The SEC has halted trading in shares of yet another publicly traded bitcoin company, Hong Kong-based UBI Blockchain Internet.

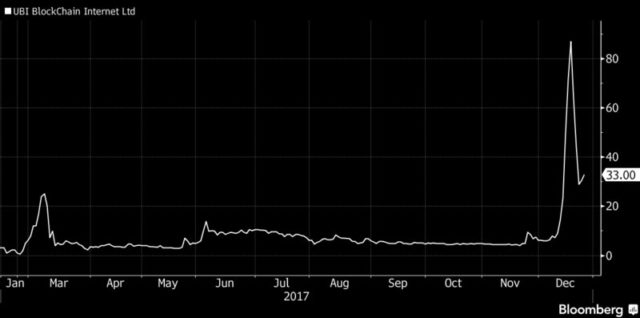

Reports hit the press this week that the Securities and Exchange Commission (SEC) has halted trading of the Chinese blockchain company UBI Blockchain Internet. The agency cited potentially inaccurate information in the company’s disclosures as well as “recent, unusual and unexplained market activity” as the factors behind its decision. Between December 11 and 18 last year, UBI’s share price inexplicably soared from $9 per share to $87 per share – a gain of over 860%. Prices have since settled down to $22 per share as of Friday.

Per the SEC, the trading halt will remain in place until January 22, 2018.

The Problem

The cryptocurrency space has attracted a huge amount of speculative capital over the past twelve months and a large portion of this capital has been directed towards buying bitcoin and various other cryptocurrencies directly.

And it’s paid off.

Sure, we’re currently seeing a bit of corrective action at the moment, but many of the top 20 coins by market capitalization returned thousands of percentage points in gains throughout 2017.

Some of the speculative capital, however, went elsewhere. ICO investment, of course, accounts for much of it but there is another type of exposure that draws investor attention – publicly traded companies.

For many (and especially for the more traditional equities investors), buying and holding bitcoin, ICO tokens or any other form of cryptocurrency is still out of reach from a technical knowledge and security standpoint. However, so as not to miss out on the potential for reward, these investors sought alternative exposures and publicly traded companies that claim a connection with bitcoin and/or blockchain tech fit the bill.

Unfortunately, many of these companies who claiming such ties, some even going so far as to change their business names, in reality, have only the most tenuous of links to the digital currency.

Investors pour in after Long Island Iced Tea becomes Long Blockchain Want to increase company value on the open market? Just change your name to something blockchain. At least, that worked for the Long Island Iced Tea Corp.. https://t.co/miZUKBkH5K

— Mon Watson (@olansha1) December 25, 2017

Looking The Other Way

Markets don’t seem too bothered about the technicalities, however. UBI rose from less than $10 a share to just shy of $90 within ten days during mid-December, in line with the rise in the price of Bitcoin and a number of other leading cryptocurrencies.

A couple of companies in this arena have already fallen victim to trading halts and UBI Blockchain is just another name in this list. Of course, whether the SEC will find anything to justify the halt remains to be seen. These halts are preventative responses that serve as a sort of discovery period as opposed to a response to any specific wrongdoing, but they serve to highlight the fact that the risk associated with this space right now is far from limited to fraudulent ICOs and volatile cryptocurrencies.

Are you a UBI shareholder? What do you think about investing in crypto through publicly traded companies? Let us know in the comments below.

Images courtesy of Wikimedia Commons, Bloomberg