Bitcoin exchange trade volumes have soared over the past week as the bitcoin price hit its high for the year. Exchanges are reporting some of the highest volumes seen this year.

Over-the-counter (OTC) trading has also taken off with over three times normal trading volumes according to Genesis Trading.

ItBit’s Director of Trading Bobby Cho released the trading desk’s October 2015 report yesterday showing monthly trading volumes up 42 percent over September:

itBit Bitcoin OTC Market Data Summary for October 2015

- Total Bitcoin Volume Traded: 41,328 XBT

- Total USD Amount Traded: $10.1 Million

- Average Daily Trading Volume: 1,878 XBT

- Month-over-Month Trading Volume Growth: 42

itBit’s report also noted some “price tightening” despite the volatile price situation:

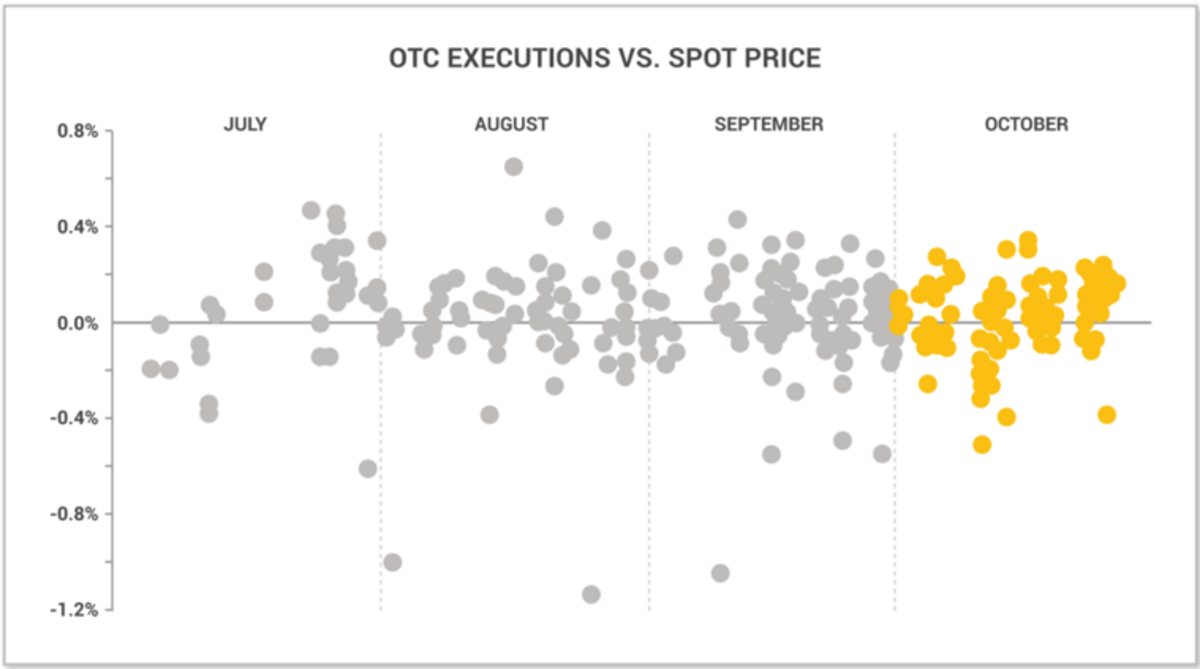

“October also saw OTC trade executions become more concentrated around the market’s spot prices (OTC Executions vs. Spot Price chart below). This price tightening in the OTC market occurred despite bitcoin prices hitting an annual high towards the end of the month, which is another positive sign for the health of the market.”

ItBit partners with TradeBlock to bring greater public visibility and accountability

ItBit’s October report also announced a new partnership with TradeBlock to provide a more streamlined OTC reporting service both to their clients and to the public:

“We are integrating Tradeblock’s order management system to enhance our OTC middle and back-office operations. TradeBlock’s system will allow us to streamline our back-end processes and provide clients with more powerful, customizable trading data analysis.

“In our ongoing effort to increase transparency of OTC markets across the bitcoin trading community, our team will be using these new tools to expand the OTC data we share publicly going forward.”

Genesis Trading CEO Brendan O’Connor told Bitcoin Magazine that they are watching their OTC market follow the public market in increasing trade volumes.

“Regarding trading in bitcoin, we’ve been seeing a three to four times increase in volume in our OTC trades," O'Connor said. "This may be caused by a number of factors including what’s happening in China, the Silk Road auction and a surge in institutional interest.

“As we typically trade over $10 million worth of BTC OTC per month, I expect we will see a record amount traded in November,” he said.

ItBit’s Cho is happy to see a steadily growing OTC market with a 6 percent increase in OTC institutional clients over the last month.

“The presence of active institutional traders is a promising sign for the future of the bitcoin OTC market,” he said.

Photo Lars Plougmann / Flickr (CC)