Bitcoin has now shown about eight weeks of consecutive buying, leading into new all-time highs (ATHs) for the past three weeks. Trying to stay objective with mild to extreme euphoria in times like this can be difficult. As someone who was a new trader during the 2013 bubble, the chart is beginning to look very similar.

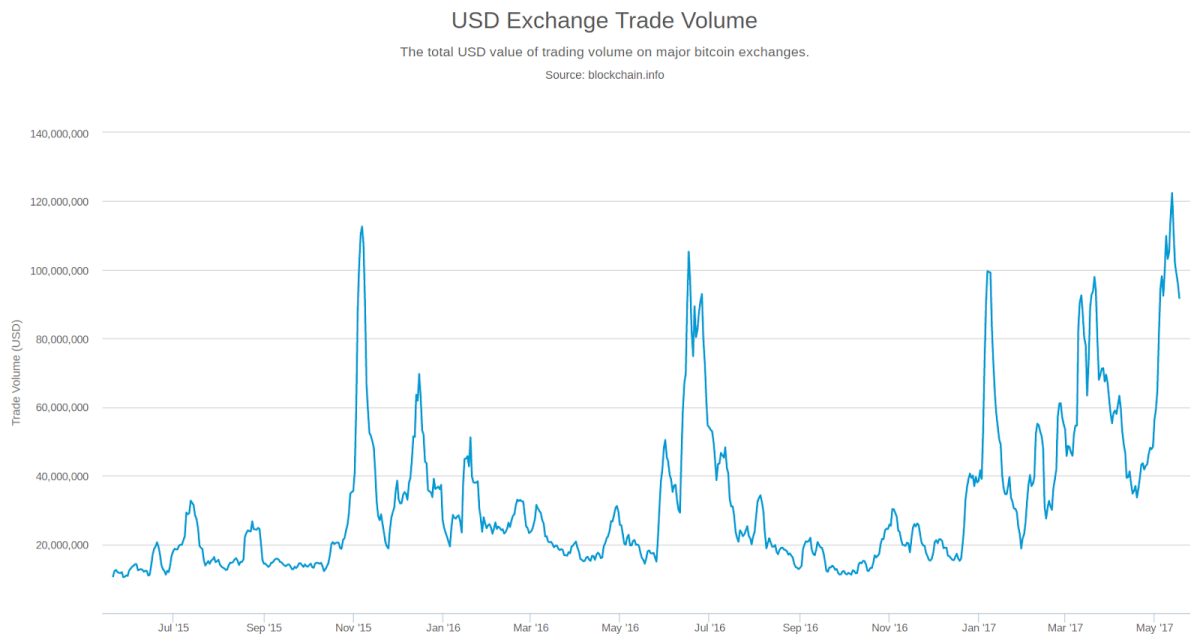

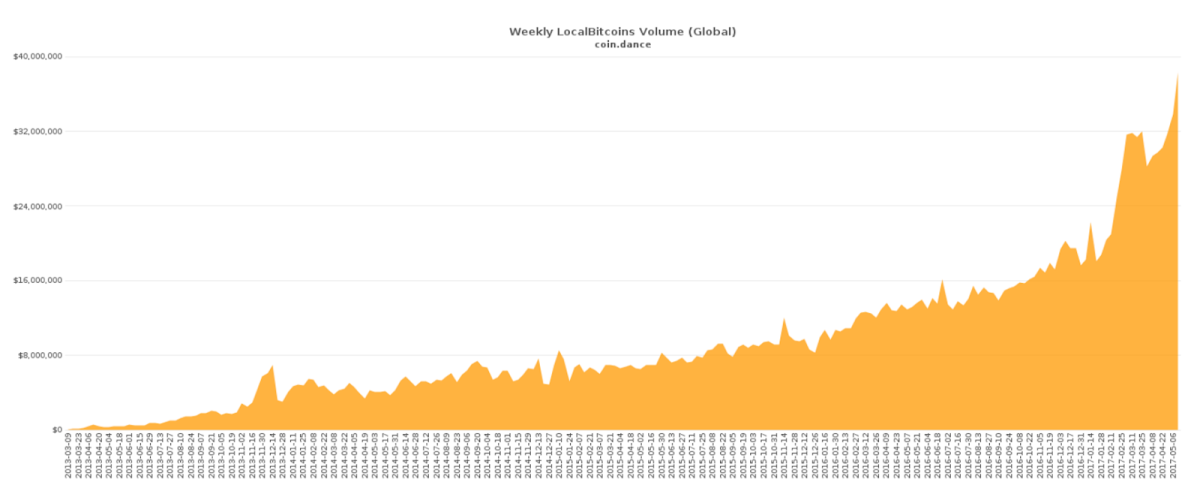

Market capitalization and trading volume both on exchanges and over-the-counter markets have hit ATHs as well.

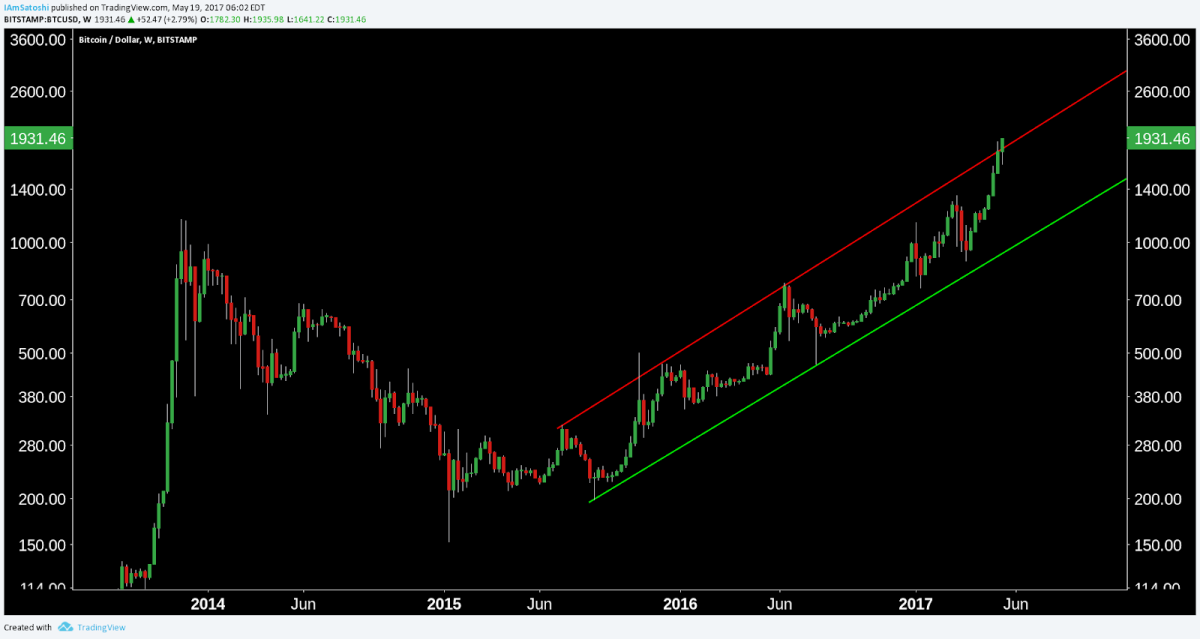

Despite being in price discovery mode, there is an established, longstanding trend we can compare the current price against, as well as the entire left side of the chart. Past results don’t always predict the future, but they can influence it.

There are a few questions we can investigate:

- Is the price near an interim top?

- Is the price nearing parabolic conditions?

- Will the price continue on the previous trend at the same rate?

Looking at the monthly Bitstamp chart, there have not been too many candles of this proportion. This would suggest we are nearing bubble-like conditions.

Price has also begun to close outside of the longstanding trend. This weekly candle has not closed yet, but if it does close outside of the diagonal, it will be the first weekly candle to do so. This again points to breaking the trend strongly to the upside.

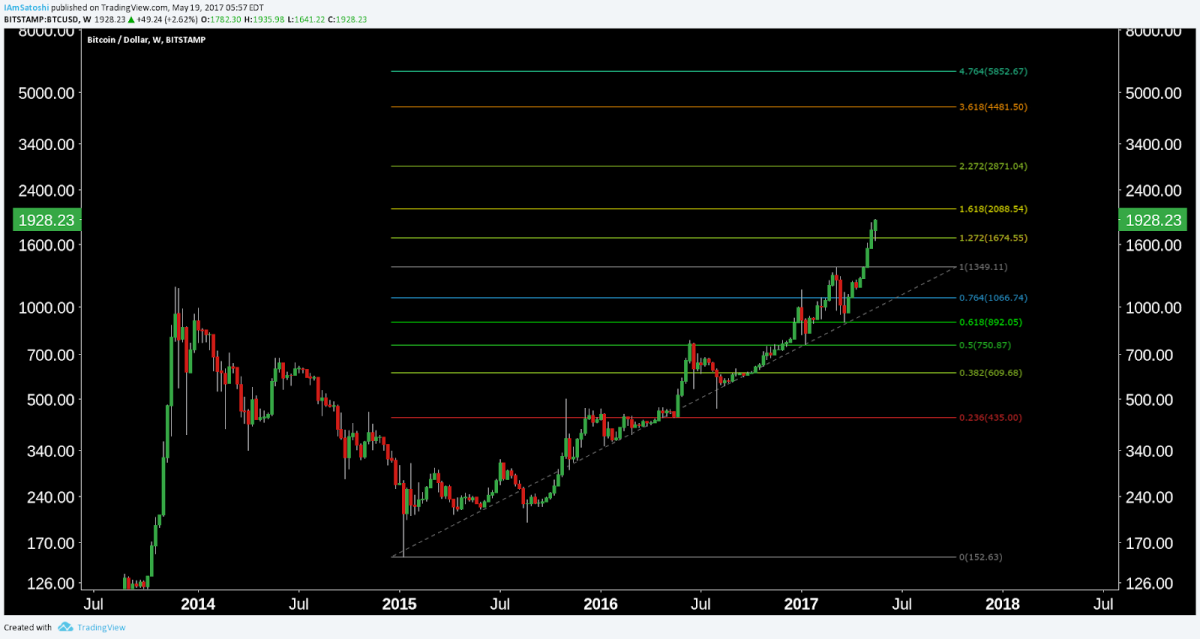

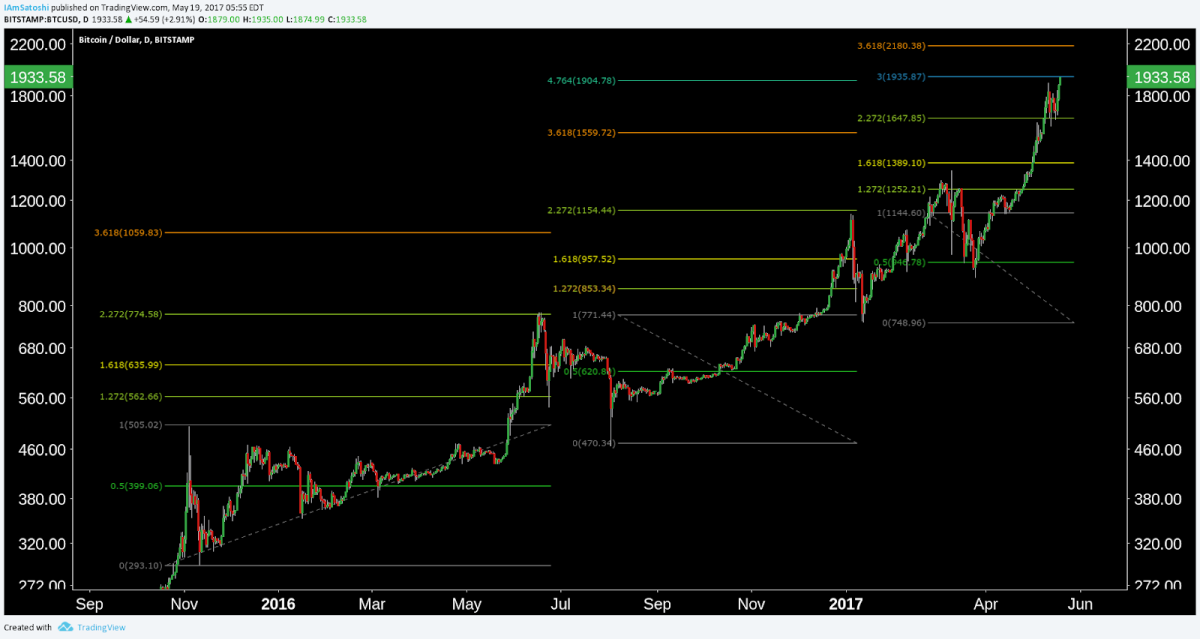

Fibonacci retracement and extensions are admittedly partly magic voodoo, but there are plenty of traders who use and watch them to make the resistance and support levels legitimate. Drawing this Fibonacci from the local high established on March 10, 2017, to the low on January 14, 2015, several Fibonacci extensions emerge as well.

These can be seen as resistance levels, the next being the 1.618 at $2,088. Although the horizontal levels are arbitrary, we can confidently predict resistance based on the fit of the previous horizontals. Most of the prior “Fibs” match the price. This should be seen less as curve fitting and more as levels that just make sense. Based on the Fibonacci levels alone, there is not necessarily evidence for top or bubble just yet.

We can tease apart the trend even further by using the Fibonacci tool on each previous high and low.

In the trend, a consolidation from the previous high to low has yielded a price that has seen resistance at the 2.272 Fibonacci extension. Currently, the price has exceeded the previous 2.272 Fibonacci extension and shown it was supported based on the multiple candle touches. This suggests price is moving faster than the previous trend as well as closer to bubble-like conditions.

For low-timeframe, intra-day trading, there was a long entry signal when the price cleanly broke the consolidation triangle. On the next correction, pullback or consolidation event, I’d expect the support diagonal (green) to remain the same.

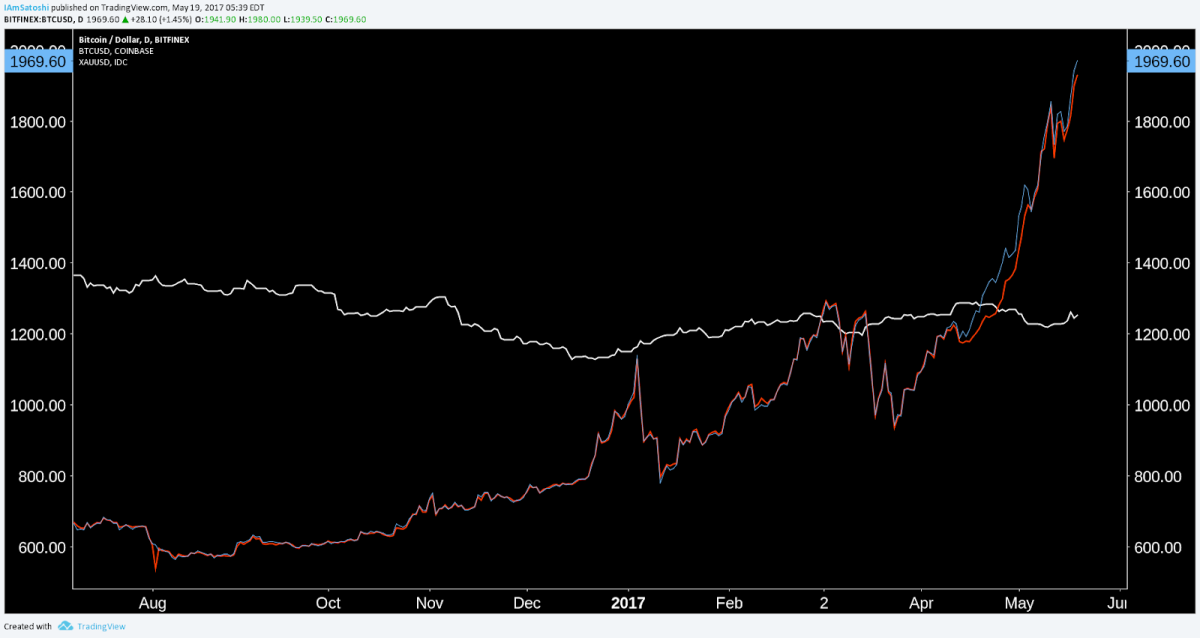

Remember that splashy gold parity headline? BTC is now sitting several hundred dollars above it.

Summary

- Bitcoin is making ATHs by almost every available metric: price, market capitalization, volume, hashrate, difficulty and fee per transaction.

- Although $2,000 is the next milestone and resistance target, the price will likely exceed that level based on the strength and rate at which the price is exceeding current trends.

- Watch for signs of a large pullback or correction in the near future, two to three months at the latest, based on previous price history.

Trading and investing in digital assets like bitcoin is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTCMedia related sites do not necessarily reflect the opinion of BTCMedia and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.