Bitcoin headlines more often than not focus on the price. Whether it goes up or down in U.S. dollar terms, the media rides the wave accordingly, denoting “bubbles” and “crashes” as they come. As a result, the technology’s fundamentals get little to no coverage and the “Bitcoin curious” audience doesn’t get much insights into what is shaping the peer-to-peer (P2P) currency’s growth.

This dynamic can be further exemplified with the adoption of bitcoin as legal tender by El Salvador. Most outlets have chosen to focus more on the ways the experiment could have and, in some instances, did go wrong, rather than on the gains the country and population have had since the inception of the legislation.

Michael Peterson, the founder of Bitcoin Beach, the circular Bitcoin economy that inspired El Salvador President Nayib Bukele to adopt bitcoin nationally, told Bitcoin Magazine that this is “all about perspective.”

“Most negative stories claim [Bitcoin payments adoption] is about 20% and paint that as failure. If a country outside of El Salvador had even 5% of businesses accepting BTC, we would be thrilled,” he said.

“I think the level of adoption as a medium of exchange is pretty extraordinary. As the saying goes, people overestimate what can be accomplished in a year and underestimate what can be accomplished in 10 years. I think 10 years from now it will be hard to find anyone who remembers being a critic,” he added.

When it comes to Bitcoin Beach specifically, Peterson opined that the impact of the Bitcoin Law has been a mixed one.

“On the negative side, it politicized bitcoin,” he said. “On the positive, it spurred a proliferation of bitcoin-related tools and ability to integrate better in the traditional financial system.”

State-sponsored bitcoin and U.S. dollar wallet Chivo, Peterson continued, allows for seamless BTC integration with bank accounts, which is important for business owners.

“From my perspective, this past year has gone much better than I was expecting it would a year ago. In five years from now it will blow people's minds,” he said.

The adoption of bitcoin by Salvadoran retailers, both locally on Bitcoin Beach and broadly in the country, has successfully been implemented thanks to the Lightning Network (LN). In addition to benefiting from Lightning, the first country to adopt BTC as a national currency also created a feedback loop through which Lightning itself has also profited. This article will explore this dynamic. But before diving into the details, an easy to understand but detailed explanation of Lightning is in order.

A Primer On The Lightning Network

Lightning was designed to scale the Bitcoin network's base layer. Bitcoin relies on a distributed ledger, cryptography, a peer-to-peer network, a consensus protocol and a hard-to-produce but easy-to-verify process to add entries to the blockchain to ensure openness, censorship-resistance and trustlessness. Together, these characteristics solve the double-spend problem and set Bitcoin as the first and proper peer-to-peer electronic cash system — a distributed network that allows uncensorable payments to be made between distrusting parties without relying on any intermediaries.

However, that is quite costly to achieve and the many nuances involved do not allow the base layer to be scaled. Blocks have to remain small, for instance, so that the cost of running a node remains low and, therefore, the network remains distributed and censorship-resistant. But if Bitcoin is to achieve its full potential and become the world's default value system, it needs to scale. That's where layered scaling comes in.

The Lightning Network is a Layer 2 protocol for Bitcoin. It utilizes Bitcoin’s base layer and protocol to abstract small transactions between users away from the Bitcoin blockchain. With smart contracts, Lightning can settle the final balance of those payments into the base layer while ensuring that all transactions abide by the rules of the protocol.

Under the hood, the smart contract created by the protocol is a multisignature address, for which the two participating users each hold a private key. In Lightning, it is known as a "payment channel."

A Lightning channel allows two users to share the funds in the address but prevents either one of them from acting maliciously to the detriment of the other. If one user makes a payment to the other, their respective balances in the payment channel are updated, indicating how much of the total channel funds each user will get upon the eventual channel closure.

Therefore, only Lightning channel-opening and channel-closing transactions are recorded on the Bitcoin blockchain. By eliminating the transaction fees and wait times that add friction to on-chain Bitcoin transactions, Lightning enables its users to enjoy affordable, fast and private payments.

A Network Of Payment Channels

When people talk about the Lightning Network, they are talking about an abstracted concept of what is, in fact, many different payment channels connected together.

As explained in the previous section, Lightning payment channels set the basis of the network as two participants lock up an amount of bitcoin on the Bitcoin network base layer to make quick and cheap off-chain payments among themselves. However, by opening more channels with different participants, payments can then be routed through this mesh network, from one participant to the next, until the final recipient of a Lightning payment is reached.

Therefore, the abstraction that is “the Lightning Network” requires different participants to communicate with each other so they can route each other’s payments and enable frictionless interaction. This is how people are able to pay someone through Lightning without directly opening up a channel with them.

This communication and routing happens between nodes who run the Lightning protocol software.

Node Software

Whereas in Bitcoin there is a de-facto standard node software, Bitcoin Core, there is more than one type of Lightning node software that is currently popular. As a result, there is a need for a set of documents to dictate how these different types of Lightning nodes — aka “implementations” — can talk to each other.

The Basis of Lightning Technology (BOLT) documents define the set of specifications that all Lightning node implementations must adhere to in order to be a stable, compliant participant in the Lightning Network. There are currently 11 BOLT documents that describe everything from how to establish a payment channel and fund it with bitcoin to how one should request a Lightning payment.

Naturally, the fact that there are different Lightning implementations also means that there are different offerings available to users, and they can pick whichever software to run based on their specific needs. At a high level, there are four major Lightning implementations: LND, Core Lightning, Eclair and LDK, each geared toward specific use cases. These differences aren’t palpable for most end users, who most often than not interact with Lightning through a mobile application that itself leverages one of these implementations, but picking the right one for the job is an important task for services providers and users willing to run their own Lightning nodes.

From El Salvador To The Federal Reserve

El Salvador adopting bitcoin as legal tender conferred much legitimacy to Lightning as it became clear to the world that, contrary to popular belief, bitcoin could indeed be used to purchase daily goods.

This recognition spurred a greater level of awareness about the technology, which can be evidenced by a research paper recently published by one of the branches of the U.S. central banking system.

Published in June 2022, the Federal Reserve Bank of Cleveland’s “Lightning Network: Turning Bitcoin Into Money” paper described how the nascent technology is able to decongest the Bitcoin base layer blockchain and enable bitcoin to better function as a means of payment.

“We find that adoption of the Lightning Network has led to a reduction in Bitcoin blockchain congestion and lower mining fees. The results are significant, both statistically and economically, and cannot be explained by changes in demand for blockchain space, nor by other technological developments. We find limited evidence that greater centralization of the network is associated with lower fees. Our results suggest that the Lightning Network can help Bitcoin achieve greater scalability, allowing it to operate better as a payments system. According to our results, if the LN had existed in 2017, congestion could have been 93 percent lower.”

The paper cites El Salvador’s bitcoin adoption as a cornerstone moment for the scaling technology, mentioning how on top of such use the network has also been leveraged by a slew of mainstream companies and services, including Twitter’s tipping functionality and the integration of Lightning payments by major bitcoin exchanges.

At large, the development of Bitcoin’s scaling protocol “may have consequences for welfare,” the paper says.

“First, as Bitcoin becomes a more efficient payments system, users are better off. Their transactions settle more quickly and more cheaply. Second, since fewer transactions need to be recorded on the blockchain, less memory and energy are needed to run a Bitcoin node. This saving lowers the cost of maintaining the blockchain, allowing more nodes to participate and making the system more secure against a double-spending attack. Third, by reducing fees, the LN reduces the incentive for Bitcoin miners to use large amounts of computing power, meaning less energy use and positive consequences for the environment. Fourth, less blockchain congestion may mean lower barriers to arbitrage across cryptocurrency exchanges, thereby improving market liquidity.”

Lightning Growth

With increased awareness comes growth, and with Lightning it’s been no different. It is possible to realize how big of an impact being in the spotlight has had on Lightning by following technical metrics that shed some light on the network’s activity and status. The most frequently tracked ones by the community include Lightning’s bitcoin capacity, number of nodes and number of channels.

Bitcoin Capacity

While capacity is a common metric to watch, its meaningfulness is rarely discussed.

As mentioned previously, Lightning works by locking up bitcoin on the Bitcoin network with on-chain smart contracts that can be shared by the parties in the channel. These public lock-ups amount together to compose what is referred to as the network’s capacity. The greater the capacity, the better. This is because capacity is related to liquidity.

Liquidity is important to Lightning because it allows bitcoin to be sent and received across channels in the network. While it is obvious to realize that liquidity is needed to send BTC, the need for liquidity to receive bitcoin on Lightning is not as straightforward to understand.

Capacity is added to a channel on its opening transaction — the amount of bitcoin committed to the transaction becomes the channel’s total capacity. Assuming the channel was opened unilaterally, the peer that did so starts off with zero inbound capacity and the channel’s total capacity as their outbound capacity; they can’t receive any bitcoin in that channel because they own all of it but can send some or all the bitcoin in the channel to the other peer. The inverse is true for the other peer: they have zero outbound capacity (because they don’t have rights to any of the bitcoin in that channel yet) and the total amount of bitcoin in the channel is their inbound capacity (because they can receive all of it).

To send bitcoin on Lightning, users need to acquire outbound capacity. Users can easily do so by opening up a channel with another peer in the network, as they would be creating a new channel with their balance and making it available to be spent on Lightning.

On the other hand, to receive bitcoin on Lightning, a user needs to acquire inbound capacity. One way to do so on the channel level is by sending some bitcoin to another peer, which “releases” some balance for them to receive bitcoin with. But that doesn’t make a lot of sense within the same channel. So, another option for the user is to incentivize peers in the network to open channels with them. However, this can be tricky because there are costs and trust issues involved. To solve this problem, different types of marketplaces have emerged to deal liquidity on Lightning, such as Lightning Pool and Liquidity Ads.

Therefore, capacity and liquidity — which are often used interchangeably — are critical for Lightning’s functioning. As such, the greater the capacity on the network, the better, because it makes it more likely that users will be able to find enough liquidity to be able to successfully route bitcoin across the network’s many channels. Of course, Lightning capacity doesn’t tell the whole story as individual balances of inbound and outbound capacity are still not represented. But broadly, bitcoin capacity on lightning helps users realize how much BTC is held on Lightning channels and, as such, available to be used in the Layer 2 network.

Therefore, it is strikingly positive to see the Lightning Network grow in bitcoin capacity. Even more meaningful is the fact that such growth has happened while the price of bitcoin in U.S. dollars has trended down. Over the past year, since the adoption of bitcoin as legal tender by El Salvador, bitcoin accumulated a 64% decline in price, while Lightning capacity has nearly doubled.

Node and Channel Count

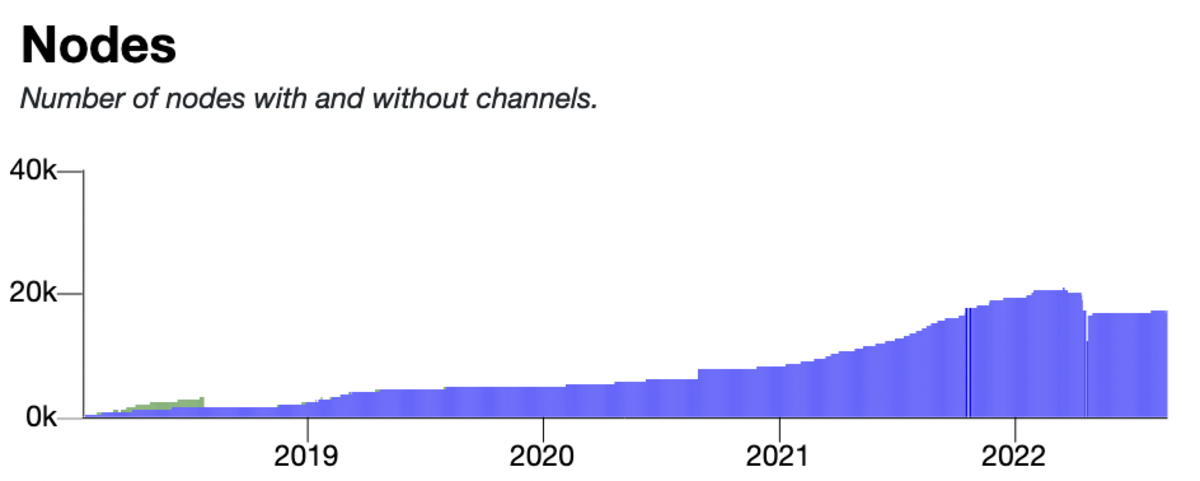

While capacity is a good indicator of the network’s size and payment capability, its number of nodes and channels can be seen as a measure of its decentralization. The more nodes, the more resilient Lightning can be thought to be as more players are actively participating as peers in the network, as opposed to embarking on it through light clients and custodial wallets.

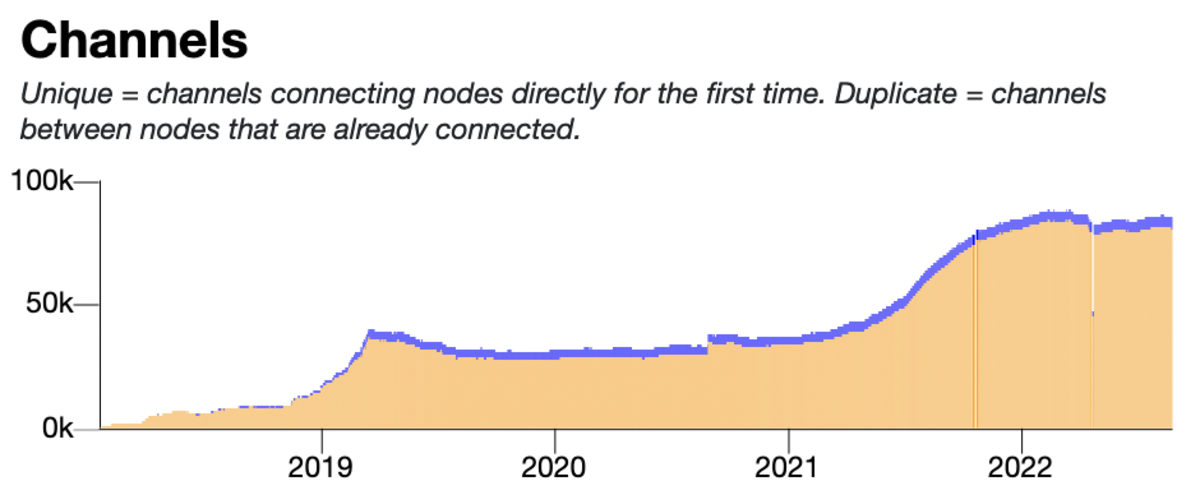

During 2021, node and channel count on Lightning grew alongside capacity to new highs. This year, however, the network’s number of channels and nodes took a hit as bitcoin’s price slump worsened in June. Since then, they have for the most part remained flat.

The number of channels in the Lightning Network exploded from 2019 to 2022, until it subdued as the bitcoin price started to slide more aggressively. (Chart/Bitcoin Visuals)

The amount of nodes making up the Lightning Network rose dramatically from 2018 to 2022, however, the count began trailing down as the market capitulated in June. It has since stabilized. (Chart/Bitcoin Visuals)

Despite the slight decrease in channel and node count, the extent to which it has happened doesn’t seem to warrant much worry at present as it’s correlated with the broader slump in bitcoin prices in June. Nonetheless, they are an important metric to watch in the pursuit of greater decentralization of the network.

Lightning Adoption

Beyond technical metrics, another angle through which to look at the development of Lightning relates to actual usage. While that is hard to accurately measure, evidence exist of the proliferation of Lightning technology and its adoption for financial inclusion across different areas of the globe.

If bitcoin usage and acceptance can serve as a demonstration of its adoption, then traveling around the world using mostly bitcoin on-chain and on Lightning is perhaps the most valuable metric to showcase how awareness about the P2P currency has proliferated.

That’s what Paco de la India decided to do last year as he committed to travel to 40 countries while on a personal bitcoin standard. He began sharing his travel on Twitter and YouTube and quickly gathered thousands of followers who were eager to know more about his feats.

“It’s a purely crowdfund campaign,” Paco told Bitcoin Magazine. “It started on September 17 last year, it’s been 11 months now and it all started with zero. I remember selling my furniture and starting with $200 and then one guy gives me $200, another gives me $100, then $300, $500. Then a big $1,000 came from a Bitcoin Core developer and then it just caught on you know.”

Over what’s now almost a year, Paco has traveled to more than 18 countries, some of which stood out to him when it comes to bitcoin adoption. Thailand, Singapore and Kenya are three examples of nations that positively surprised the traveler.

“Kenya was one place where I bought a book for bitcoin, got a massage for bitcoin, got food with bitcoin, paid for my guide with bitcoin, and found a pool table, a game of pool that you could play with bitcoin,” he said.

“[But] Singapore is crazy,” he added. “You can literally get a coffee with bitcoin.”

Even though many merchants accepted bitcoin, Paco sees most of them being crypto enthusiasts rather than Bitcoiners.

“Most of the people haven’t understood the philosophy of Bitcoin and its bigger purpose,” he said. “Everybody sees this from a price action point of view. Once you just see the price, then you always will look at the numbers and, as the numbers keep fluctuating, it keeps you in doubt of whether it is a real thing or not.”

“But when you get to share what is happening with the printing of money, the devaluation of the currency…it’s like, ‘Hey guys, have a look at, from a different angle, what Bitcoin is,’” he continued.

As in-depth knowledge about bitcoin is still low, knowledge about Lightning, which builds on Bitcoin’s functionality, should naturally be even lower. And that’s in line with what Paco has seen.

“Lightning is something that people are still getting to know about,” he said.

To foster the adoption of bitcoin and Lightning for everyday transactions and long-term savings, however, many hotspots have begun emerging around the world since the creation of Bitcoin Beach and later the adoption of bitcoin as legal tender by El Salvador.

Guatemala

“On Lake Atitlán in Guatemala, merchants and community members are painting the town bitcoin orange and accepting Lightning payments for everything from pizza to parasailing,” Andrew Begin, director of marketing at bitcoin banking software firm Galoy, told Bitcoin Magazine.

The community, called Bitcoin Lake, emerged after its founder got inspired by the developments happening at Bitcoin Beach in El Zonte, El Salvador.

Replicating the success of Bitcoin Beach is not a simple feat, however, and as such, different communities choose different tactics to gather traction, Begin explained.

“Bitcoin Lake, for instance, engaged Bitcoin Twitter to send sats over Lightning for a pizza party,” he said. “The event helped reveal the power of Lighting to the newly onboarded merchant while rewarding local kids for community service work.”

While many communities have emerged and will continue to do so, the need to learn about the new technologies poses a barrier to their growth. Software applications exist to ease the tech learning curve, such as Galoy’s own solution, but other barriers to adoption still exist.

“Another hurdle to community adoption is having fiat on- and off-ramps,” Begin said. “Getting the flywheel spinning in traditionally unbanked communities can be greatly accelerated with external funding injected into the project.”

In the early days of Bitcoin Beach, he continued, having a bitcoin ATM helped people exchange cash for bitcoin and vice-versa with greater convenience, which facilitated the adoption and usage of BTC by the community.

Costa Rica

Costa Rica is home to Central America’s third circular bitcoin economy, Bitcoin Jungle. The community is “spreading Lightning adoption across ferias (farmer’s markets) and merchants,” Begin told Bitcoin Magazine.

Bitcoin Jungle leverages Galoy infrastructure for its needs, but local developers added their own twist to the core banking stack so it would better fit the needs of the community.

“A team of developers in Costa Rica launched the Bitcoin Jungle App on top of the Galoy open-source core banking platform, bringing a locally branded and managed wallet to their community project,” Begin explained.

Galoy brings a custodial banking solution to communities which, while reducing friction, creates additional trust and security assumptions. However, the stack aims to prevent total centralization by leveraging a multisignature setup.

“Communities using wallets built on Galoy […] get the reliability and ease of use of a custodial wallet, with the security of having funds in a multi-signature cold storage set up managed by the local community,” Begin argued.

It is worth mentioning that while custodial solutions can often improve usability and be a helpful tool for onboarding new users onto Lightning, they are arguably better used that way — as an initial step along the way to eventual self-custody setups.

Peru

Down south, a nonprofit organization has been making huge strides in leveraging bitcoin to bring financial inclusion to underserved communities.

Also inspired by Bitcoin Beach, Rich Swisher, co-founder and president of non-profit global empowerment group MOTIV, saw the many opportunities that a sovereign and decentralized monetary network had to empower those who have been left out of the traditional banking system. Now, through a series of programs ranging from medical care to entrepreneurship classes, MOTIV is leveraging bitcoin to bring inclusion and hope to disadvantaged communities through many hubs in Peru.

“There is an outstanding alignment between Bitcoin and humanitarianism,” Swisher told Bitcoin Magazine in an interview earlier this year. “Being able to have unobstructed access to a financial system that is not seizable and not able to be shut off by changing governments is key for people to build hope.”

Swisher explained that in the villages and municipalities that MOTIV works in, the issue is systemic, as the lower classes are kept at the bottom and don’t believe there is a way to overcome that. A lack of hope for the future is entrenched in these communities, which are left behind by a financial system that does not cater to them or to their needs.

MOTIV’s hubs facilitate the birth of micro-businesses in these communities as people begin to see their neighbors bypass that initial mental blockade and achieve some financial freedom by enrolling in a class and, later, independently selling a product for bitcoin.

The program has grown to encompass more and more communities in Peru through different initiatives. In early August, the nonprofit announced it had helped establish a total of 16 circular bitcoin economies in the country. A week later, MOTIV shared news that it had released a series of programs to further financial inclusion in these communities and encourage the formation of new ones.

Brazil

The first Brazilian circular Bitcoin economy was spun up last year in the paradisiac beach of Jericoacoara, Ceará — a state in the northeastern region of the South American country. Jeri, as it’s nicknamed, is a beach known for its beautiful sights and year-round sunshine.

Fernando Motolese, who is leading the set up of Praia Bitcoin — a literal translation of Bitcoin Beach to Portuguese — told Bitcoin Magazine that his endeavor has been hard, but nonetheless very rewarding.

“The experience has been enriching despite the challenges involved in doing something like we’re doing here,” he said.

According to Motolese, attracting funding has been the biggest challenge. Brazilians, for the most part, aren’t culturally wired into helping social projects, he argued. To date, Praia Bitcoin has raised 0.66 BTC through its donations page.

Despite the hardships, the project was able to onboard over 20 businesses onto bitcoin and Lightning last year. But that number has decreased since the start of the market downturn.

“Now there are only 10 businesses holding on, in addition to the many hawkers,” Motolese said.

Nonetheless, Praia Bitcoin has kept progressing on a front Motolese deems critical: education.

“Disinformation about bitcoin may be the main barrier for adoption, but once people start transacting [in bitcoin] they kickstart a journey of many stages,” he said.

Recently, Praia Bitcoin built paper wallets to gift BTC to local children who lack access to a smartphone. Now, Motolese is working on a new solution to further the adoption of bitcoin and Lightning in the region.

“With the help of new tools and a donation from the Youtube channel ‘Palavra de Satoshi,’ we’re producing 2,000 NFC cards, out of which 408 will be distributed to students and teachers of a local public school at the Children’s Day party on October 11, 2022,” he said.

The development of the card, a more robust server infrastructure and the one year anniversary of the start of the project make Motolese confident that Praia Bitcoin will be able to better serve the community and facilitate the onboarding of even more businesses.

Argentina

While there still doesn’t seem to be a circular Bitcoin economy in Brazil’s neighboring country Argentina, the nation is broadly famous for its bitcoin adoption levels, which is believed to be due to the harsh monetary reality experienced by its citizens.

Argentina’s inflation is among the highest in the world. For the 12 months ending in July 2022, the country’s inflation rate was reported to be a whooping 71%. This is one of the reasons the country was the second outside the U.S. in which Lightning payments app Strike launched.

“Today, we launch a superior financial experience to a country that faces hyperinflation, predatory payment networks, and unusable cross-border transfers,” Strike founder Jack Mallers tweeted on the day of the announcement. “Today, we use the world’s open monetary network, Bitcoin, to give hope to the people of Argentina.”

In the midst of soaring inflation that has lasted for decades, Argentina sits among the top 10 countries in cryptocurrency adoption in the world, according to a research report by Chainalysis. Naturally, local developments have spurred to meet such high demand.

In July, local exchange Lemon Cash integrated Lightning into its platform through a partnership with payments processor OpenNode, enabling 1 million Argentines to take advantage of Bitcoin’s scaling network.

“Thousands of Lemon Cash customers have transacted on Lightning and we expect this to exponentially increase over the coming months,” Head of Strategy at OpenNode, Josh Held, told Bitcoin Magazine.

Lemon Cash’s Lightning integration came on the heels of the country’s biggest private bank move to offer bitcoin trading to its customers. In May, Banco Galicia announced that it would enable bitcoin buying, selling and trading on its mobile app through a partnership with cryptocurrency infrastructure company Lirium. Later that month, however, the Argentine central bank ruled that financial service providers would be prohibited from offering cryptocurrency-related products to its customers. While such a crackdown can slow the pace of bitcoin adoption in the country, Bitcoin’s P2P nature ensures it won’t be able to stop it.

South Africa

On the other side of the Atlantic, Bitcoiners have started Bitcoin Ekasi, a local circular bitcoin economy in the city of Mossel Bay, South Africa.

“Bitcoin Ekasi is using Lightning to fuel commerce and fuel education programs,” Begin told Bitcoin Magazine, adding that the community leverages a slew of different wallets and applications.

“Ekasi” is a colloquial term for “township” and is associated with the growth of slums outside South African cities where black people were forced to live during apartheid.

“Unemployment, crime and poverty remain rife there,” Bitcoin Ekasi said in a tweet. “We believe #Bitcoin can help uplift those who need it most.”

This is one of the many areas bitcoin can be of use, and at the moment it is arguably the most important one. By providing an alternative financial system that doesn’t deny service based on nationality, race, status or beliefs, bitcoin can help secure the financial freedom of billions of people worldwide who have been reprehended or left behind. And the more small circular bitcoin economies pop up around the world and the more countries start making bitcoin legal tender, the greater the fuel going into the spark that is igniting this fire of freedom.