In its recently published quarterly report, Square revealed it’s channeling Bitcoin trades from its Square Cash application to private brokers instead of public exchanges.

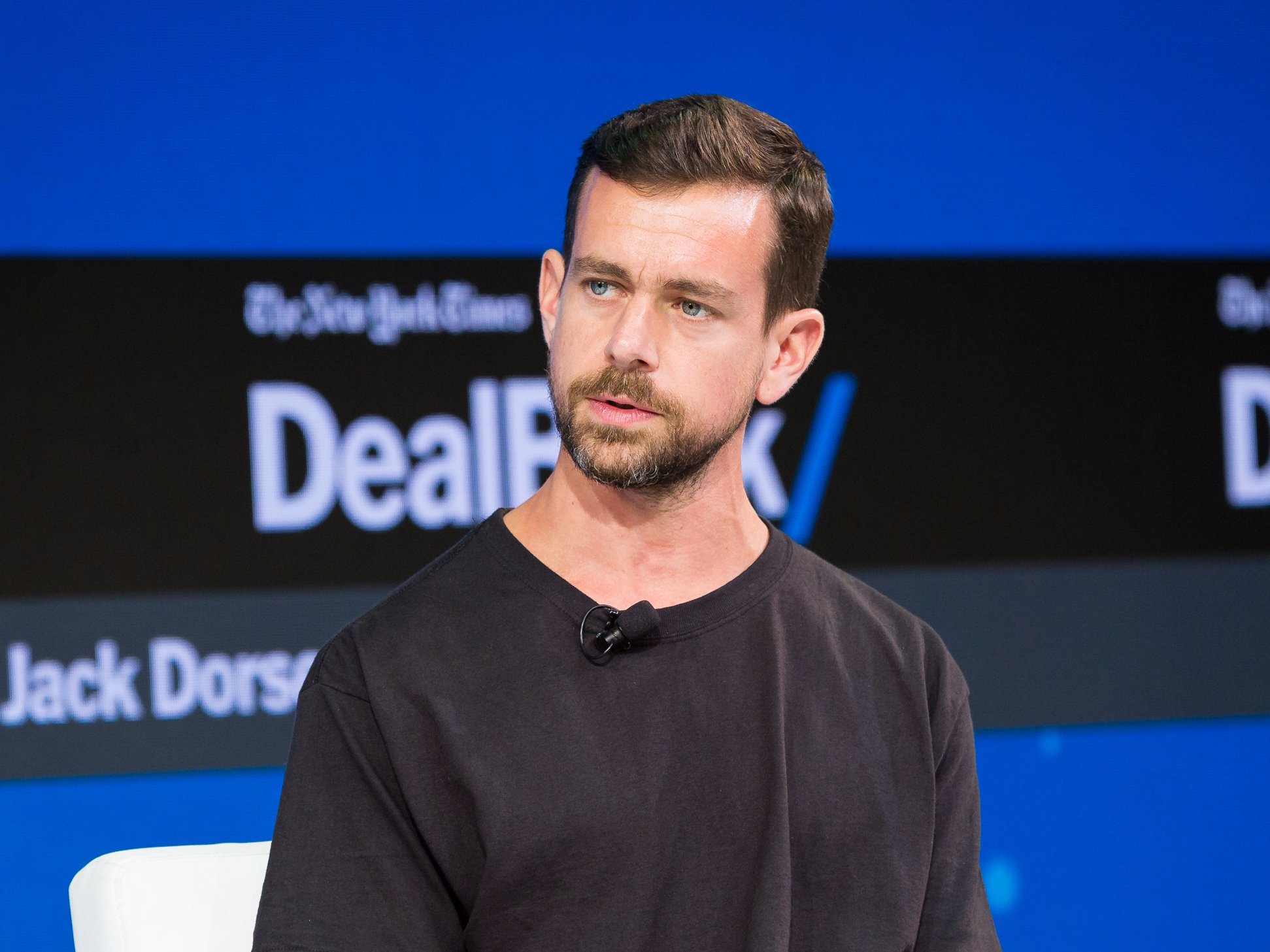

Jack Dorsey’s Square Cash application enabled Bitcoin purchases and sales for most users early in 2018, adding to its consumer payments suite. Though overall, Square’s profits are substantial, it’s not making a fortune on Bitcoin trades just yet. Square reported just $400,000 profit on $37 million worth of revenue from Bitcoin for quarter two, 2018.

Square hasn’t announced that it has moved to over-the-counter (OTC) trading services for its Bitcoin transactions. The published quarterly report instead quietly revealed that Square “purchases bitcoin from private broker-dealers,” to facilitate Bitcoin trades for users of the application.

Why Over-the-Counter?

There could be a number of reasons behind Square’s choice, firstly it could protect Square from some of the Bitcoin price volatility seen on public exchanges. Sudden large sellouts from weighty Bitcoin owners and market “whales,” move Bitcoin’s price far quicker than on OTC desks. Meltem Demirors, chief strategy officer at CoinShares told CNBC:

Working with a broker likely gets Square better pricing and better execution services than floating orders on the open market, as well as more confidentiality.

Secondly, the company could be looking to avoid some of the security issues and hacks associated with public cryptocurrency exchanges. Private brokers and OTC services may also be providing Square with faster Bitcoin transactions while at the same time hiding Square’s market activity from competitors.

Potentially, the move also gives Square more visible compliance from its use of institutional style trading facilities. Square has yet to comment on the matter.

OTC Bitcoin Trading Increasing

A recent study by TABB Group, if accurate, shows that OTC trading of Bitcoin may have overtaken daily Bitcoin trading volumes on public exchanges. Certainly larger trades of Bitcoin by millionaire investors and institutional investors moving over, along with Bitcoin associated enterprises, may be fuelling OTC service demand.

TABB Group puts OTC trading of Bitcoin at $12 billion dollars worth per day, but the study has been refuted by some. According to statistics from coinmarketcap.com daily trading of Bitcoin via public exchanges is around $4.3 billion.

What do you think an increase in OTC Bitcoin transactions means for cryptocurrency markets?

Images courtesy of Shutterstock, Bitcoinist archives