The unexpected message I got from a student was simple enough: “Any chance you're doing any sort of independent study regarding crypto or anything of that nature?” I had no intention of teaching a course on crypto. But I had been thinking of offering a course on Bitcoin. This was the prompt I needed.

As a university engineering educator and a bitcoiner, I am acutely aware that education about Bitcoin is crucial to the full realization of its potential. The intrinsic properties of Bitcoin make it a sound foundation for a new monetary system. However, it will have to grow significantly in the emergent property of wide acceptance before it can challenge the status quo. Acceptance will only grow with education. Bitcoin is still new and unfamiliar and confusing to most people. We need to find curious individuals who will put in the work to understand it—and then pass along their understanding and their confidence to others in their circle of trust.

As I was thinking about the student’s request and the paramount importance of Bitcoin education, I considered whether I should offer a course on Bitcoin. What better way to educate people about Bitcoin than to have them as a captive audience for an entire semester, with skin in the game in tuition and a grade on the line! I put out some feelers among other students and got a positive reception.

BITCOIN COURSE LANDSCAPE

I began to look for course models. In the process I made a surprising discovery. While a large number of courses at major universities cover Bitcoin, most don’t focus on Bitcoin. The courses are often listed as “Bitcoin and Cryptocurrencies” and treat Bitcoin as just another crypto. “Bitcoin and Blockchain” courses address blockchain abstracted from Bitcoin as the innovation that really matters.

Other courses, like the course developed by Korok Ray at Texas A&M, explore in some depth the technical aspects of Bitcoin and require programming as a significant part of the experience. This approach can be valuable for technically minded students. But it may not attract those who aren’t motivated to code.

The only courses I found that were Bitcoin-specific but not primarily technical were the following:

“The Philosophy and Economics of Bitcoin,” taught by Andrew Bailey, Associate Professor of Philosophy at Yale-NUS

“Bitcoin and the Future of Money,” taught by Craig Warmke, Associate Professor of Philosophy at Northern Illinois University

“Bitcoin and Digital Assets,” taught by Nik Bhatia, Adjunct Professor of Finance and Business Economics at the University of Southern California

*Professor Ray is working on a more general course for business students now.

(If anyone else is offering such a course, please let me know!)

Clearly, a general course specifically organized around Bitcoin is a massive need in the university.

COURSE PHILOSOPHY

I chose to offer a course that was not primarily technical but focused specifically on Bitcoin. I called it “Exploring Bitcoin.” I discussed other crypto projects but partly in order to make a sharp distinction between Bitcoin and crypto. I wanted students to understand that Bitcoin is a potentially world-shaping innovation. While some crypto projects may have value for functions other than money, they shouldn’t be put on the same level as Bitcoin and don’t deserve the same level of attention. I argued that a layered approach to building capabilities on Bitcoin makes engineering sense. I used Lightning, Rootstock, and Liquid as examples of efforts that are doing just that. It is not sound engineering practice to try to build protocols that do everything all at once.

My course covered the technical and engineering details on an accessible level, but it put just as much focus on the economic, financial, and social aspects of bitcoin. I deliberately structured the course so that students from any major could take the course without prerequisites. I wanted the appeal to be as broad as possible; bitcoin is for everyone.

I got a little pushback about my decision to focus on Bitcoin. The students were broadly curious about crypto but generally accepted my arguments about the priority of Bitcoin. Others questioned how a focus on Bitcoin reflected academic values like research, analysis, and experimentation. My response was that Bitcoin is the original cryptocurrency; it is the genesis of absolute scarcity. It solves the foundational problems of money. It has a market cap equal to all other crypto assets combined and a network effect that dwarfs the others. And it makes sense to study the most important thing in depth rather than to superficially cover a thousand far less important things.

LEARNING EXPERIENCES

I believe this approach was successful and maintained the academic values of challenging students to think, advocating time-tested design principles, and focusing on the fundamental issues. One student had this to say after the course was over: "I thought I knew a lot about Bitcoin before this course, but this course humbled me and challenged some of my perspectives. Most importantly, this class helped me learn why Bitcoin should be separated from other crypto, which is a message I plan to carry as I go on telling others about Bitcoin."

Because my goal was to accommodate a wide variety of students and interests, I required each of them to design and execute a significant term-length individual project. The project could involve hardware, software, a case study, or a research paper. By giving them the flexibility to choose a topic with my approval, the course adapted to their individual interests, strengths, and career direction. Topics ranged from research on challenges in Bitcoin education to a hardware implementation of a simple mining rig.

The final assignment required students to pull from everything they learned in the course to create an informative and persuasive presentation about Bitcoin. They were to make their best case for why everyone should—or should not, if that was their conclusion—care about Bitcoin and present it to at least three people. (I am happy to report that all the students chose to do a pro-Bitcoin presentation.) Student approaches to this were quite inventive. One student asked all his hearers to pull out their phones, set up an account on an exchange, and buy $10 of bitcoin. He walked them through the process, and they all walked away holding a little bitcoin—now with skin in the game and a reason to learn more about bitcoin.

A few students also discovered to their dismay that some of their hearers were adamantly opposed to Bitcoin (usually to “crypto”), and the students’ attempts at persuasion did very little to change opinions. Bitcoin education is challenging! I hoped that this experience would be the beginning of a life of learning and effort in educating others about Bitcoin. At the end of the term over 70% of the students indicated that they plan to find ways to educate others about bitcoin.

STUDENT RESPONSE

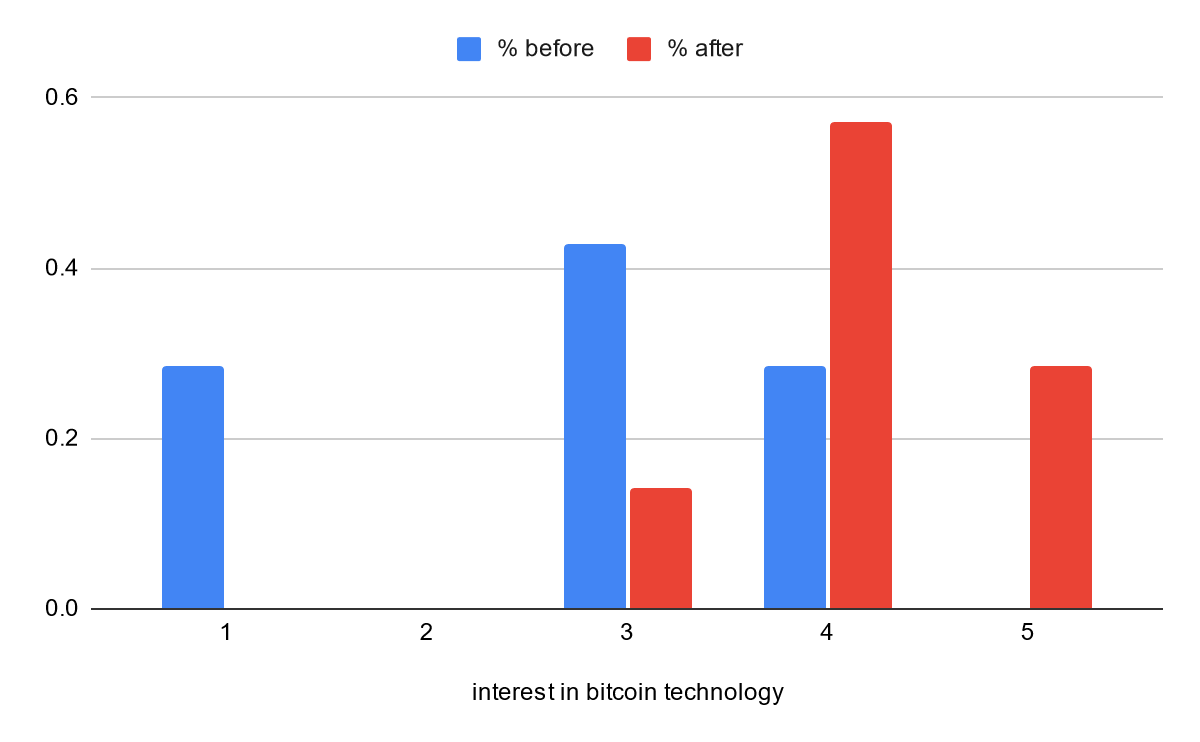

Overall, I believe this course was quite effective in educating students about Bitcoin and preparing them to carry that forward in their own decisions and conversations with others. I was able to assess several measures that confirm this claim. To put this data in perspective, almost half the class signed up not because of an interest in bitcoin but for the stated reason that “it was the only relevant course available.” Not a great piece of news for the professor’s ego, but it was a worthy challenge nonetheless. Only a little over a fourth of the students had ever dabbled in crypto at all. The change in the distribution of interest in bitcoin technology is depicted below.

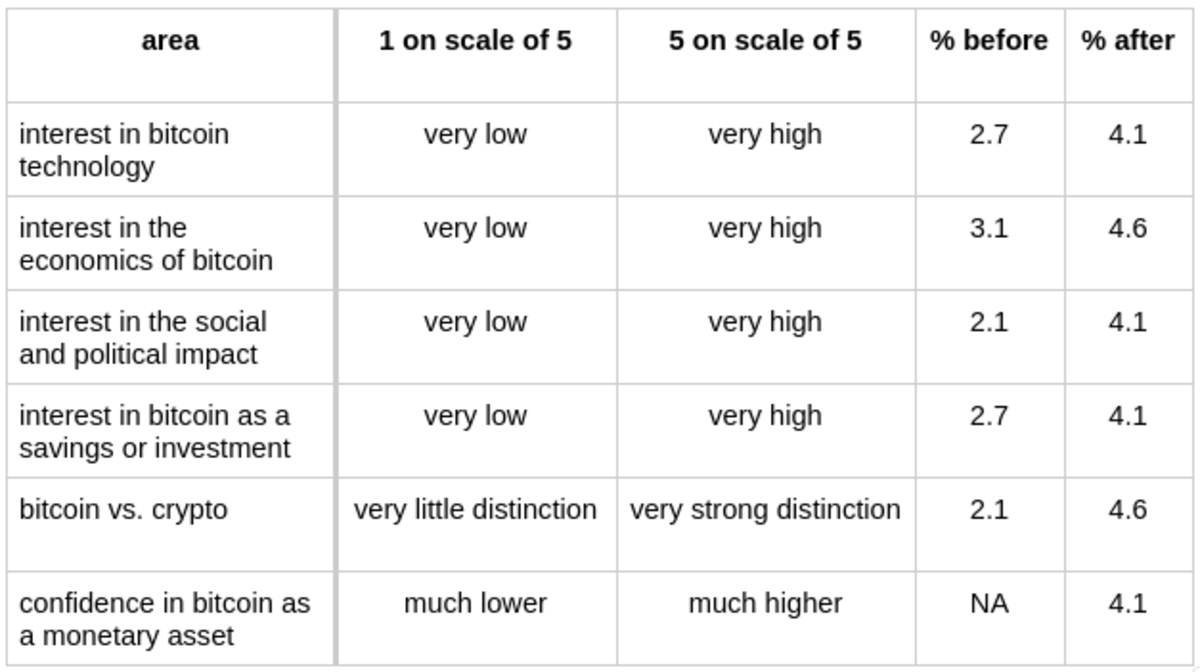

Student feedback in other areas is also revealing, as evidenced in the table below.

Students were engaged in every aspect of bitcoin that we covered. They began fairly neutral on every topic area that I surveyed, but they landed between high and very high in terms of interest in every topic. They asked penetrating questions and dug up some of their own answers online. Many times they answered each other’s questions.

Student feedback made it clear that they wanted assignments to be as hands-on as possible and as early as possible. One student expressed it this way: “The way I approach a problem is typically to find a working solution and then study it and figure out how it works.” While I required the students to make Bitcoin and Lightning transactions, I didn’t require it early. In the future I will make that a requirement near the very beginning and maybe even offer them some small bitcoin rewards. This will give them more hands-on context for everything that is discussed subsequently, especially security, the blockchain, mining, and scaling. They will immediately have some bitcoin to motivate their study. And it will establish a do-your-own-research culture for the course, which is crucial for bitcoiners to embrace.

TAKEAWAYS

The response to the course confirms that Bitcoin education in a university context has a great deal of promise. It underscores a more general strategy that bitcoiners should employ—use existing channels to teach about Bitcoin. One of my students did his project on the challenges of Bitcoin education, and this principle was one of his key takeaways. We don’t have to develop entirely new outlets for Bitcoin education. Many avenues exist already. For example, community colleges are often looking for interesting topics to offer the community in the form of short courses. Some communities and universities have special programs that target retirees with guest lectures and popular topics. High schools teaching economics courses may sometimes welcome a guest speaker on a topic like Bitcoin. There are many great resources available for these efforts, such as the My First Bitcoin curriculum. Use your imagination. You’ll discover many such opportunities.

A few challenges have to be overcome to grow Bitcoin education in a university environment. First, more university professors need to embrace Bitcoin and see the need for Bitcoin education. Those who have the ear of professors should make a special effort to expose them to the transformative nature of Bitcoin. Advocating for Bitcoin in an academically rigorous way is important. But a little known secret is that professors are people too and can sometimes be influenced through ordinary conversations with non-academics. That’s how it happened for me.

Second, Bitcoin is a highly interdisciplinary subject, and professors from many disciplines will need to embrace the opportunity to teach about Bitcoin. Bitcoin as a class topic may experience resistance in some departments that are ideologically contentious, such as philosophy or economics. In my area (engineering), the bigger challenge is convincing non-engineering students to take a course that’s listed as engineering. That may require engineering professors to sharpen our marketing skills!

Third, a Bitcoin course may provoke some academic turf wars due to its interdisciplinary nature. A strong argument needs to be made that Bitcoin does not neatly fit in one department or college. As long as some aspect of the course requires expertise within that department, a case can be made that the course be taught there by the professor who created the course.

I invite other professors who are interested in teaching Bitcoin courses to reach out to me for further discussion.

FINAL THOUGHTS

Introducing a Bitcoin course during a bear market may seem like a fool’s errand. But having established university courses in place before the next bull run positions the Bitcoin education enterprise for a groundswell of interest. This is the time to work toward that goal.

We are on the cusp of a monetary revolution, but it will require education. Bitcoin education in the university offers not only a way to educate students about Bitcoin. It also offers a way to equip these students to become Bitcoin educators for the next generation of adoption. University students are generally curious, energetic, and influential—just the kind of people who can effectively introduce Bitcoin to others. As education around Bitcoin grows, trust will grow. And that will open the door to the widespread adoption of Bitcoin that we are working for.

This is a guest post by Stan Reeves. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.