Update: WalletBit has posted their official press release on Reddit and Bitcointalk. Also, the flat rate portion of their bank deposit fees has now been dropped.

WalletBit, the merchant platform that has begun rapidly growing in prominence and pushing itself as a mainstream alternative to BitPay this fall, has announced a new feature for merchants who are located in Europe: payment by bank deposit. Participating merchants can now accept Bitcoin without ever handling them themselves, instead having their earnings immediately converted to local currency and deposited regularly into their bank accounts.

Of course, WalletBit’s offering is hardly new; BitPay has been providing an equivalent service almost since its inception in May 2011, and the feature has proven to be an extremely popular one. However, WalletBit does promise a number of advantages over BitPay. First of all, WalletBit is intent on winning over merchants with its lower fees. For those merchants who wish to receive their earnings in bitcoins, BitPay has maintained a consistent transaction fee of 0.99% since it was first established, but WalletBit has recently reduced its fees to a slightly lower 0.89%. For merchants in the US, WalletBit’s 2.75% is slightly higher than BitPay’s 2.69%, but while BitPay’s commissions for European merchants increase to 3.99%, WalletBit’s rates remain the same.

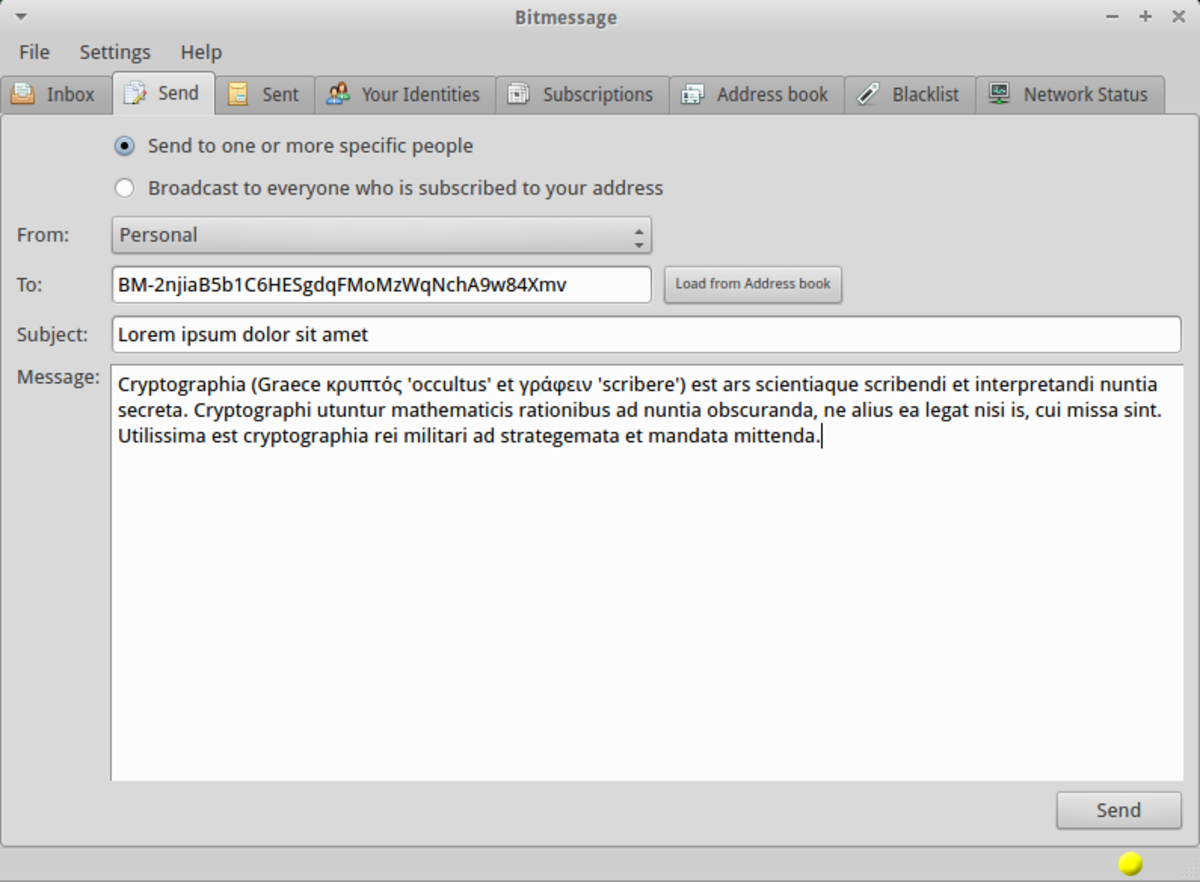

Another advantage is internationality. Bitpay’s European bank deposits are only available to bank accounts in Germany, France, Spain, Italy, Finland and the Netherlands, but once this offer from WalletBit goes live its merchants will be able to receive Euros into bank accounts located anywhere in the Single Euro Payments Area (a superset of the European Union) as well as Danish krones in Denmark. WalletBit is also keen on advertising its security, featuring ACID and PCI-DSS compliance as well as AES-256 encryption for internal data on the server side, and the option of three-factor authentication using Google Authenticator and WalletBit’s own SecureCard, a printable grid of characters from which users are asked to provide a random three cells as part of the authentication process, to help clients protect their own accounts.

More developments from WalletBit are soon to come. Support for Canada is high on their list of priorities, although WalletBit is moving carefully in its efforts at Canadian integration in an effort to ensure legality and secure the best possible rates. WalletBit has also recently been putting a large amount of work into the usability of their payment systems, with particular emphasis on their smartphone and tablet applications. WalletBit Mobile, formerly ResponsePay, provides an easy-to-use wallet for the average user, and WalletBit will also soon launch a fully fledged point-of-sale solution that will allow stores and restaurants to record customers’ orders and accept payments all within a single tablet application.

WalletBit’s push for adding features since September has so far proven enormously successful for the company. Before Adam Harding joined the team as Director of Marketing in September, WalletBit saw very little use by Bitcoin merchants, to the point that few people realize that the business has been around since July 2011. Now, WalletBit’s transaction volume is more than double what it was this summer, and founder Kris Henriksen is confident that it will continue to grow as the new features that the company is developing fall into place. Canada remains a largely untapped market, with relatively few stores accepting Bitcoin despite the fact that interest in Bitcoin is not that much lower in Canada compared to the US. Brick-and-mortar stores and restaurants are another direction that WalletBit is intent on expanding into. Currently, although they have 167 merchants in total, only one of them is of the brick-and-mortar variety: a small kiosk in Kris’s home town in Denmark. “But once this bank transfer is up and running,” Kris writes, “I will have many brick-and-mortar stores to speak about.”