On-chain data shows the total number of Bitcoin addresses has seen rapid growth recently, a sign that adoption may be accelerating.

Bitcoin Total Addresses Have Grown By 3.95% During The Last Two Months

According to data from the on-chain analytics firm Santiment, BTC now has a total of 45.14 million addresses. The relevant indicator here is the “BTC Supply Distribution,” which tells us which wallet groups in the market include how many addresses right now.

The wallet groups here refer to cohorts divided based on the total number of coins they are currently holding. For instance, the 1-10 coins group includes all addresses that are carrying a balance between 1 and 10 BTC at the moment.

If the Bitcoin Supply Distribution metric is applied to this group, then it would measure the total number of such wallets in the market that are satisfying this condition.

Since in the current case, the quantity of interest is the total number of addresses across the entire network, regardless of wallet amount, Santiment has simply merged all the existing address cohorts to show their combined Supply Distribution.

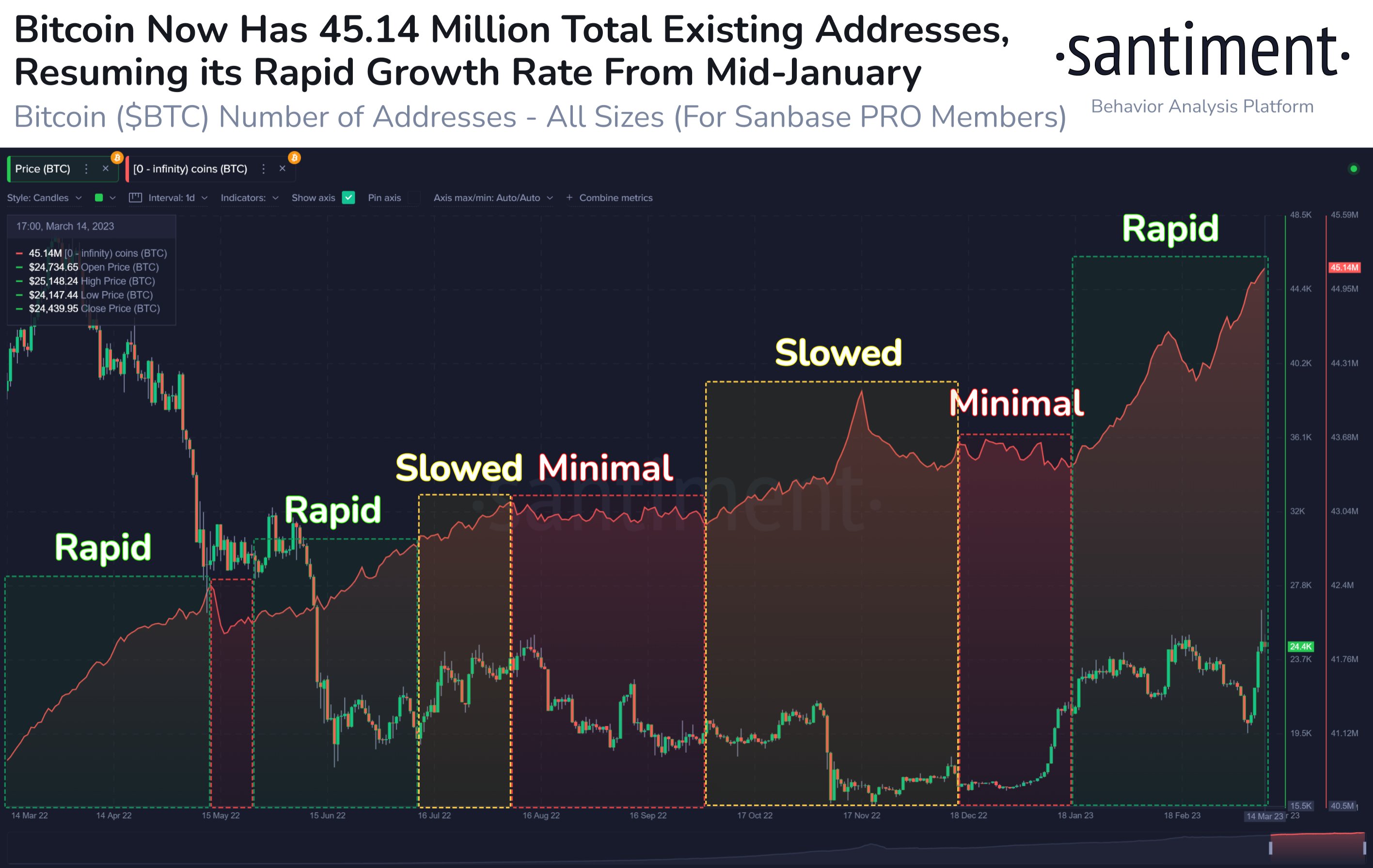

Here is a chart that shows the trend in this indicator over the past year:

As displayed in the above graph, the total number of addresses holding between 0 and infinite BTC (that is, a range that covers wallets of all sizes in the market) had been observing some sharp growth around a year ago, when the bear market was only just setting in.

This suggests that new addresses were still being created at a rapid pace back then. Whenever this kind of trend is seen, it means that a large number of new users are possibly joining the network, and thus the adoption of the cryptocurrency is picking up.

However, when crashes like those triggered by the LUNA collapse and 3AC bankruptcy shook the market and a bearish transition happened in full swing, the growth slowed down and the indicator even encountered large stretches of sideways movement.

Usually, investors find consolidating markets boring, so activity slows down during bear markets when the price is showing such a trend. Naturally, the network has a hard time attracting new users in these conditions, so the increase in the total addresses also plateaus.

On the contrary, volatile moves are exciting to holders and thus, bring a lot of attention to the blockchain, which ends up pulling in new users to the cryptocurrency. An example of this is clearly visible during the FTX crash in the chart, where the addresses suddenly jumped in a period of otherwise slow growth.

With the latest Bitcoin rally during the last couple of months, the indicator’s value has once again started showing a sharp rise, implying that a lot of new users are being attracted to the asset now.

In this period alone, the total number of addresses has grown by almost 4%, a notable increase in such a short amount of time. More adoption is generally a positive sign for any coin, as it provides a sustainable base for long-term growth.

BTC Price

At the time of writing, Bitcoin is trading around $24,900, up 15% in the last week.