Bitcoin startup Bitreserve is becoming a full-fledged financial services company and rebranding as Uphold. CEO Anthony Watson announced the move with a post titled “ Welcome to Uphold. The Internet of Money.”

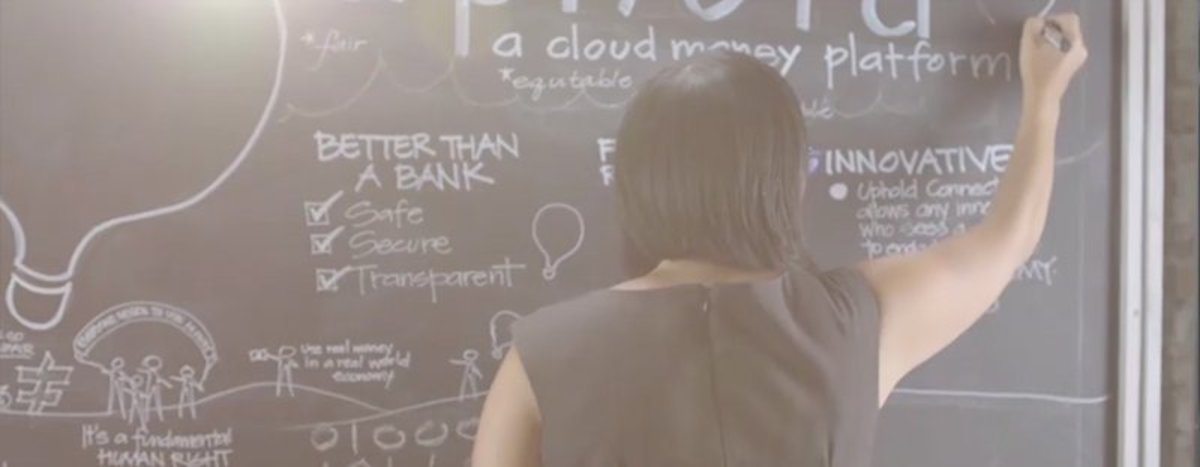

A press release notes that Uphold wants to be the world's leading cloud-based money platform, connecting the legacy and fragmented financial ecosystem with the future of money and finance. Uphold will be a members-only, member-to-member financial service for individuals, businesses, charities (including nonprofits and nongovernment organizations) and developers.

Watson, former Nike CIO and member of the exclusive Fortune 40 Under 40 list, joined Bitreserve as president and chief operating officer earlier in 2015.

“I am thrilled to join Bitreserve at such a pivotal moment in the evolution of cloud money and financial technology,” he said.

Founded by CNET founder Halsey Minor in 2013, Bitreserve launched innovative features to shield its customers from the volatility of bitcoin by instantly locking deposits to a fiat currency selected by the customer, such as the U.S. dollar.

“Bitreserve is on a mission to democratize the use of digital currency by protecting businesses and consumers from the risks inherent in the bitcoin model,” noted a Forbes

review quoted on the Bitreserve website.

In March, Bitreserve launched two new “bitcurrencies”: the bitrupee (BitINR) and bitpeso (BitMXN), pegged to two key developing world currencies – the Indian rupee and the Mexican peso – that allow Indian and Mexican customers to hold their local currencies on Bitreserve.

“Today, Bitreserve takes its next great step forward on the journey to transform global financial services for the benefit of everyone, everywhere,” says Watson. “Together with the entire company, I’m proud and excited to announce that Bitreserve has become Uphold. But that’s just the beginning. We have additional exciting updates and announcements to share, from new market entries to new products and services and broader changes at our company.”

Now, customers in 30 European Union countries, as well as Switzerland, can deposit money into Uphold via bank transfer or from credit and debit cards. In November, Uphold will begin to roll out its services to customers in the United States and China (limited beta), followed by India in January 2016 (limited beta).

Members can fund their Uphold accounts by linking any bank account, debit and/or credit card (Visa and MasterCard initially), in addition to bitcoin and ‘the Voxel’ or ‘Voxels,’ a new form of virtual currency that the company and a partner will announce in the next few days.

In December, Uphold plans to roll out multiple card and payment products, both physical and virtual (limited beta release). Members, based on their location and jurisdiction, will be able to choose among Visa, MasterCard or Discover to pay for goods and services, online or in person, using cards directly linked to their Uphold accounts.

Watson’s post emphasizes that Uphold is not a bank and doesn’t lend or leverage members’ funds.

“Our members can rest assured that value held in Uphold is 100 percent safe and secure and can be withdrawn, at any time, regardless of what is happening in the global economy,” says Watson. He adds that Uphold services will be mostly free, with some fees that will apply in special cases. For example, a fee of 2.75 percent will apply to members who choose to fund their Uphold account with a debit and/or credit card.

Fortunenotes that Bitreserve, now Uphold, is de-emphasizing the role of bitcoin in its business model and operations. That is shown by the new name without “bit” – “that oh-so-common prefix amongst digital currency startups” – and the new emphasis on financial services linked to traditional credit cards and bank accounts.

“I’ll be surprised if bitcoin is here in five years,” Watson told Fortune

. “The value of bitcoin isn’t the currency, but the technology. I think once the world becomes more accustomed and attuned to the platform of bitcoin, the noise will go away, and the currency will go away, too.”

The company’s founder Halsey Minor, too, predicts that bitcoin as a currency “will get destroyed.”

Minor and Watson’s remarks are certainly attuned to the prevailing mood in the financial services industry, which focuses on the advantages of using the blockchain technology for faster, cheaper and traceable transactions while considering the bitcoin currency as a temporary inconvenience. At the same time, it is worth bearing in mind that the current system – blockchain technology plus bitcoin currency – is proven to work.