The introduction of non-fungible tokens (NFTs) has sparked exponential growth in celebrity endorsements and investments. These unique digital assets, built on blockchain technology, have opened up fresh avenues for celebrities to engage with their fan bases, capitalize on their brands, and delve into the realm of cryptocurrencies.

Nevertheless, the NFT market is known for its unpredictability and volatility, often resulting in rapid and significant price fluctuations.

While numerous celebrities have enthusiastically embraced the NFT culture, not all have experienced favorable outcomes. For certain individuals, these investments are not solely motivated by financial gains but rather form part of a broader marketing strategy.

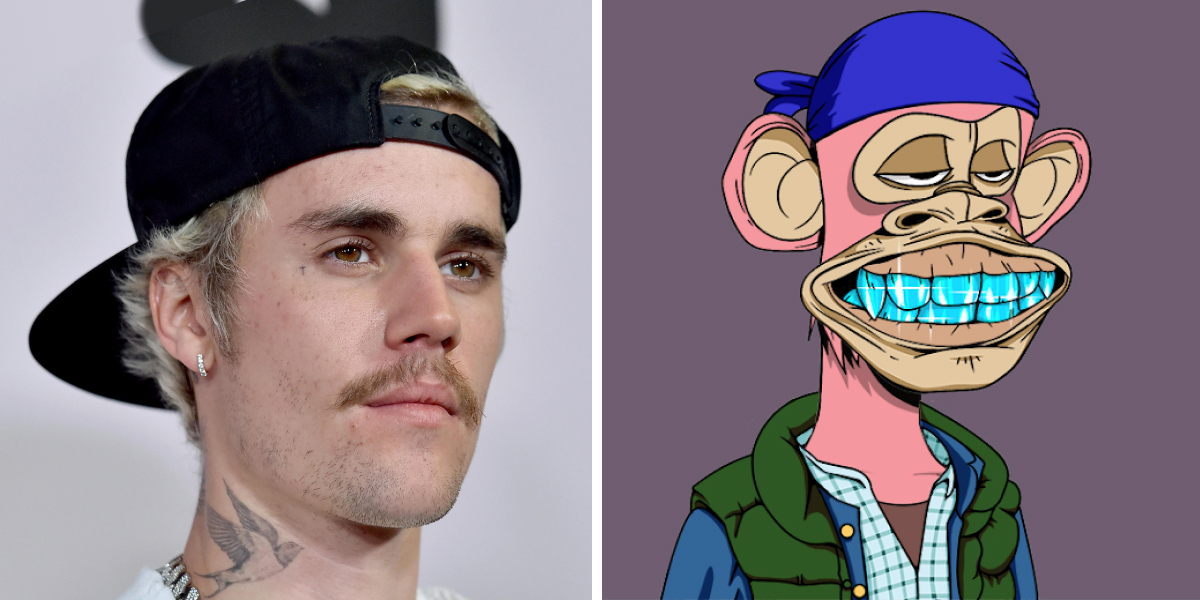

Justin Bieber, a renowned pop icon, appears to have suffered a significant setback following his venture into the realm of non-fungible tokens through his acquisition of the Bored Ape Yacht Club (BAYC) NFT. The worth of his digital collectible has plummeted by approximately 95% as of today.

Related Reading: Belarus Intends To Put A Ban On P2P Crypto Transactions, Here’s Why

Justin Bieber’s investment of $1.3 million in Bored Ape Yacht Club (BAYC) NFTs has now dwindled to a mere $59,000, resulting in a loss of approximately $1.2 million.

Has Justin Beiber Really Incurred A Significant Loss In The NFT Investment?

Although Justin Bieber’s NFT investment in Bored Ape Yacht Club (BAYC) has resulted in a significant loss of approximately $1.2 million, there are speculations suggesting that the effective loss for him might be negligible.

It has been speculated that Bieber potentially acquired the BAYC NFT for free as part of a promotional agreement, where he agreed to endorse and promote BAYC on social media platforms.

Considering Justin Bieber’s estimated net worth of $285 million as of September 2021, the $1.2 million loss from his NFT investment, while significant, is likely within his financial means.

As the singer has diversified his income streams through music, merchandise, endorsements, and now NFTs, he has built a financial foundation that can help mitigate the impact of the NFT’s depreciation.

Speculation has arisen among Twitter users regarding a transfer of 400 ETH (approximately equivalent to $1.2 million at the time) to Justin Bieber’s wallet from a wallet associated with Yuga Labs and MoonPay.

The NFT company is known for generating a significant buzz by providing NFTs to celebrities in the past. This development has sparked intrigue and further discussion within the online community.

In December of the previous year, both MoonPay and Yuga Labs found themselves as defendants in a lawsuit that alleged their involvement in deceptive promotions through the use of celebrity endorsements.

The lawsuit raised concerns about the ethical and legal implications surrounding their marketing practices, which further added to the controversy surrounding the companies.

As of now, the Bored Ape Yacht Club has established a price floor of 31.50 ETH. This indicates the minimum price at which these non-fungible tokens are being traded within the marketplace. However, the collection has recorded a 24-hour trading volume of 2,906 ETH.