“Make sure to close the door behind you,” Mathis Schultz, the CEO of Northern Bitcoin, said to me in a near shout. As we entered the backside of the shipping container, partitioned for the ASIC miners’ exhaust, Schultz wanted to make sure the heat emitted wouldn’t mingle with the temperature-controlled front end of the shipping container.

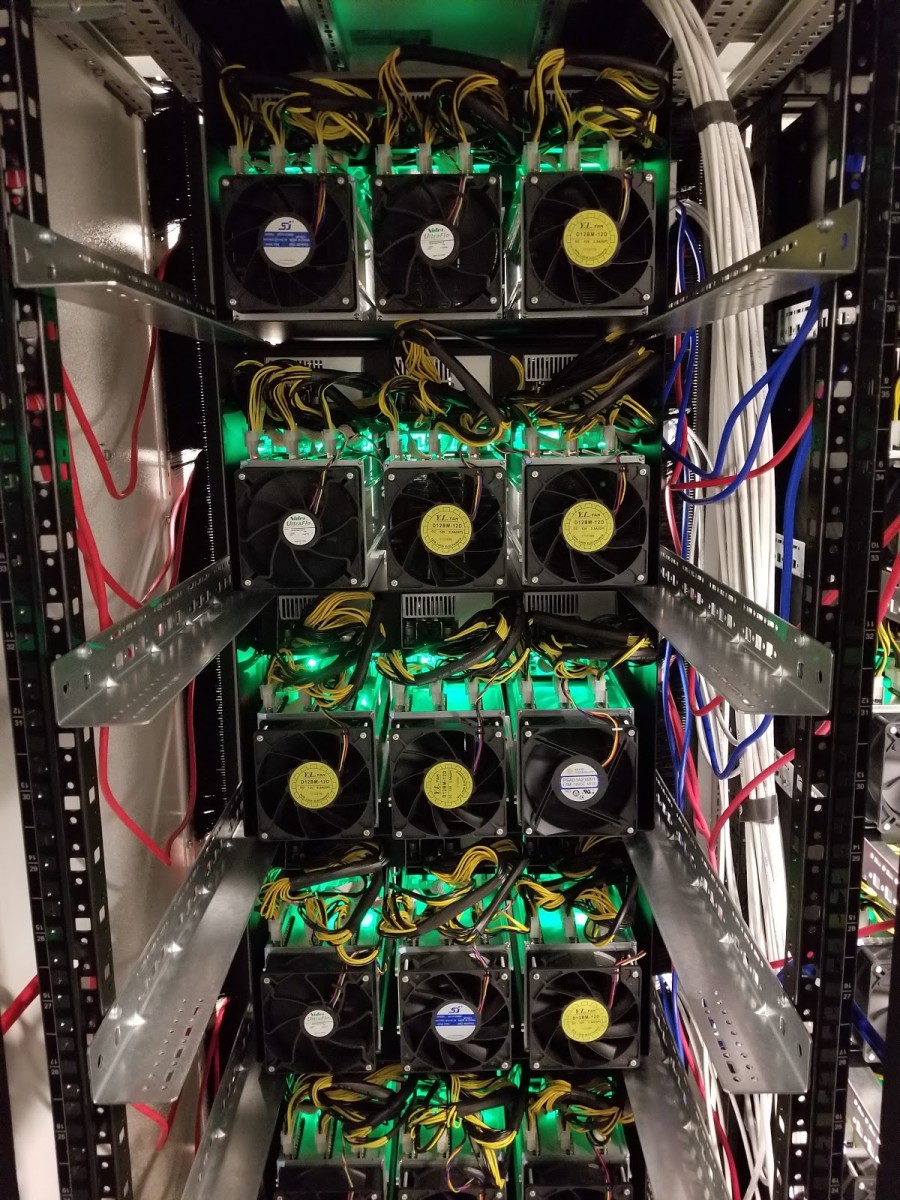

The door opened, my senses, already ringing from the blaring of the ASICs’ mechanized grind, were ignited. Like stepping from one climate zone to the next, I was greeted by a wave of hot air, the collective, arid exhaust from the shipping container’s 210 Antminer S9s.

The backside of the mining rigs emit a powerful exhaust.

All that heat and the cacophony came from just a fraction of the 3,250 miners Northern Bitcoin runs in 15 shipping containers. Situated in Lefdal mine — a data center located roughly 31 miles northwest of Sandane, Norway — the operation is certainly unique. Bridging two industries and centuries, the bitcoin mining farm sits in a defunct olivine mine from the ’70s.

Even more serendipitous, the converted data center is powered by 100 percent renewable energy from hydroelectric plants built in the same decade. Fed by the fjords that punctuate Sandane’s mountainous landscape, hydroelectric dams provide the data center with an abundance of clean energy.

For Northern Bitcoin, this means mitigating the biggest headache when it comes to scaling and operating a mining farm: electricity costs.

Northern Bitcoin

Northern Bitcoin was founded in 2015. In its infancy, it was an aspirational leap into a new and still uncertain industry for CEO and Founder Mathis Schultz. A former banker for such firms as LGT, Julius Baer and Elan Capital partners, Schultz decided to shelve his former career in the old financial mode to pursue what he considers the future of finance.

“I have always been interested in finance, the nature of money and its impact on our society. When I first heard of bitcoin and began to deal with it, I was instantly fascinated: Bitcoin is a revolution of our financial system. Its technology will replace many of their services, especially global transactions, and I wanted to be part of it,” Schultz told Bitcoin Magazine.

Northern Bitcoin's core team who accompanied us in Norway, standing front of a shipping container: (from left to right) Dr. Hans Joachim Dürr, Moritz Jäger, Mathis Schultz, and Marieke Garrels.

Thus far in the company’s young development, Schultz’s gamble has been paying off. What started off as a single container operation of a handful of miners has scaled into the 3,000+ ASICs held in Lefdal today. From this growth, the company has taken its operations public. Traded on the Munich stock exchange, Northern Bitcoin is valued at $177 million. More impressive, its valuation has stayed relatively stable during the recent bear market, something that most crypto-related businesses have struggled with as prices continue to tread water.

Northern Bitcoin’s novel operations are no doubt integral to this success. Schultz expressed that Norway and the Lefdal mine formed “a perfect match for all [the company’s] criteria.”

With access to cheap, renewable energy — which the region’s plants produce in surplus and the Norwegian government exports — the mine can operate with minimal costs and with neutral carbon emissions.

The region itself boasts up to 6.7 TWh of excess renewable energy. This puts the mine’s electricity costs somewhere between $0.035–0.045/kWh, giving it a power usage efficiency value of 1.08 — a more than favorable figure.

To put this into perspective, Mongolia provides Bitmain access to renewable forms of energy at an average of $0.08–0.09/kWh.

Northern Bitcoin’s energy costs are lowered still by the climate control measures Lefdal mine features by design. As if the Norwegian climate wasn’t cool enough, the data center is situated some 656 feet below ground, so it maintains a constant temperature of 55 degrees Fahrenheit (~12.5 degrees Celsius).

On top of this, the center pumps water in from the surrounding fjords to cool its IT hardware, dumping it back into the fjords so as to ensure zero waste.

This process allows Northern Bitcoin to cool its rigs down from 86 degrees Fahrenheit to 64.4 degrees Fahrenheit when they’re operating at full capacity. The team claims that this reduces their operating costs by up to 40 percent.

“The 15 containers in Lefdal have an electric power of about 4.6 MW and thus consume a little bit more than 110 MWh a day,” CTO Moritz Jäger told Bitcoin Magazine.

To increase the hardware’s efficiency and cut operating costs further, Jäger and his team have developed their own software for running the miners. This software, Jäger claims, allows the miners to perform at a fuller capacity by cutting back on secondary functions.

“... the factory software is not optimized for best performance. It is doing other things additionally to the hash computations, like communicating with different servers, rendering a web user interface and so on. Some of these functions can be turned off completely and others can be executed with lower priority to save CPU time for the actual hashing. It is also very restricted in its overclocking functionality.”

The company has also developed its own proprietary monitoring software, Jäger added, “which makes managing the ASICs as easy as possible.” This lets the team oversee their hardware and manage problems from back in Frankfurt, the most common problems needing only a reboot to resolve. Many of these issues, like when a machine has temporarily degraded performance, are automatically fixed with a reboot.

The team receives alerts for problems that cannot be solved automatically. For everything else such as “maintenance that requires remote-hands, like replacing a power supply, the technical staff in the mine has been trained and knows what to do,” Jäger said.

The Mine: A Look Inside

Traversing the two-lane highways that weave in and around the mountainous landscape, we set out for the mine. Situated 111 miles from Bergen, Norway’s second-largest city, the trek took a good 30 minutes from our lodging in Sandane, and it included a 10-minute ferry ride across the fjord’s many vast channels.

Lefdal Mine Data Center, featured with a Northern Bitcoin shipping container

Arriving at the mine, we were greeted by Mats Andersson, the chief marketing officer of Lefdal mine data center. Eager to showcase the mine’s digs, he briefed us on a few dos and don’ts and, loading up in the van, we began our descent.

Established in the late ’70s, the data center occupies what was originally an olivine mine. Maintaining cool, steady temperatures year-round thanks to its subterranean environs, the mine is ideal for housing IT hardware, which often require intensive cooling measures to prevent overheating and excessive electrical consumption.

As the mine was already hollowed-out from its previous incarnation, the data center’s infrastructure was largely in place upon its inception. In total, the mine’s prior activity furnished the data mine with six levels to house equipment, a total surface area of 393,700 feet. Spiraling downward a total of 4,265 feet, a central avenue runs through each level, which branches out to numerous streets on either side. Typically 328 feet in length, these streets house storage containers for the mine's IT equipment. Of these six levels, three are currently operational as the mine builds out its cooling and electrical infrastructure.

Running through the mine's multiple levels, the avenue is flanked on either side by the streets that house IT equipment.

Northern Bitcoin’s operation sits on the second level of the facility. Stacked three units high, the shipping containers are equipped with power grids to monitor and manage their power consumption.

As an additional means for chilling to add to the mine’s naturally cool insulation, a series of pipes pump water from the fjord through each shipping container to refrigerate the 210 ASICs resting inside. Going in, the water averages a temperature of 46.4 degrees Fahrenheit, and it leaves the mine to reenter the fjord at temperatures upward of 80 degrees Fahrenheit.

This cooling effect resulted in the drastic temperature change we experienced as we moved from the front to the back of the storage container the Northern Bitcoin team showcased. The near frigid-climate of the frontend, fitting enough for a pullover or heavy cardigan, gave way to a circulation-parched, baking air on the backend, an atmosphere more suited for swimsuits and flip-flops than the mild winter gear we were sporting at the time.

On the front end, the ASIC miners hard at work in the temperature-controlled shipping container.

The temperature change was palpable and drastic, enough to give one the impression of how pivotal the mine’s natural and artificial cooling features are to making the operation sustainable — and profitable.

When asked by a German reporter how low bitcoin would need to drop to throw the operation into the red, Schultz gave a confident, if esoteric and pithy, reply.

“Very low.”

Scaling: A Look Forward

As Schultz put it, given its access to intrinsic cooling techniques and clean energy, “right from the start the infrastructure for fast growth was in place.” Having only operated in the Lefdal mine since May of 2018, Northern Bitcoin has harnessed the infrastructure and its unique setup to an impressive and expedient effect. A single container turned 15-container operation, the company claims to invest 100 percent of its mining profits back into infrastructure to scale further.

One of three streets where Northern Bitcoin has parked their shipping containers.

At its current size, the farm averages a hash rate of 47,000 TH/s. Even still, this nets them just below 1 percent of the entire Bitcoin network’s hashrate, a far cry behind AntPool, Slush Pool, BTC.com and BTC.top.

The difference here being that Northern Bitcoin does not operate as a mining pool. As the company continues to grow, however, it plans to expand its reach by establishing a pool for serious, larger-scale projects to join, giving special preference to those miners who tap into renewable energy.

“The next step is the opening of our mining pool for miners worldwide at the end of August. As one of very few mining pools worldwide, we support ‘Asic-Boost.’ We plan to promote miners who engage in green sustainable mining … to build a greener Bitcoin network to secure its future prosperity,” Schultz said

In addition to opening up a pool, Schultz stated that Northern Bitcoin will provide different cloud mining services for individuals and entities that lack the technical knowledge and proficiency to engage in the practice themselves.

These mining services are the company’s next target in what is proving to be a continuous period of growth. If it scales its operations in the future as well as it has in the past, it’ll likely be a boon for the company’s investors, which included a handful of family offices and private equity firms, one of which, Singularity Capital, owns a hefty 60 percent of the company.

Taking Steps Toward A Greener Network

At the height of bitcoin’s run-up last year, price wasn’t the only metric on people’s mind.

Media outlets, crypto and mainstream alike, published articles telling a grim story of Bitcoin’s electrical consumption. Some of the more alarmist voices framed this usage as one of the graver threats to our ecosystem. The way these stories were spun, you’d think Bitcoin had upstaged other sources of carbon emissions as the focus of debates surrounding climate change.

Bitcoin’s power use certainly deserves attention in the world’s and the industry’s conscious, and it’s important to remain critical and vigilant when examining the topic. That said, many reports and articles on the topic favored a sensationalized perspective over a comprehensive one, as they rarely delved into the means through which bitcoin can be mined through clean, renewable means.

As Katrina Kelly argues in a recently published piece for The Conversation, the bitcoin energy debate rarely looks into where the energy is sourced and how it is produced.

“Not all types of energy generation are equal in their impact on the environment, nor does the world uniformly rely on the same types of generation across states and markets,” she argues in the article. Not all energy production nets the same carbon emissions, Kelly’s argument goes, so not all mining operations are consuming electricity that is as detrimental to the environment as detractors claim.

Northern Bitcoin’s zero carbon emission mining is a testament to Kelly’s thesis. As with other companies dedicated to green mining, they’re reframing the debate on mining. If mining can be conducted in a responsible manner, as Northern Bitcoin’s operations demonstrate, this model challenges us to rethink how the network can scale in eco-friendly ways going forward.

Northern Bitcoin’s commitment to taking steps toward a greener future for Bitcoin includes an invitation to other renewable mining operations to join them with their mining pool. According to Jäger, clean mining must be the future; with it, we can secure a sustainable future for Satoshi Nakamoto’s creation to reach its potential.

Bitcoin is a genius creation and the most valuable cryptocurrency for now. It is the most effective way to store value and participate in global trade for people living in countries with unstable currencies. We anticipate a bright future for Bitcoin and that it will impact the lives of billions of people. As it consumes a lot of energy, the future of Bitcoin has to be green. That is why we focus on green, sustainable mining of bitcoin.