right direction on how to allocate their savings and investments. When I was first starting out I remember hearing an old Wall Street adage, “nobody gets fired for buying IBM.” Today, it could very well be “nobody gets fired for recommending an S&P 500 index fund.” Index funds and index-based ETFs (I’m using these terms interchangeably) have become the preferred solution for wealth managers and retirement investors today. It’s a sacred cow.

An index fund, according to Investopedia, is “a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor's 500 Index.” There are good reasons why the growth of these products have exploded. Lowering expenses, winning by not losing, is important. Most importantly, John Bogle (founder of The Vanguard Group of investment companies)’s brilliance was about preaching the discipline to buy-and-hold ... to HODL, if you will.

The index fund gave us a simple way to participate in the appreciation of stock indexes without having to pay high expenses. They were a necessary innovation in an era where unsophisticated savers have been forced to participate in investments they know nothing about because of fiat inflation.

The Problems With Index Funds

The crux of the matter is that index funds are what I call “nihilistic” investing, because it is investing where nothing matters.

To understand why, let’s take a look at the example of checkout lines in a grocery store. You may notice that it is usually the case that every checkout line at the grocery store is about the same length. Why is this?

The reason is because each shopper surveys the lines and then stands in the one that appears the shortest. The collective result of these decisions are orderly lines that are more or less equal. It is order that is created by no one person.

But imagine instead if everyone said to themselves, “the markets are efficient, the lines are always equal, so I will just naively stand in the first one.” Now the orderliness ceases to exist. The lines were more or less equal because everyone was making an active decision, they were not nihilists!

Now we can start to understand the fundamental problem with index funds. If everyone indexed, it is no longer a market at all. John Bogle, the inventor of the index fund, even said as much towards the end of his life:

“If everybody indexed, the only word you could use is chaos, catastrophe…The markets would fail.” - John Bogle, May 2017

Index fund apologists might respond that there will always be greedy investors trying to find an edge in the market. These investors will always provide much needed “price discovery,” they might say. This may be true to an extent, but there is still a distortion to prices when a large portion of the market is “dumb money.”

This is exactly what we are now seeing today. Because index investing, once viewed as the way to circumvent Wall Street, is now the establishment.

Let’s take a look at the monolith of BlackRock, Vanguard Group, Fidelity Investments, Capital Group and State Street, the five largest providers of index funds and ETFs. These firms collectively manage over $27 trillion dollars in global assets, which is more than 60% of all the assets held in U.S. stock funds.

BlackRock in particular may have even more influence than even the U.S. Federal Reserve Board. It is cronyism in all its glory. A telling report by the American Civil Liberties Project found that:

- BlackRock holds a 5% or greater stake in more than 97.5% of the S&P 500 companies.

- They have a former Fed Vice Chairman on the payroll.

- In June of 2021, BlackRock’s two largest bond ETFs grew to their largest size ever following the Fed’s announcement that it would purchase corporate bond ETFs.

- Then the Fed hired BlackRock to manage these corporate bond buying programs that, (you guessed it), would purchase BlackRock’s own ETFs!

- CEO Larry Fink is a very key advisor to President Joe Biden.

BlackRock’s influence is so large that Bloomberg has called them “the fourth branch of government.” And who is the largest shareholder of BlackRock Inc (BLK)? That would be none other than Vanguard themselves.

So we can speculate that the growth of indexing has not just been the result of market choice, but through at least partial influence of government power. This trend has only been amplified by the Department of Labor’s 2016 fiduciary rule, where my own financial advisor community dramatically shifted from favoring actively managed investments towards passive index funds and ETFs. This two-headed monster of government regulation and a powerful corporate lobby nudges more and more investors towards passive indexing.

The influence of these crony firms could diminish when investors finally wake up to a better alternative, however.

Why Bitcoin Is Superior To Index Funds And ETFs

The good news is that bitcoin, the money that you must choose if you want to use it, is a superior solution that comes with no coercion. Since bitcoin is money, it exists for the very purpose of savings. As Saifedean Ammous has put it, “under a hard money, all demand for savings would just go to holding cash.” In other words, there would be no need to save using investment products when there is money that holds its value and even appreciates while you hold it.

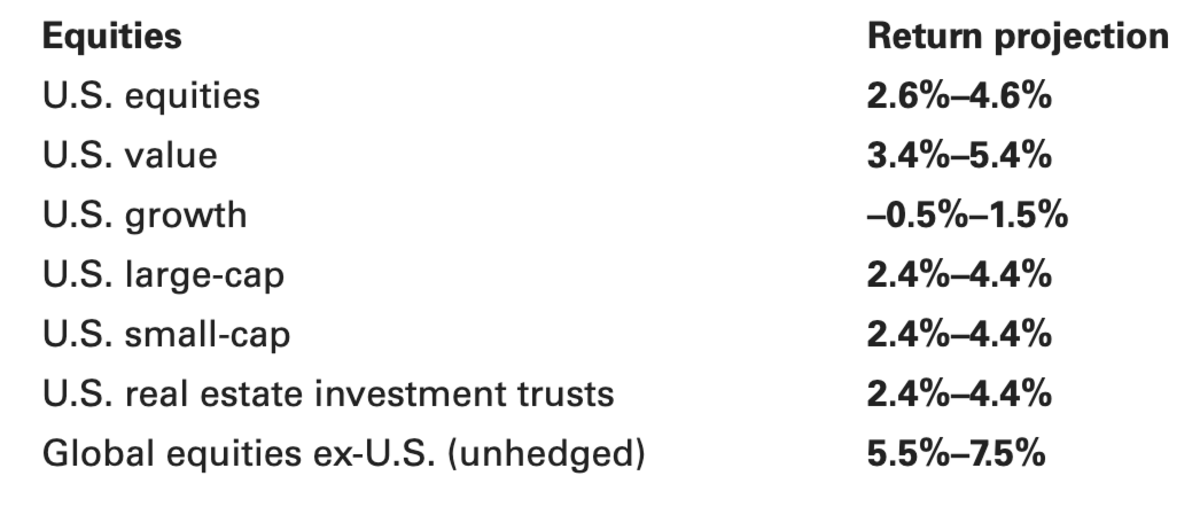

Sure, stock index funds will most likely experience lower volatility than bitcoin in the future, but their upside return potential is also much lower. By Vanguard’s own admission, projected returns over the next ten years are for around only 2%-4% annualized in U.S. stocks:

Source: Vanguard Investment Strategy Group, March 21, 2021

On the other hand, bitcoin is an asset class that is still in its infancy, yet “it has delivered an annual average return of 891% (2011-2020).” As pure monetary premium, it exists for the very reason that most people own index funds anyway. That is, to store their hard earned savings, to transfer it to their future selves, and leave something of value to their generations.

Bitcoin Requires Creativity Out Of Investors

For me, it took a bit of creative imagination to make the switch to bitcoin. It required me to speculate, a dirty word to financial advisors, on what the future might look like (as others have done here, here, and even here. There are no backtests available for this sort of endeavor. Likewise, this may be a hangup at first for Bogleheads. But once they make the switch, I think the inertia will pull that community of believers into bitcoin as well. After all, there is no better marketing than “number go up.”

Investing, in its essence, will always exist, but saving in bitcoin will replace nihilistic index investing.

Thank you to Trent Dudenhoeffer and Don Stuart for reviewing and providing feedback on this article.

This article should not be construed as specific recommendation or investment advice. Always consult with your investment professional before making important investment decisions.

This is a guest post by Andy Flattery. Opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.