Coinbase Custody is expanding its custodial services to include dozens of additional crypto assets, like XRP, EOS, and Monero. Coinbase is enhancing the custodial services to allow its institutional clients to securely store large amounts of cryptocurrencies.

Coinbase Custody to Cover Additional Crypto Assets

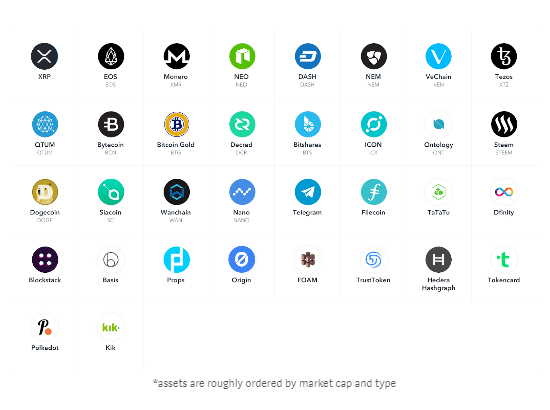

On August 3, 2018, Coinbase announced that it was exploring the possibility of adding new crypto assets, such as XRP, EOS, and Monero to Coinbase Custody. The chart below shows the additional assets:

Coinbase describes these custodial services as follows,

Coinbase Custody is a combination of Coinbase’s battle-tested cold storage for crypto assets, an institutional-grade broker-dealer and its reporting services, and a comprehensive client coverage program.

In this effort, Coinbase Custody is partnering with ETC (Electronic Transaction Clearing). Their purpose is to provide custodial services to selected financial institutions and hedge funds worldwide.

ETC is registered by the Securities Exchange Commission (SEC) and is a member of the Financial Regulatory Authority. ETC focuses on trade processing, custody, and clearing.

The announcement also indicates that the new cryptocurrencies will not be added to other Coinbase products. To do so, they must first pass Coinbase’s Digital Asset Framework. This process involves a review by an internal committee of experts whose responsibility is to verify whether a crypto asset satisfies the criteria set by the framework.

Investors Demand Reliable Custody Before Allowing Big Money to Flood the Market

Bitcoin is already overcoming technical problems such as scalability. However, several obstacles remain, hindering big financial institutions from pouring big money into the crypto market. Indeed, according to Robert Dykes, writes:

Global institutional investors have $130 trillion of assets under management. A tiny slice of that moving into crypto will have a huge positive impact on an industry whose market cap remains under $300 billion.

However, to attract this kind of money into the market, Dykes adds, “the crypto industry needs to provide the facilities and tools these big-money players are used to.”

And, he points out, custody is the biggest obstacle discouraging the participation of financial institutions. Hence, it is encouraging that Coinbase is enhancing tools such as Coinbase Custody, to solve this major issue.

Do you think solving custody issues will release big money into the crypto space? Let us know in the comments below.

Images courtesy of Shutterstock, Coinbase