- Bitcoin saw some wild overnight volatility that came about after a flurry of selling activity liquidated long positions and sent its price reeling lower

- This selloff was quite intense and caused the aggregated market to face some immense selling pressure that is showing no signs of letting up

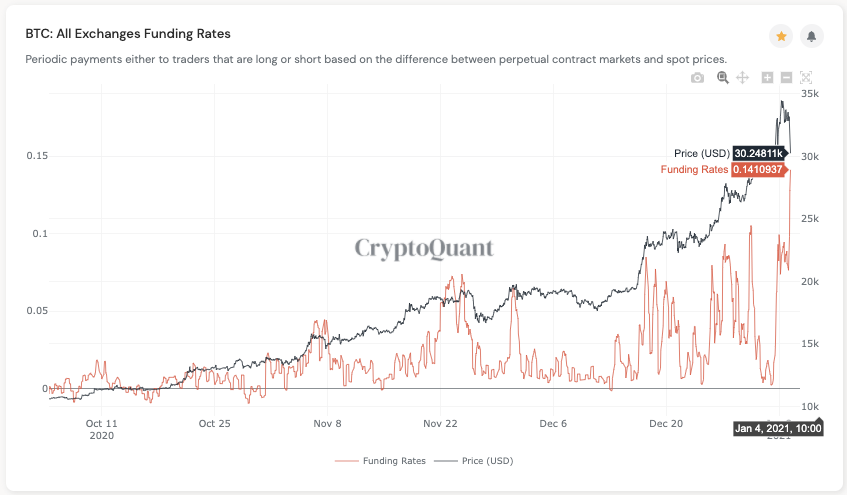

- One analyst explained that where the market trends next will undoubtedly depend largely on the derivatives market

- He notes that funding rates are still quite high and may hamper the cryptocurrency’s outlook for the time being

- As such, he is calling the crypto’s current positioning “dangerous” – despite the strength of its rebound

Bitcoin has seen another massive drop and recovery, which is commonplace during parabolic moves higher.

One analyst explained that he is now watching for the entire market to see continued weakness, noting that high funding rates on margin trading platforms indicate that a wave of selling pressure could be imminent.

That being said, from a technical standpoint Bitcoin appears to be building strength, as its recovery from the overnight drop below $30,000 is beginning to pick up steam.

Where the market trends next should provide some serious insight into the aggregated market’s mid-term outlook.

Bitcoin Rebounds from Overnight Plunge as Bulls Vie to Control $30,000

At the time of writing, Bitcoin is trading down just under 5% at its current price of $31,600. This is where it has been trading throughout the past few days but does mark a decline from its recent highs of nearly $35,000.

Where the market trends in the near-term will undoubtedly depend on whether or not bulls can confirm that the lower-$30,000 region is a strong support zone.

A continued bout of trading above here following the dip below this level would be a promising sign.

Analyst: BTC Funding Rates Still Dangerously High

One on-chain analyst explained in a recent tweet that he believes Bitcoin is still in a dangerous position following the overnight decline because funding rates are still incredibly high.

He notes that although BTC could continue higher in the short-term, it may not be as strong as it looks.

“I’ll patiently wait for the moment the funding rate cools down. BTC could go up more, but it’s too dangerous.”

Image Courtesy of Ki Young Ju. Source: CryptoQuant.

The coming few days should shed some serious light on Bitcoin’s near-term outlook and whether or not the cryptocurrency will be able to push any higher.

Featured image from Unsplash. Charts from TradingView.