Writing on the bank’s official website, ABN AMRO Head of Innovation Arjan van Os, praises the blockchain technology behind Bitcoin in an article titled “The Next Big Thing.”

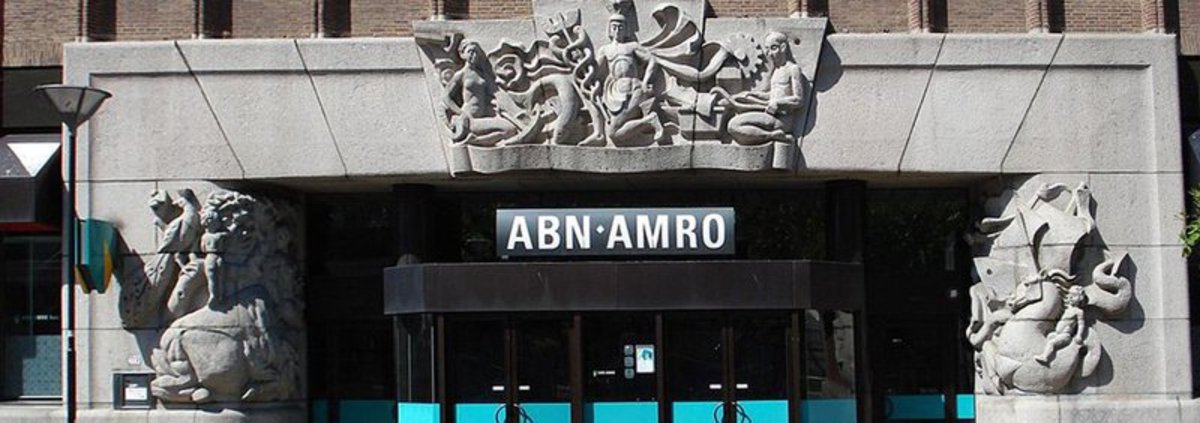

Dutch state-owned ABN AMRO Bank is a product of a long history of mergers and acquisitions that date to 1765, making it one of the oldest active banks. In 2007, ABN AMRO was the second-largest bank in the Netherlands and the eighth largest in Europe by assets. Then the bank was acquired by a consortium of international banks and eventually bailed out and nationalized by the Dutch government, which expressed intentions to restore private ownership at due time.

“Fasten your seatbelts,” says van Os. “What the Internet has done for information and the way we communicate, the blockchain will do for value and the way we look at trust. The financial world is going to flip upside-down.”

The article summarizes the unique advantages of blockchain-based financial technology, which today are recognized by the mainstream financial establishment: faster and cheaper transactions, which are made intrinsically secure by the distributed, decentralized nature of the blockchain.

“Each node maintains an identical copy of a shared transaction ledger – the so-called ‘single source of truth,’” says van Os. “As transactions take place, the nodes communicate with each other to verify that the transaction is valid. If the ledgers don’t match up, the transaction is rejected. That virtually eliminates the single point of failure: If one server is hacked, the other nodes will recognize the intrusion and block the hacking attempt. The more nodes added to the Blockchain, the more security the transaction has.”

Smart contracts represent a disruptive innovation with a huge potential. In 2001, legendary cryptographer Nick Szabo spoke of smart contracts that solved the problem of trust by being self-executing.

“Through specific scripts in the blockchain, all conditions of any contractual agreement can be stored, verified and secured within the system,” says van Os of smart contracts.

Next-generation “Bitcoin 2.0” platforms such as Ethereum, scheduled to go live in a few weeks, implement smart contracts. According to an Ethereum spokesperson, global banks and financial corporations are showing interest in Ethereum.

Interestingly, van Os doesn’t have much to say about the fashionable debate about the blockchain as a system vs. bitcoin as a currency – the term “bitcoin” is never used in the article, which seems to imply that van Os considers the bitcoin currency as an early, incidental and not very interesting application of the blockchain. On the other hand, he clearly states that the blockchain technology will change everything in the financial world, and banks should get on board.

“It’s clear to see that blockchain has the potential to turn the financial world upside-down,” says van Os. “So, what can we do? How do we stop ourselves from becoming obsolete? The answer is quite simple. We learn. We explore. We investigate. We open ourselves up to change, and embrace all the possibilities that lie in store for our futures. We not only need to change the way we do business, but the type of business we do.”

The ABN AMRO Innovation Center, opened in September 2013, explores trends, problems, and solutions relevant to the bank’s business, and organizes several networking events for clients, partners and staff. One of these regular events is Startup Friday, held once a month. A video recording of a recent Startup Friday, dedicated to the blockchain, is available online (partly in Dutch).