Bitcoinist spoke with Kumar Gaurav, CEO of Cashaa, a blockchain-powered P2P marketplace that makes it possible to send and receive cash anywhere in the world with zero fees.

Unfortunately, when it comes to remittances, the poorer the country, the higher the fees, says the CEO of Cashaa, a blockchain startup based in Canary Wharf, London. Too often, the poorest of citizens can lose up to 20% when receiving money from abroad with traditional services like Western Union.

Bitcoinist finds out how Cashaa manages to solve this major problem using Bitcoin’s technological ‘backbone’, the blockchain.

Interview with Cashaa CEO, Kumar Gaurav

Bitcoinist: What major problem does Cashaa solve? What is the potential of the market you are targeting?

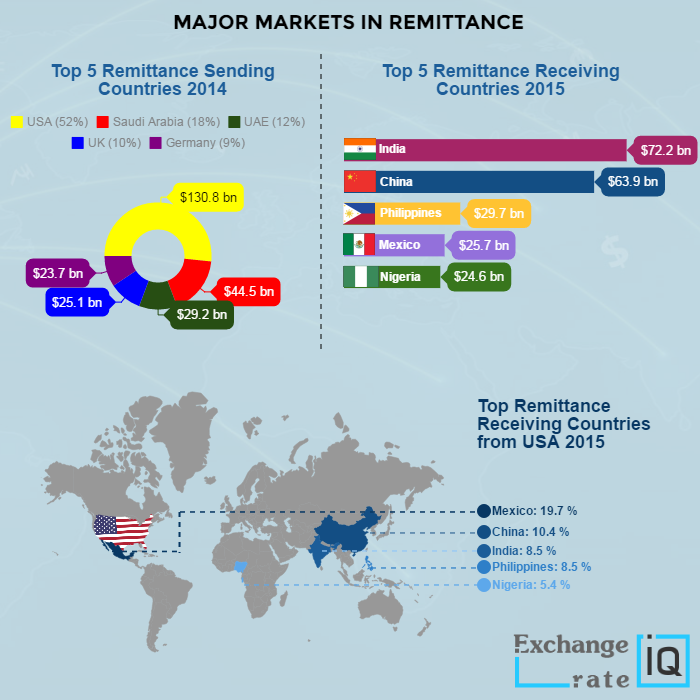

Kumar Gaurav (KG): We are targeting individuals who wish to send and receive cash in different parts of the world, but who are currently losing up to 20 % in fees. There is a cash remittance industry of ca. $240bn, which is mostly controlled by expensive money transmitter companies, which charge on average 15%. Sadly, the poorer the country, the higher the fees. This is the major problem that Cashaa solves.

Bitcoinist: What blockchain is used for this service? Is it public or private?

KG: In April 2016, we for testing purposes launched BTC2BID, a Bitcoin trading platform. Cashaa, which is going to be launched in early 2017, will use Inter Ledger, which enables us to match traders of same or 2 different cryptocurrencies with the cash sender and receiver. This means, the cash sender can give their cash to a trader who sold their Bitcoin, and on the other side, the cash receiver can receive cash from a trader who bought e.g. Bitcoin, Ether, Litecoin etc. Therefore, we are cryptocurrency-agnostic and welcome traders of any cryptocurrency to join our platform for trading.

Bitcoinist: Why can’t a regular encrypted database be used instead?

KG: We are necessarily using blockchains as our use case is a cryptocurrency use case. Thanks to cryptocurrencies, for the first time, money can be moved globally without any fees, which was not possible in this way before.

Bitcoinist: How does your service offer a fee-free cash transfer? How does Cashaa make money?

KG: Cashaa is bringing the cryptocurrency traders more opportunities by bringing liquidity from the cash transfer industry. Through us, they can trade in an international market and make more money. Now, for example, people would like to sell their Bitcoin in India, but so far, they would have had the problem of how to pay or get paid from someone abroad. We are solving that problem indirectly as now, they are free to trade at their own price without thinking about this issue, as people get paid locally in cash.

And we charge cryptocurrency traders from the profit they made during their trade compared to their local Bitcoin price.

Bitcoinist: What is Cashaa’s trader network? Can anyone become a part of it?

KG: We launched an anonymous trading platform called BTC2BID in April 2016 to test the model, we have more than 10000 traders sign up from 125 different countries, who transferred more than $2m till now. Anyone can become a trader and invite their friends – for everyone they get involved, they get 10 $ when they made their first trade.

Bitcoinist: Does one need a bank account/credit card to use Cashaa? Do you have a mobile wallet app?

KG: Cashaa’s first product is for the cash-to-cash community, with no bank account, credit cards, mobile money or e-money involved. Not only are we are solving the problem of fees, we are also solving the problem of people not having bank accounts, credit cards or even smartphones at the receiver side – we use a simple passcode that works on any mobile phone.

As a technology company, we are working on sequential products where users can do bank transfers, credit card to bank or vice versa. However, as the inspiration for Cashaa comes from the cash transfer industry which has seen no innovation for years, this will be our first product.

Not only are we are solving the problem of fees, we are also solving the problem of people not having bank accounts, credit cards or even smartphones at the receiver side.

Bitcoinist: Does one need a bank account/credit card to use Cashaa? Do you have a mobile wallet app?

KG: Cashaa’s first product is for the cash-to-cash community, with no bank account, credit cards, mobile money or e-money involved. Not only are we are solving the problem of fees, we are also solving the problem of people not having bank accounts, credit cards or even smartphones at the receiver side – we use a simple passcode that works on any mobile phone.

As a technology company, we are working on sequential products where users can do bank transfers, credit card to bank or vice versa. However, as the inspiration for Cashaa comes from the cash transfer industry, which has seen no innovation for years, this will be our first product.

Bitcoinist: What is the lowest/highest amount that a user can send via Cashaa without a bank account?

KG: Cash senders can send anything up to $2,000 a week.

We never touch any fiat or any cryptocurrency, and the traders are independent and not our affiliates.

Bitcoinist: You’re based in London. What kind of advantages or incentive does UK’s legal framework provide for such a blockchain startup as Cashaa?

KG: London is a global city with citizens from 100s of countries, a friendly environment for startups and provides an entrepreneur visa. There is no help or any legal framework for a blockchain startup, but at this stage, we don’t need that.

Concerning suitability for Cashaa in particular, London is a global city with multinational people, which means a huge market for us. London also is a high-liquid Bitcoin market, which makes it the ideal place to be the first city to send cash from when Cashaa launches.

Bitcoinist: What kind of regulations does Cashaa’s business model fall under? Are you a money transmitter service by definition?

KG: Cashaa is not a money transmitter, we never touch any fiat or any cryptocurrency, and the traders are independent and not our affiliates. We are the matchmaker, bringing traders together with cash senders and receivers, that`s it. We do an email- and phone verification, we let traders sign an agreement that they are following the laws of their respective country and care by themselves about any licenses they may need.

Furthermore, we have partnered with Coinfirm, which provides KYC & compliance services for blockchain companies, so that no external wallet is related to any suspicious or illegal activity is used on our platform.

We are targeting young people to become Cashaa traders, which can be run like a business, comparable to being an Uber driver, but cheaper

Bitcoinist: How does Cashaa solve the “last mile” problem? In other words, how does a person in Kenya, for example, actually get cash into their hands when only cryptocurrency is traded?

KG: We are solving this problem as the trader in Nigeria is giving local currency to the cash receiver. When launching Cashaa, we will use our traders network that we gained from testing; later, we are also partnering with other business and giving them special software to trade and buy and sell bitcoins from us, which will help solve this problem, Ex: Uber and Ola drivers in India.

Bitcoinist: Are you targeting the African market in particular? What specific global regions stand to benefit the most from Cashaa?

KG: Yes, we are targeting the African market in particular. We are first launching in Nigeria and received huge interest from different African countries. Furthermore, we are targeting young people to become Cashaa traders, which can be run like a business, comparable to being an Uber driver, but cheaper – instead of having to buy and maintain a car, they could buy cryptocurrency cheaply compared to their local price, and deliver cash to locals.

Aside Nigeria, we are also going to launch in India, which has seen a doubling in Bitcoin activity since the recent demonetization. We have also received interest and potential partners in other Asian countries such as Philippines, and in Latin America.

We are not in the money transmission business, we are a technology platform with minimal cost to survive and disrupt the market through our agile and lean structure.

Bitcoinist: If Western Union, for example, successfully implements a blockchain platform similar to Cashaa’s, who will have the upper hand?

KG: We already tested our model and acquired more than 10,000 traders and moved $ 2m without any formal launch and the trend will continue once we close our funding round and launched formally. We also need to consider we are not in the money transmission business, we are a technology platform with minimal cost to survive and disrupt the market through our agile and lean structure which is almost impossible for any corporation.

Legacy companies can potentially get killed themselves by technology giants like Microsoft, Apple, Google if they don’t catch up the race. We will see more Kodak and Nokia in the coming days. The real competitors of legacy companies are technology giants and we as a startup are the only hope for these legacy companies.

Will Cashaa’s business model prevail over traditional means? Share your thoughts below!

Images courtesy of shutterstock, cashaa.com, exchangerateiq.com