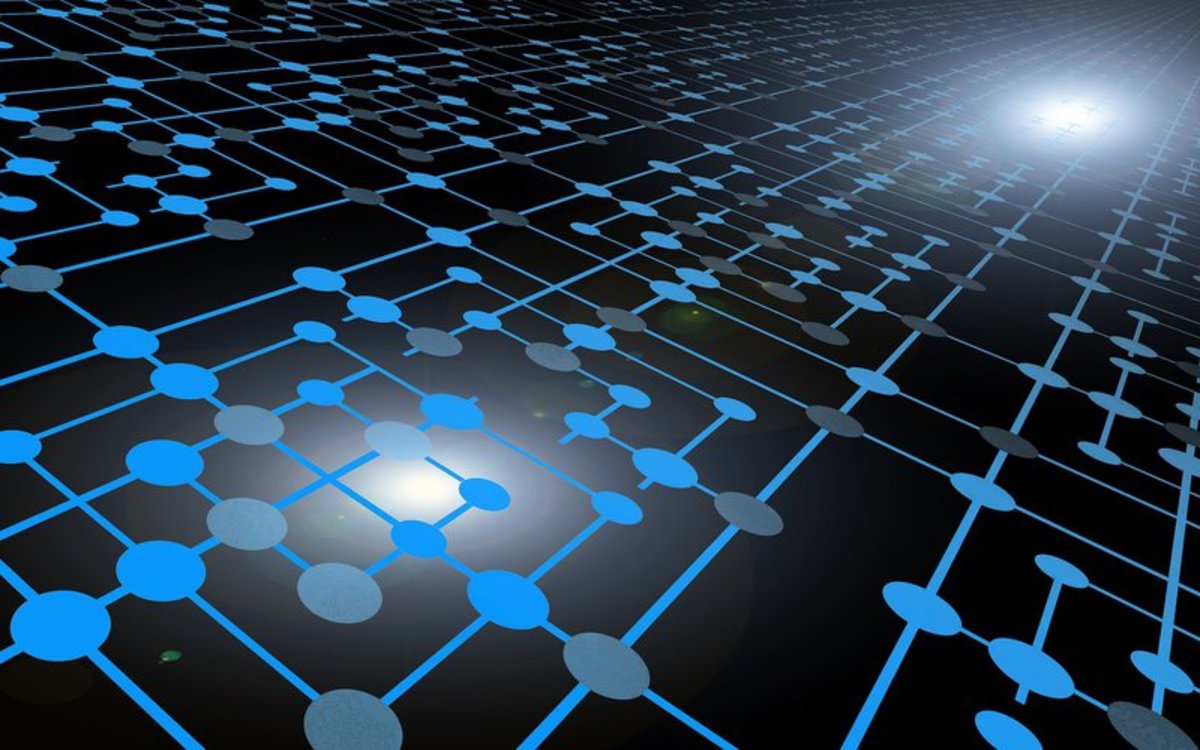

Last week Bitcoin Magazinereported that 11 member banks of the R3 consortium, a collaborative group of the world’s largest and most influential banks and financial institutions, participated in a pilot test of the Ethereum-based blockchain network. The banks connected on an R3-managed private peer-to-peer distributed ledger, powered by Ethereum technology and hosted on a virtual private network in the Microsoft Azure Blockchain as a Service (BaaS) cloud, to execute simulated financial transactions instantaneously.

R3 is expanding its comparative evaluation project to include other banks, distributed ledger technologies and cloud computing platforms. The latest R3 announcement reveals that the group experimented with five distinct blockchain technologies in parallel in the first test of its kind. The trial represented the trading of fixed income assets between 40 of the world’s largest banks across the blockchains, using five different distributed ledger technologies built by Chain, Eris Industries, Ethereum, IBM and Intel.

“[The banks] evaluated the strengths and weaknesses of each technology by running smart contracts that were programmed to facilitate issuance, secondary trading and redemption of commercial paper, a short-term fixed income security typically issued by corporations to raise funding,” notes the R3 press release, which includes informative statements from the companies whose technologies were assessed in the trial.

“This development further supports R3's belief that close collaboration among global financial institutions and technology providers will create significant momentum behind the adoption of distributed ledger solutions across the industry,” said R3 CEO David Rutter. “These technologies represent a new frontier of innovation and will dramatically improve the way the financial services industry operates, in much the same way as the advent of electronic trading decades ago delivered huge advancements in efficiency, transparency, scalability and security.”

Each of the distributed ledgers ran a smart contract based on identical business logic to enable the banks to accurately compare the difference in performance between them. Cloud computing resources were provided by Microsoft Azure, IBM Bluemix and Amazon AW, to host the distributed ledgers.

ING Bank, a Dutch multinational banking and financial services corporation headquartered in Amsterdam with more than 48 million individual and institutional clients in more than 40 countries, participated in the trial. ING Bank joined R3 in November, stating that joining R3 was the next step with blockchain technology to collaborate on research, design and engineering that will advance innovative solutions for clients that meet banking requirements for security, reliability, performance, scalability and auditing.

“The trial marked an unprecedented scale of institutional collaboration between the financial and technology communities exploring how distributed ledgers can be applied to global financial markets,” notes ING’s announcement of the latest R3 blockchain test.

“It is great to see that the trials are bringing all parties so much closer together,” said ING Global Head of Payments Jurgen Vroegh, who is leading the project for ING. “The engagement between the member banks at all levels and across all disciplines was very intense and full of enthusiasm. With constructive in-depth communication we really managed to create an expert community. The trials gave us a higher level of understanding of the various technology options and insight on how smart contracts can really work on a distributed ledger.”

"The successful trial of the five cloud-based emerging blockchain technologies in parallel gave us a lot of insights into how smart contracts work,” Vroegh told Bitcoin Magazine. “Very interesting to learn was that while they all started out with the same basic business assumptions, they all came up with different possible solutions. The insight this gave us is that there are many possible ways to implement smart contracts and that there is still much more for us to discover and many choices to be made."

While Vroegh’s diplomatic statement shows that it’s too early to expect a “winner” to emerge from R3’s comparative study, its open-endedness is informative. In fact, it seems likely that different distributed ledger technologies will coexist, each optimized for specific applications.

R3 will continue to work with the banks in its Global Collaborative Lab over the coming months to test and develop applications based on distributed ledger technology for the financial services industry. According to R3, the Lab has quickly become a center of gravity for collaborative applied blockchain efforts in the financial services and distributed ledger technology industries.