The global tariff war sparked by US President Donald Trump’s blanket 10% tariff on all countries – effective April 5 – continues to escalate, sending shockwaves through global markets. In a sharp retaliation, China has announced an 84% tariff on US imports, following Washington’s move to increase tariffs on Chinese goods to 104%.

Bitcoin Shows Weakness Amid Rising Global Tariffs

This rising economic tension has injected significant volatility into traditional and digital asset markets, with Bitcoin (BTC) showing signs of weakness amid growing uncertainty.

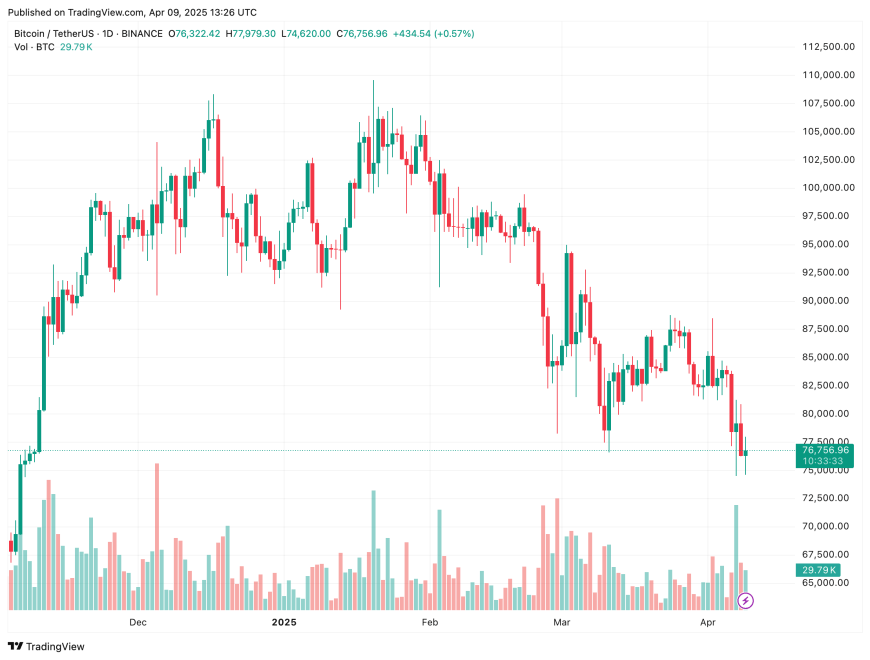

Over the past seven days, Bitcoin has dropped by 9.1%, falling from approximately $87,100 on April 2 to around $76,000 at the time of writing. The weakness isn’t isolated, as altcoins like Ethereum (ETH), Solana (SOL), and XRP have posted double-digit losses, underperforming even the flagship cryptocurrency.

Meanwhile, the probability of a global recession has spiked to 68%, its highest level since the height of the COVID-19 pandemic. Major equity markets are also under pressure, with the Dow Jones Industrial Average plunging 9.8% over the past five days – one of its sharpest short-term declines in recent memory.

Despite the grim macroeconomic backdrop, prominent crypto analyst CryptoGoos believes there’s no need for panic yet. Sharing a historical BTC price chart, the analyst noted that “every bull market sees major corrections,” and that the current dip is not unusual.

In a separate post on X, CryptoGoos also highlighted that crypto whales – wallets with substantial BTC holdings – are accumulating at an unprecedented rate. While this could signal confidence from institutional players, it may also suggest potential volatility ahead, as large investors can manipulate prices and trigger “bull traps” to shake out retail traders.

On the other hand, analyst Master of Crypto presented a more optimistic outlook. Pointing to a bullish divergence forming on the daily BTC chart, the analyst suggested that Bitcoin could target $83,500 in the short term if current support levels hold.

Is BTC Heading To $65,000?

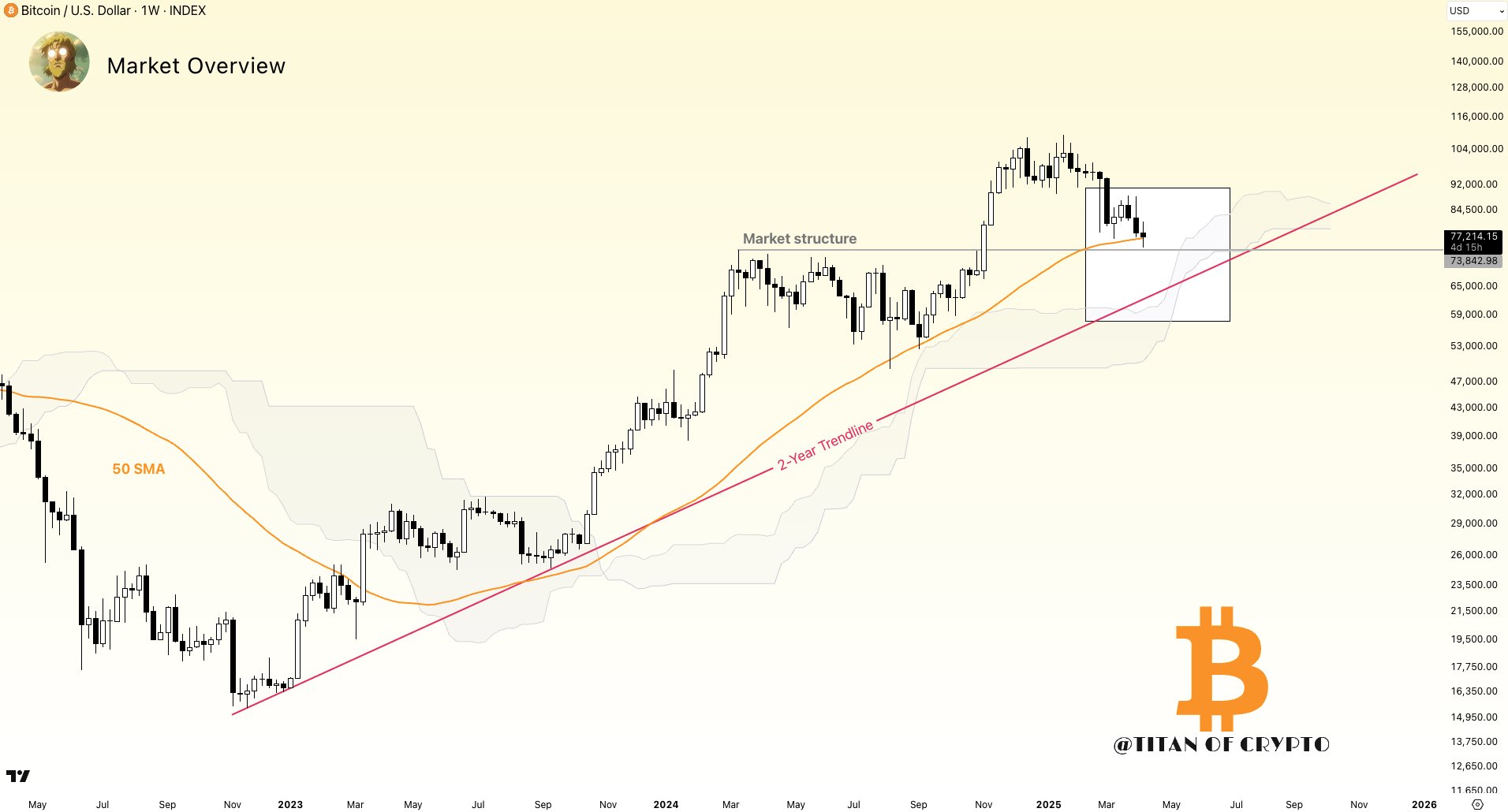

However, not all experts share this enthusiasm. Commentator Titan of Crypto warned that BTC is approaching a critical inflection point. He shared the following weekly chart showing Bitcoin testing two historically strong support levels – the 50-week simple moving average (SMA) near $73,000, and a 2-year rising trendline around $65,000.

Despite conflicting short-term views, a recent Binance Research report emphasized Bitcoin’s underlying strength. The report noted that, despite mounting tariff pressures, BTC’s March 2025 monthly close maintained the asset’s bullish market structure. At the time of writing, BTC is trading at $76,756, down 4.1% over the past 24 hours.