A massive sell off of Bitcoin and other cryptocurrencies has resulted in the total market cap of the cryptocurrency market dropping to below $66 billion. The decrease marks a 43% decline from this year’s record-setting high of $116 billion back in late May.

Market Thrown into a Tailspin

With the market cap in a nosedive and Bitcoin prices seeming to drop almost daily, the past two weeks have been a stomach churning roller coaster ride for investors. In the past week especially, fear, doubt, and uncertainty have reigned supreme.

While it is next to impossible to correctly predict any market, let alone the cryptocurrency market, there are a handful of significant events that have happened and that are going to happen that can be pointed to as catalysts for Bitcoin’s plummeting value.

A Tale of Two Blockchains

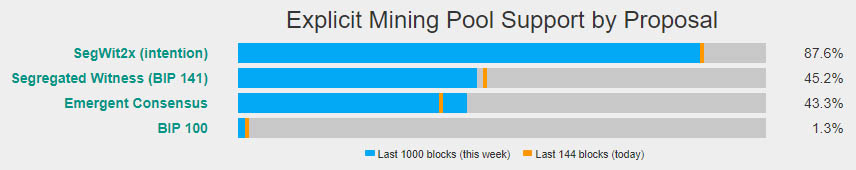

For more than two years, a battle has been fought on the battlegrounds of social media, conference rooms, and cryptocurrency forums to decide the best way to scale Bitcoin in order to avoid inflated transaction fees and unacceptably long transaction times. While several solutions have been proposed, Segwit2x has emerged the front runner, with close to 90% of mining pools indicating their intent to support the scaling protocol.

Two dates related to the implementation of Segwit2x are looming and causing investors to sit on the edge of their seats in nervous anticipation of what is to come:

July 21, 2017 – This is the day on which miners, instead just showing the intent to support Segwit2x, should actively begin supporting the protocol.

August 1, 2017 – This is the day that has many investors and exchanges sweating bullets. UASF will be implemented by its supports and will begin to check to see if subsequent bitcoin transactions are in compliance with Segwit2x. A minimum threshold of 80% of the network’s hashing power is required in order for Segwit2x to activate. Should the threshold fail to be met, a blockchain split seems likely.

GDAX Trade Suspension

The scaling debate found its way to exchanges last week as GDAX announced to its customers its intent to stop trading on August 1st in the event that a soft fork is activated. GDAX is owned by Coinbase, which is currently the world’s largest exchange for Bitcoin, Ethereum, and Litecoin trading.

The announcement underscores the concerns that many investors have about the possibility of a major market disruption.

GDAX General Manager Adam White offers this assurance to GDAX users:

We will implement safeguards to ensure the safety of our customers’ funds. For example, we will temporarily suspend the deposit and withdrawal of bitcoin on GDAX and may pause the trading of bitcoin as well. This decision will be based on our assessment of the technical risks posed by the fork, such as replay attacks and other factors that could create network instability.

Alphabay Taken Down

Earlier this week, Alphabay, the largest Dark Web marketplace built in the wake of Silk Road, was taken down by a coordinated attack from the governments of Thailand, Canada, and the United States. Unlike Silk Road, Alphabay doesn’t only specialize in drugs, but also weapons, stolen credit cards, and other illegal items. Servers and other equipment were confiscated as well as the personal assets of those arrested.

At a time when Bitcoin seems to be struggling to find mainstream acceptance, events like this and recent WannaCry and Petya ransomware hacks only serve to remind investors and potential adopters of the shady past associated with the digital currency.

Bitcoin Core Weighs In

An announcement was posted on bitcoin.org last Thursday warning users about using the network during the potential fork that could occur in the beginning on August. With over a thousand nodes supporting BIP 148, the proposal that will make all blocks not signaling Segwit invalid, the odds of a chain split are growing every day. Read more about BIP 148 on Bitcoinist here.

How long do you think it will take for Bitcoin’s price to recover if it even does? Let us know in the comment section below!

Images courtesy of Coin.dance, GDAX, Bitcoin.org, Shutterstock