The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

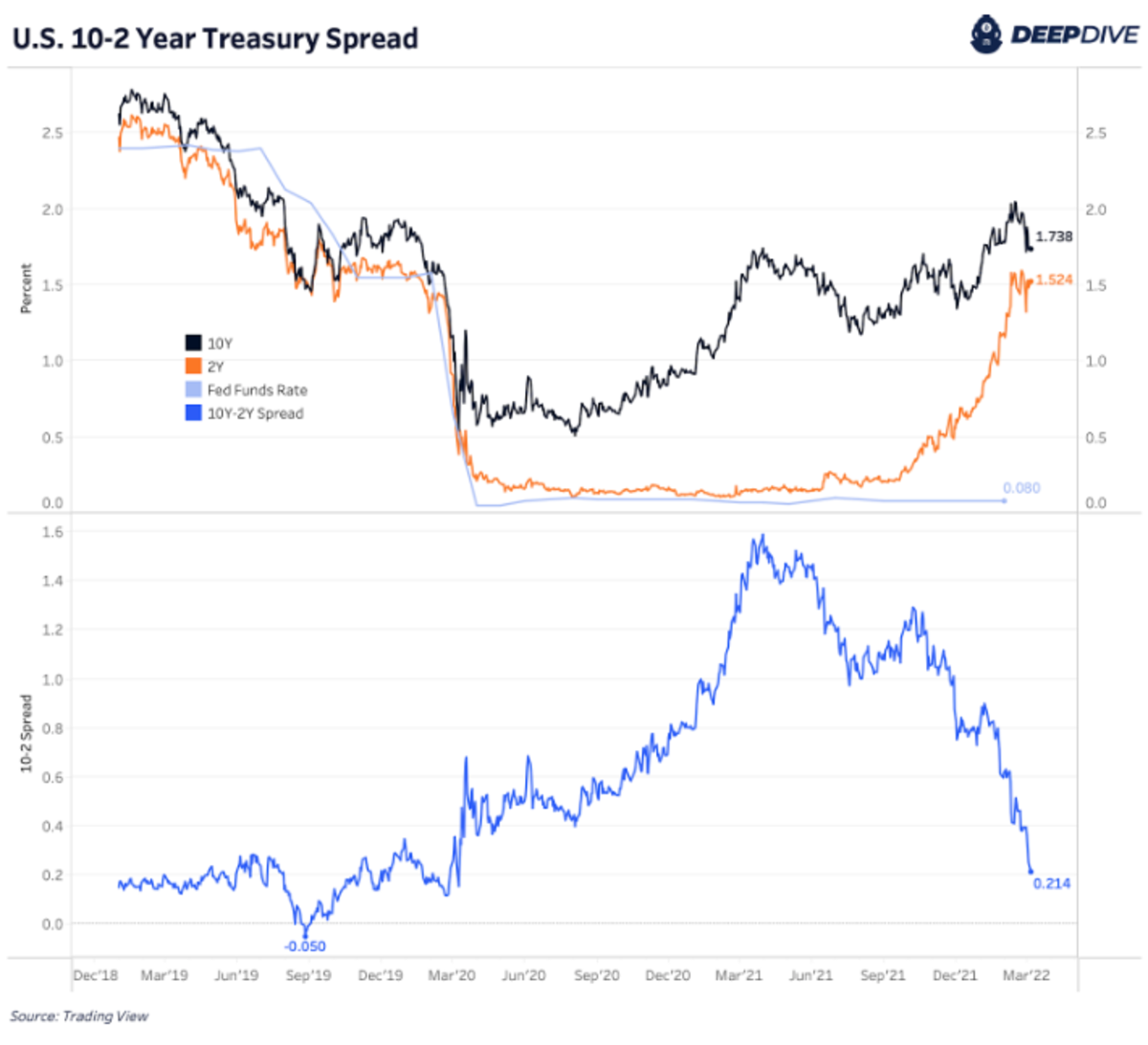

The meltdown in equity and credit markets is occurring while the yield curve (10-year U.S. Treasury yield minus two-year U.S. Treasury yield) is flattening in a dramatic way:

The yield curve is of great importance in the financial system due to the way that lending is conducted. Most creditors borrow short to lend long (i.e., take on short-dated liabilities and acquire long-dated assets), so when the yield curve inverts, it means that creditors are more incentivized to hold short-dated government paper than they are to lend out for duration. The implications of short-dated yields being higher than long-dated means it is also less risky to hold cash than it is to invest in risk assets (even with negative real yields) that sell off with weak economic activity.

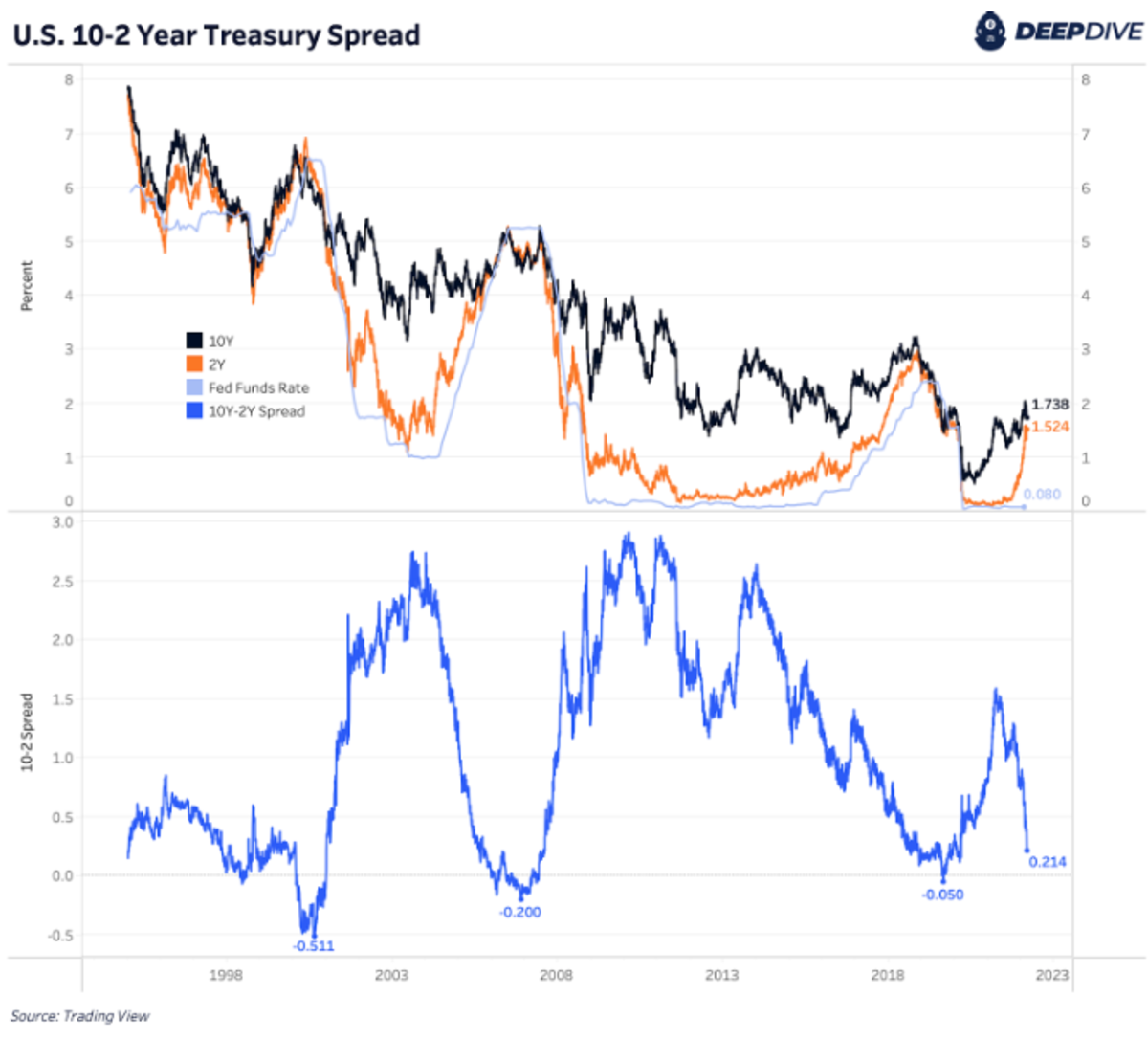

This leads to liquidity issues in the economic system and it is why a yield curve inversion has predated every recession in the United States since the 1960s.

Yield curve inversion has predated every recession in the U.S. since the 1960s. Source: Trading View.

The most jarring aspect of the current environment is the reality that the Fed funds rate is still near 0%, with recession indicators flashing bright red.

Recession indicators are flashing bright read. Source: Trading View.

The SPX is rising as the percent yield spread declines. Source: Trading View.

It would be wise to warn our readers that despite being extremely bullish on bitcoin’s prospects over the long term, the current macroeconomic outlooks looks extremely weak. Any excessive leverage present in your portfolio should be evaluated.

Bitcoin in your cold storage is perfectly safe while mark-to-market leverage is not. For willing and patient accumulators of bitcoin, the current and potential future price action should be viewed as a massive opportunity.

If a liquidity crisis is to play out, indiscriminate selling of bitcoin will occur (along with every other asset) in a rush to dollars. What is occurring during this time is essentially a short squeeze of dollars.

The response will be a deflationary cascade across financial markets and global recession if this is to unfold.

This is why we prefer to maintain a multi-year (multi-decade even) outlook on bitcoin, as it is our belief that the response to this event will be only one viable “solution”: more stimulus.

This will likely come in the form of yield curve control, where the Federal Reserve monetizes any amount of debt securities across various durations at a certain level of yield.

Quantitative easing is a fixed amount of money printing at any price. Yield curve control is in theory an unlimited amount of printing to maintain a certain price. This is where the system is headed in our view.

And this is why we own bitcoin.