Data shows the Bitcoin Fear & Greed Index has registered a sharp jump following the recovery in the asset’s price above $81,000.

Bitcoin Fear & Greed Index Is Now Pointing At ‘Fear’

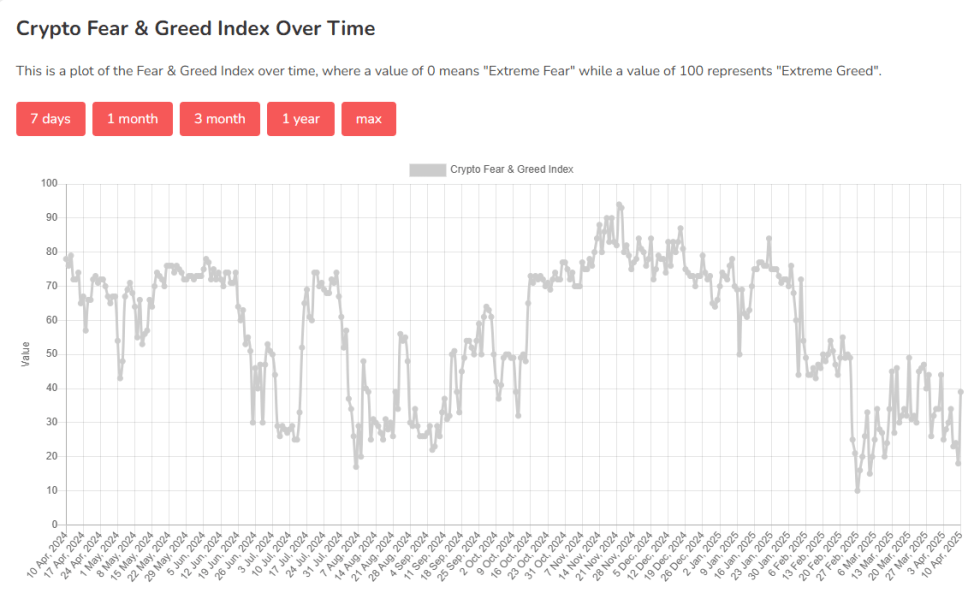

The “Fear & Greed Index” is an indicator made by Alternative that tells us about the average sentiment present among the investors in the Bitcoin and wider cryptocurrency markets.

The index makes use of a numeric scale running from zero to hundred for representing the investor mentality. All values above 53 correspond to a sentiment of greed, while those below 47 that to fear. Values lying between these two cutoffs suggest a net neutral sentiment.

Now, here is what the current market sentiment is like, according to the Fear & Greed Index:

As displayed above, the Bitcoin Fear & Greed Index has a value of 39 right now, which means the average trader in the space holds a sentiment of fear. The fearful mentality isn’t too strong, however, as the indicator’s only 8 units away from the neutral zone.

Yesterday was different, though, as the metric held a value of 18. This level of FUD was so strong that it was inside a special region known as extreme fear (25 and under). This low for the indicator came as Bitcoin and others crashed amid uncertainty around the tariffs.

With US President Donald Trump putting a 90-day pause on the tariffs for most countries, prices have seen some recovery, which has naturally allowed for an uplift in the market mood.

While the Fear & Greed Index has bounced back for now, it’s unknown how long the recovery would remain. From the above chart, it’s visible that the metric has been up and down a lot lately, implying the investors have been fickle.

Historically, Bitcoin and the altcoin market have tended to move in the direction that the crowd least expects. As such, extreme fear, where FUD has been the strongest, has often paved the way for market bottoms. BTC was just inside the extreme fear territory so it’s possible that it may have formed a bottom. If so, then the latest recovery could be one to last.

It should be noted, however, that in late February, the index hit a notably lower value of 10 and while it did coincide with a low, it was clearly not the main bottom. Thus, it only remains to be seen how things would play out this time.

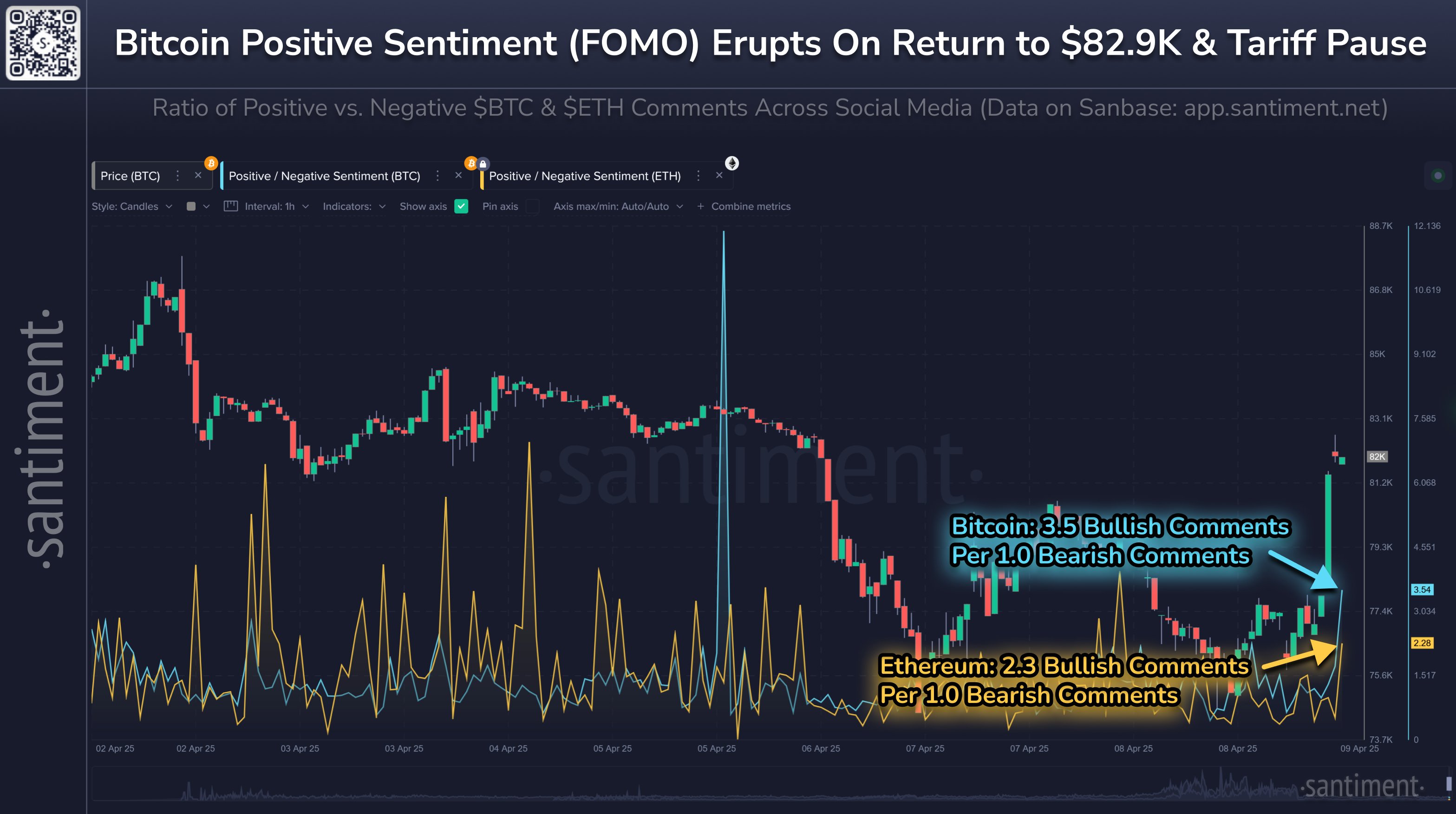

The Fear & Greed Index bases its value off of many factors, one of which is the sentiment on social media. In a post on X, the analytics firm Santiment has talked about how this facet of the market sentiment has changed following the tariff pause news for Bitcoin and Ethereum, the two largest digital assets.

It would appear that bullish sentiment erupted on the social media platforms following the news, with 3.5 and 2.3 positive comments coming for every negative post related to Bitcoin and Ethereum, respectively.

BTC Price

At the time of writing, Bitcoin is trading around $81,500, up almost 6% in the past day.