The below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Crypto In The Crosshairs

On February 9, bitcoin’s exchange rate gave up some of its year-to-date gains as headlines of increasing regulatory crackdown on the broader crypto industry came across the newswire. The SEC announced charges against Kraken for the selling of unregistered securities due to the firm’s crypto staking product offerings. Similarly, the New York Department of Financial Services announced an investigation into Paxos, the issuer of the Pax Dollar and the BUSD Binance stablecoin.

While the regulator’s concerns aren’t directly related to bitcoin itself, there is increasing chatter of a new-era Operation Choke Point throttling the crypto industry. In simple terms, Operation Choke Point was a controversial initiative launched by the federal government which used the Federal Deposit Insurance Corporation (FDIC) to reduce access to the U.S. banking system for certain “high-risk,” but (mostly) legal industries. While there is no doubt that there has been plenty of fraud and criminal activity intertwined throughout various parts of the crypto industry, some are worried that the heavy hand of the state could harm honest actors if regulators create burdensome hurdles that have wide ranging limitations. For example, some people who are still interested in staking their crypto might now choose to find an offshore and sketchy exchange to do so, putting their assets even more at risk than before. We’ve written about some of the problems with yield offerings in “Collapsing Crypto Yield Offerings Signal ‘Extreme Duress.’”

Bitcoin Market Dynamics

In regard to the bitcoin price action, one could presume that the newsflow was the cause of the recent local downturn, but there were various signs of local exhaustion after an explosive rally across the daily timeframe.

The current dynamic in the bitcoin market is as follows:

- Bitcoin’s supply is inelastic as it has ever been due to extremely strong HODLer dynamics.

- Risk-on/risk-off flows dominate, with dollar strength and equity markets deciding much of the direction for the bitcoin price in the short term.

- The extreme lack of order book liquidity for BTC will lead to volatile moves in both directions, with liquidity at post-FTX collapse levels despite the recovery from the November 2022 lows.

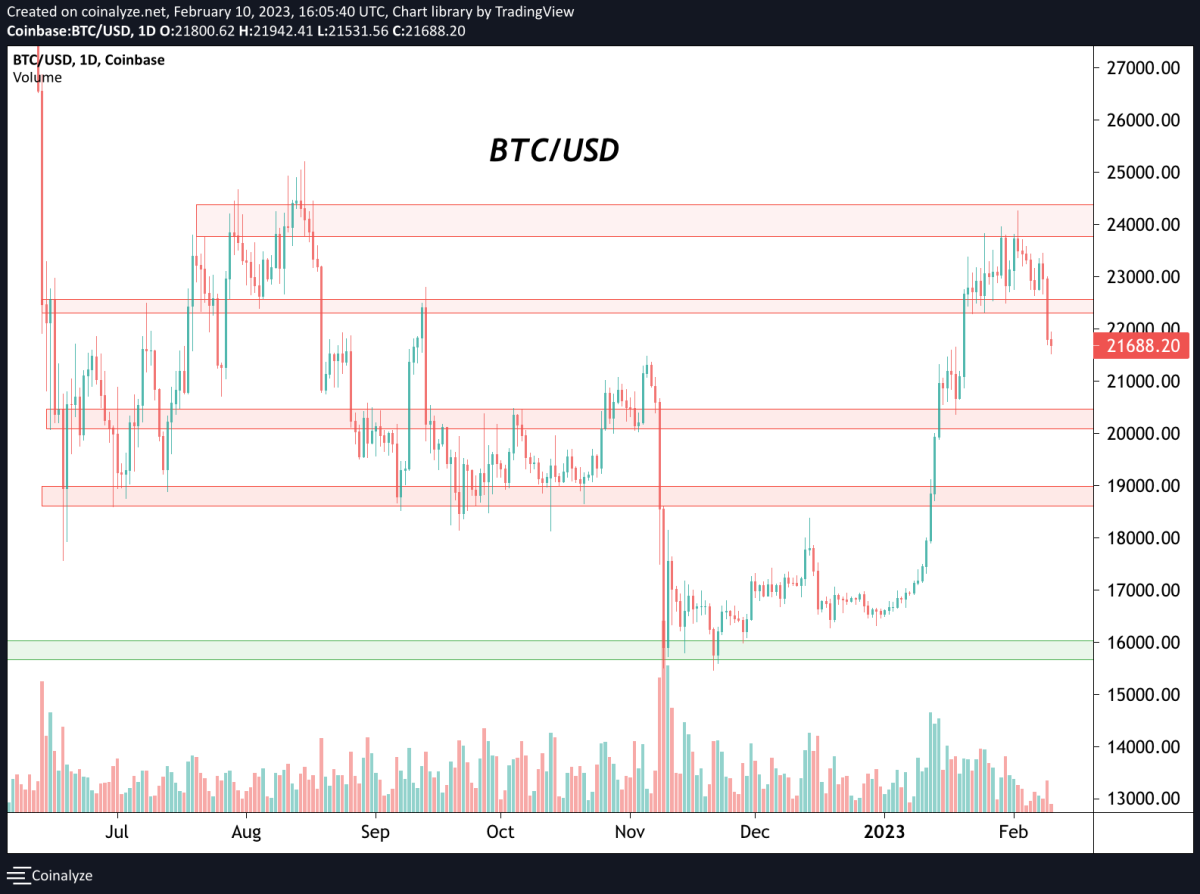

- Bitcoin is still range bound between the $16,000 and $24,000 levels until the market decisively decides otherwise. Expect the pinball match between bulls and bears to continue for some time.

Important price levels to note between $16,000 and $24,000.

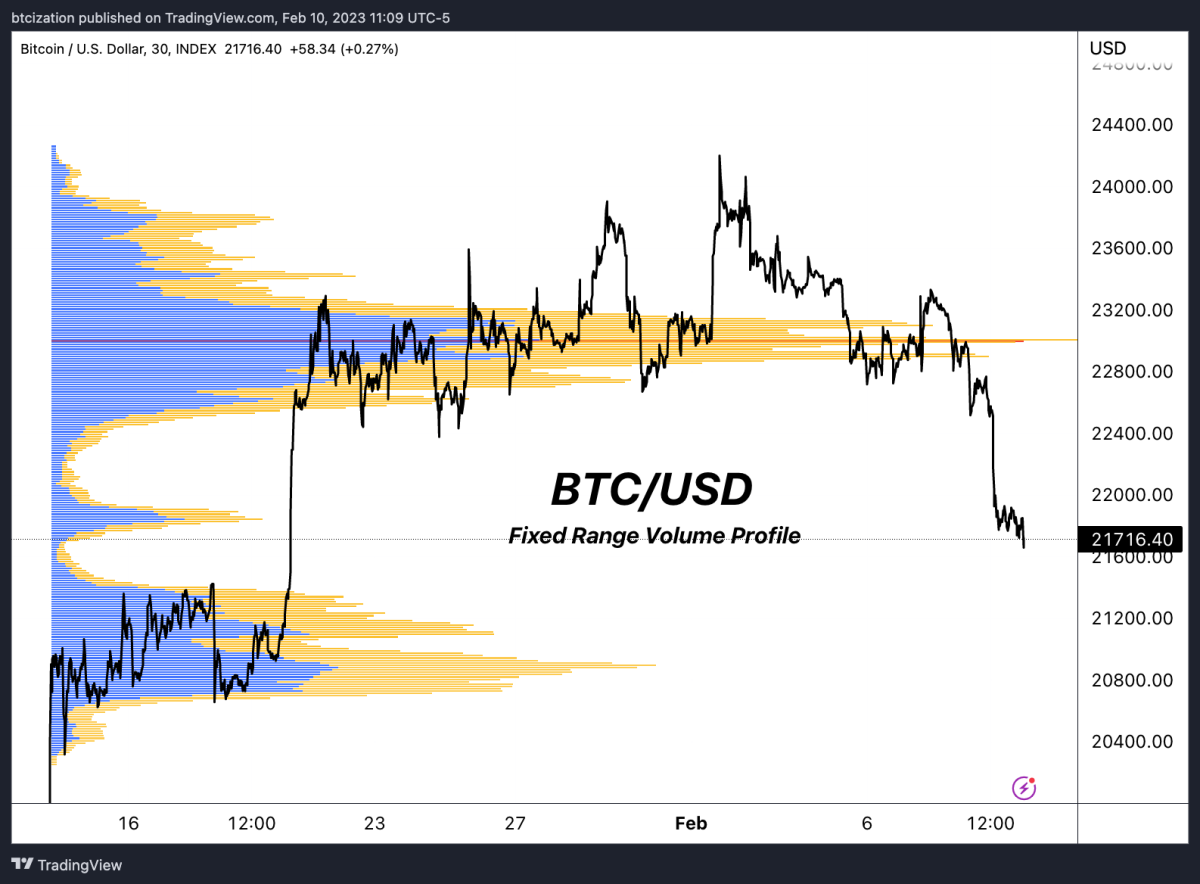

From a volume perspective, the market currently finds itself in a meaningful liquidity gap due to the short squeeze that led to prices reaching their recent 2023 highs. Volume support sits around the $21,200 level, with more buyers waiting in the barracks between $19,000 and 20,000.

Liquidity gap with support at $21,200.

Bitcoin Derivatives

The futures and derivatives market has been relatively quiet since the short-squeeze-fueled rally that led to the significant outperformance to start the year. During rapid periods of price appreciation, notice the demand for calls as shown by a negative skew. Long-call and short-put strategies are two different ways that this dynamic can develop and can serve as a tailwind for the market until mean reversion occurs.

The futures market is no longer signaling bitcoin is in the depths of its contagion, but is still very far from the overheated levels seen during the bull market that helped bring about the leverage collapse that toppled the market like a house of cards.

Spot inflows are a must for any meaningful squeeze position to manifest and break bitcoin out of its seven-month range.

Like this content? Subscribe now to receive PRO articles directly in your inbox.

Relevant Past Articles:

- No Policy Pivot In Sight: "Higher For Longer" Rates On The Horizon

- Bitcoin Rips To $21,000, Shorts Demolished In Biggest Squeeze Since 2021

- Collapsing Crypto Yield Offerings Signal ‘Extreme Duress’

- The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

- A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Increased Global Liquidity

- Inflationary Bear Market Spells Trouble For Investors