As blockchain fever is taking hold of prominent financial industry firms around the globe, two men from Kentucky believe to have found the key to rewire international supply chain infrastructure.

Fluent cofounders Lamar Wilson (CEO and developer) and Lafe Taylor (CDO) recently unveiled the Fluent Network, a blockchain-based financial operating network to streamline supply chain finance. And they've got $2.5 million in seed funding to back their efforts.

From Pheeva Wallet to Blockchain Startup

Wilson and Taylor, who previously founded the Pheeva Bitcoin wallet for iOS, are not your typical Stanford-dropout fintech architects.

Far removed from both the old money in the incumbent financial sector, as well as the new money in Silicon Valley, Wilson and Taylor met at their high school in Lexington, Kentucky. Having first discovered Bitcoin back in 2011, the two founded the Pheeva wallet in 2014, the only iOS-compatible Bitcoin wallet throughout Apple's anti-Bitcoin era.

In that same year, 2014, Wilson and Taylor also increasingly shifted their focus to Bitcoin's underlying technology, the blockchain. And – like many others – they became convinced that the innovative distributed ledger technology could fuel a parallel revolution to Bitcoin's: a revolution specifically geared toward removing friction from the existing financial infrastructure.

Building on this vision, Wilson and Taylor founded their second venture, Fluent. And, after months of research, they pinpointed a niche they believed could be significantly improved by blockchain technology: supply chain finance. Mirroring logistical supply chains, often composed of dozens or even hundreds of production steps, supply chain finance consists of a long series of ledgers and processes maintained by individual operators.

This is an inefficient infrastructure, ripe for disruption, according to Taylor:

“Most financial supply chains right now consist of very siloed and opaque systems, which is tremendously inefficient. And, to make it worse, large companies at the head of these supply chains typically push out payment terms as far as possible to increase their cash flow. This puts a lot of pressure on suppliers in particular; they need the cash as fast as they can in order to pay their employees, buy raw materials, and other expenses.”

The solution, Wilson and Taylor believe, is blockchain technology.

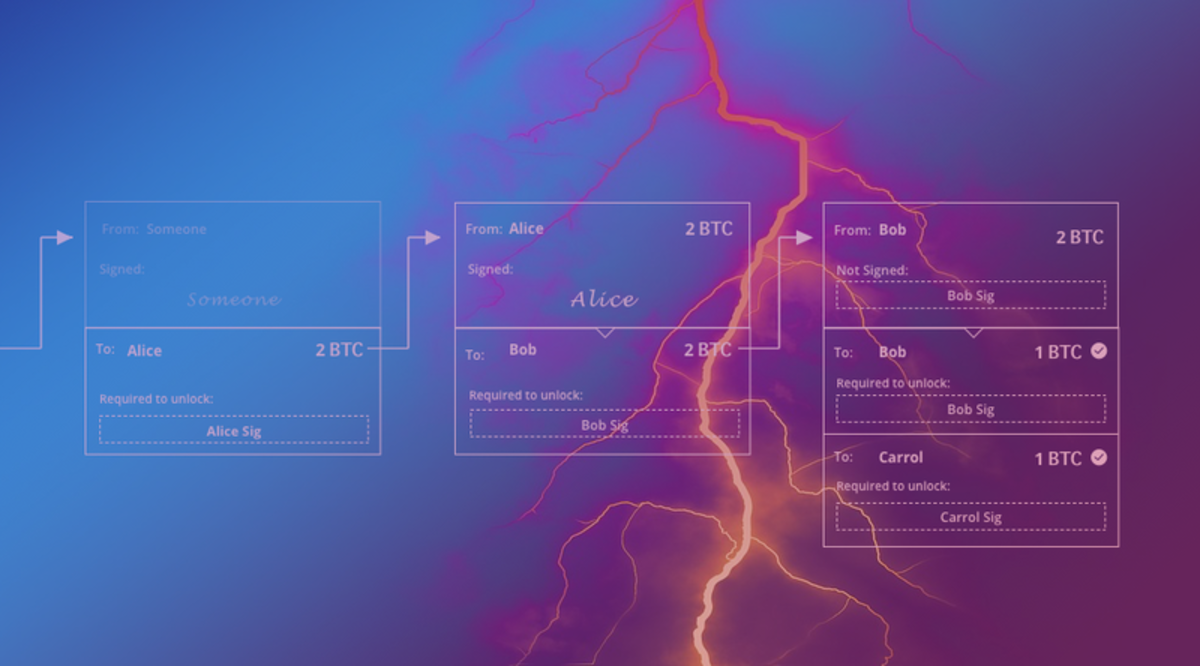

In particular, the Fluent Network benefits from the introduction of tokenized invoices. Tracking and approving invoices on a blockchain prevents them from being refinanced (“double-spent”), but perhaps more important: significant stages of the payment process can be automated and harmonized.

Wilson:

“Buyers, for instance, approve of invoices on the Fluent Network once they consider goods delivered to be satisfactory. The buyer of a good on the due date can automatically pay the invoice directly to whomever owns the invoice even if it has been partially financed by multiple parties or subsequently purchased by other finance providers. A single platform with cryptographically verified invoices, instant settlement and low operating costs benefits all parties on the system. It’s a win-win-win for the buyer, supplier and financier.”

A Blockchain on Top of Banking

The Fluent Network's blockchain is largely based on Bitcoin's architecture, but purpose-built for global supply chains with specific focus on invoicing and payments. It is perhaps best described as a blockchain layer on top of the existing banking infrastructure. The actual funds – typically U.S. dollars – remain in custody of banks at all times, though they are tokenized and represented on the blockchain, too. The network is to be rolled out among financial institutions, as well as global enterprises that take part in the supply chain.

Unique to the Fluent Network, the custom-built private blockchain is comprised of a hybrid consensus model, with both a federated system as well as proof-of-work security. The proof-of-work security – SHA-256 – works similar to the way it does in Bitcoin, but with one great difference: mining is not an open process anyone can participate in, but a closed circuit where participants are permissioned by Fluent.

“Participants of a supply chain, including financial institutions, can sign up to become a node and miner on the Fluent Network,” Taylor explained. “As a federated system, participants do require permission to mine; we know who the miners are, as does the rest of the network. But within this permissioned infrastructure, we solidify the core with a proof-of-work system. Think of giving permission to your neighbors to come to an open house but locking up the good China for extra security. Also, because we know who the miners are, we don't need nearly as much hashing power as you would on a permissionless blockchain.”

And while miners on the network – the financial institutions and other companies – can't earn a native token by mining, the Fluent team believes securing the network should be incentive enough.

According to Wilson, “This could prove to be an important step in opening up and connecting to trustless value chains in an industry 4.0 economy. Blockchains, at the end of the day, are fantastic tools with a specific purpose. We plan on using the best tool for the job.”

Wilson and Taylor are not the only ones to think so. Fluent closed a pre-seed financing round last year, raising a total of $875,000, followed by $1.65 million in seed funding in 2016 in a round led by ff Venture Capital, with participation from institutional investors including Tim Draper's Draper Associates, Thomson Reuters, 500 Startups, UMB Bank and SixThirty. The platform is now being tested, with participants including a top-ten bank on Forbes’ 2015 America’s Best Bank list. Fluent will be presenting a demo of the Fluent Network at next week's Distributed: Trade conference in St. Louis hosted by BTC Media, Bitcoin Magazine's parent company.