Searching For The Roots Of Bitcoin’s Narrative

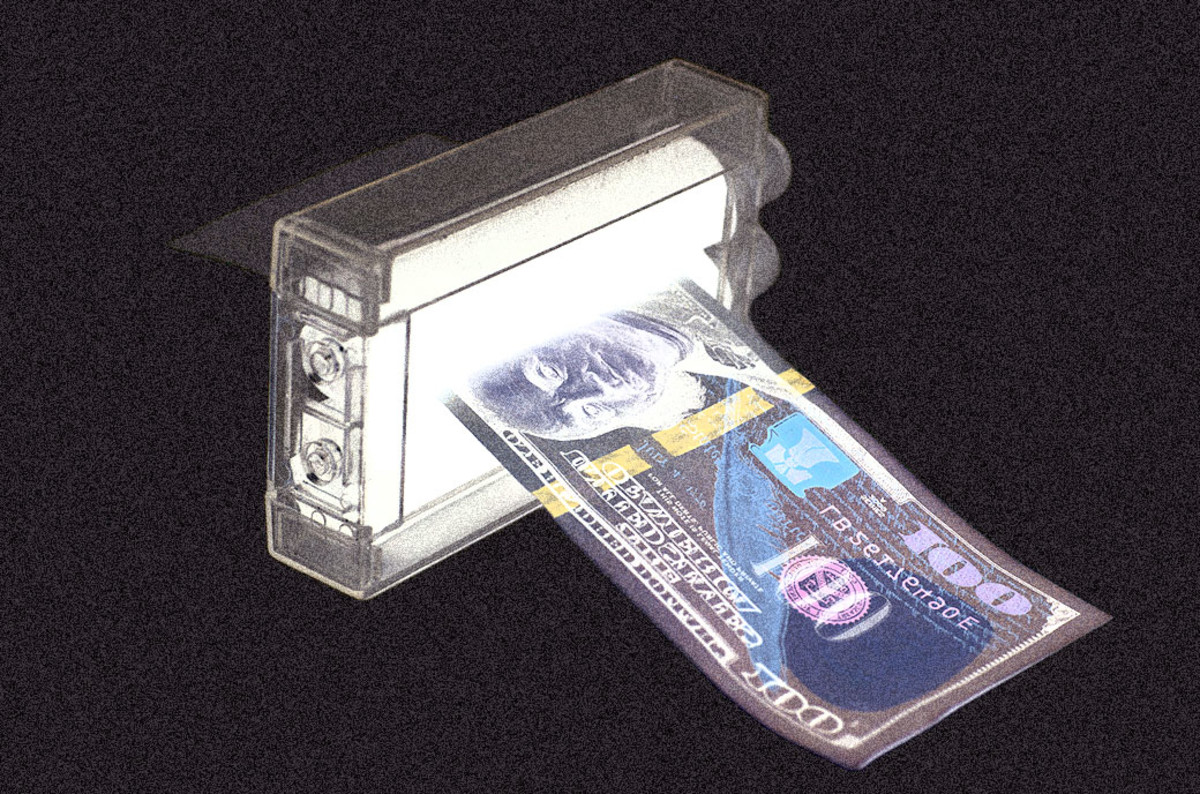

If we are to understand bitcoin’s meteoric rise, we must return to 2008. After all, the world’s largest cryptocurrency by market capitalization is a child of the global financial crisis (GFC).

Once Lehman Brothers went into bankruptcy, many banks and financial institutions across the globe followed. Governments all over the world soon stepped in, bailing them out. Three days after Lehman went bust, Hank Paulson, U.S. Secretary of the Treasury, and Ben Bernanke, head of the Federal Reserve, went to President George W. Bush and him, “We need a trillion dollars in cash, and we need it by five o’clock,” as Steve Bannon, a former Goldman Sachs investment banker and advisor to President Donald Trump, recalled in 2018.

After Bush shrugged them away, Paulson and Bernanke went to Congress, where they repeated their plea: “If we don’t have a trillion dollars by today, the American financial system will melt down in 72 hours. The world financial system will melt down in two weeks, and there will be global anarchy,” Bannon recounted.

While the global financial system didn’t slide into abyss, trust had been lost in a monetary system that ran on trust. Robert Shiller, named a Nobel Laureate in 2013, pointed out that the experiences surrounding the financial crisis wove the narrative for Bitcoin:

“I think narrative is very important to the popularity of Bitcoin and other cryptocurrency,” he said. “Part of the reason that Bitcoin succeeded is that it fed into an anarchism narrative that government is unnecessary and untrustworthy. It fostered a narrative that young people have created a financial institution that is out of the government’s reach. That’s a powerful narrative.”

Fast forward a decade — welcome to a world of “helicopter money,” negative interest and big debt.

Though the U.S. and EU economies had been out of the woods for a while, neither the Fed nor the European Central Bank (ECB) could stop their addiction to expansionary monetary policies.

Then COVID-19 came, piling pressure on the Fed and ECB to open the financial floodgates another time. As the U.S. government distributed $1,200 stimulus checks to its citizens, Milton Friedman’s “Helicopter Money” became reality.

Yet Friedman was prescient enough to know that “there ain’t no such thing as a free lunch,” as the saying goes. In 2020, the U.S. debt-to-GDP ratio skyrocketed to unprecedented levels.

Deflating National Debt Through Inflation

With Modern Monetary Theory (MMT) en vogue, many economists believe that huge government debt is not a problem. Yet, at some point, the day of reckoning arrives. As of now, there are three main ways for governments to deal with debt, per Winklevoss Capital: “They can choose to (i) not pay some portion of their debt (i.e., ‘hard default’), (ii) adopt austerity measures in hopes of running a budget surplus, or (iii) reduce the value of the debt they owe through inflation (i.e., ‘soft default’).”

With more than a fifth of all dollars in circulation being printed in 2020, the U.S. government picked the path of a “soft default.” Cynics may point out that COVID-19 even provided the U.S. government with a noble excuse for printing money; and thus, reducing its debt burden.

While we’ve witnessed inflation in various areas (including equity prices and real estate), the real inflation rate (measured by the CPI) remains low. Yet inflation doesn’t simply happen whenever more money is pumped into the system. The velocity of money matters.

For the velocity of money to rise, people need to stop hoarding money and spend it. This could either happen voluntarily or through a collapse in trust. The former scenario might happen when the virus is defeated, while the latter could happen if the people’s confidence in both the government and the future collapses — akin to what went down in the Weimar Republic.

The Pandora’s Box Of Central Bank Digital Currencies

However, there is a third way that masquerades under the acronym of CBDC. The abbreviation conceals the ECB’s panacea: Central Bank Digital Currencies in the form of a digital euro.

The digital euro is nothing less than immaterial cash. Instead of carrying it in your purse, you have your own account at the ECB. Given the digital euro’s proposed use of blockchain technology, this might sound tempting.

Yet, on the way are several red flags. One of them was pointed out by Jörg Krämer, chief economist of Commerzbank, who noted that it would unnecessarily “make the state more powerful at the expense of its citizens.”

The heightened potential for citizen surveillance explains the allure for China’s government to experiment with a digital yuan. Any transaction could be tracked via the blockchain ledger.

Further, Bill Campbell, a portfolio manager for DoubleLine highlighted another troubling aspect of CBDCs: “With CBDCs, the central banks would possess the necessary plumbing to directly deliver a digital currency to individuals' bank accounts, ready to be spent via debit cards. Such a mechanism could open veritable floodgates of liquidity into the consumer economy and accelerate the rate of inflation.”

But perhaps this hypothesis illustrates the most troubling aspect of a digital euro:

Assuming that the digital euro gradually replaces cash, it would be impossible to evade negative interest rates. Not willing to see their deposits deflate, people would stop hoarding money, looking for safe harbors, but also increasing consumption. This would inevitably raise the velocity of money, pushing the rate of inflation higher.

The Allure Of Digital Gold: Scarcity In An Age Of Superabundance

When confronted with such scenarios in the past, people searched for safe harbors. They usually found them in gold. Yet with everything becoming digitized, it was only a matter of time until gold found its digital equivalent.

And Bitcoin wants to be that — or at least, that’s what the crypto community hopes for.

The brilliant author Niall Ferguson succinctly captured Bitcoin’s allure: “Bitcoin is the only digital asset or token that has scarcity built in. Everything in the internet is defined by a superabundance; Bitcoin is the exception.”

While gold’s supply continuously increased as demand rose over the years, bitcoin’s supply is capped by default at 21 million bitcoin.

Toward Hayek’s “Denationalisation Of Money”

As bitcoin’s price reached record heights in recent weeks, some believe we are finally destined to witness economist Friedrich Hayek’s “Denationalisation of Money.” In 1976, Hayek wrote: “I don't believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can't take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can't stop”

He also wrote: “I do not think it is an exaggeration to say history is largely a history of inflation, usually inflations engineered by governments for the gain of governments.”

Hayek believed that people — if given the opportunity — would punish producers of inflationary money by abandoning it. As governments would no longer be able to reduce their debt burdens through inflation, it would also enforce fiscal discipline. Thus, currency competition would serve as an effective debt brake.

Until the advent of the internet, governments didn’t have to worry about competing currencies that were out of their reach. Yet with the decentralized structure of cryptocurrencies, currency competition in the spirit of Hayek has arrived.

Will Leviathan Retaliate?

Looking ahead, the crucial question will be if governments decide to reign in on Bitcoin. ECB President Christine Lagarde’s recent comments served as a warning shot: “There has to be regulation. This has to be applied and agreed upon ... at a global level because if there is an escape that escape will be used.”

A look at history provides another bleak reminder. During the Great Depression, Franklin D. Roosevelt enacted Executive Order 6102, banning gold ownership. The ban lasted for 41 years until 1974.

As the crypto community experiences peerless euphoria, it might be worthwhile to revisit history. The time of governments as bystanders will come to an end — sooner rather than later.

This is a guest post by Philip Schaar. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.