Over the past few days, Bitcoin has hit fresh all-time highs (ATHs) on all exchanges, as well as new all-time highs in market capitalization.

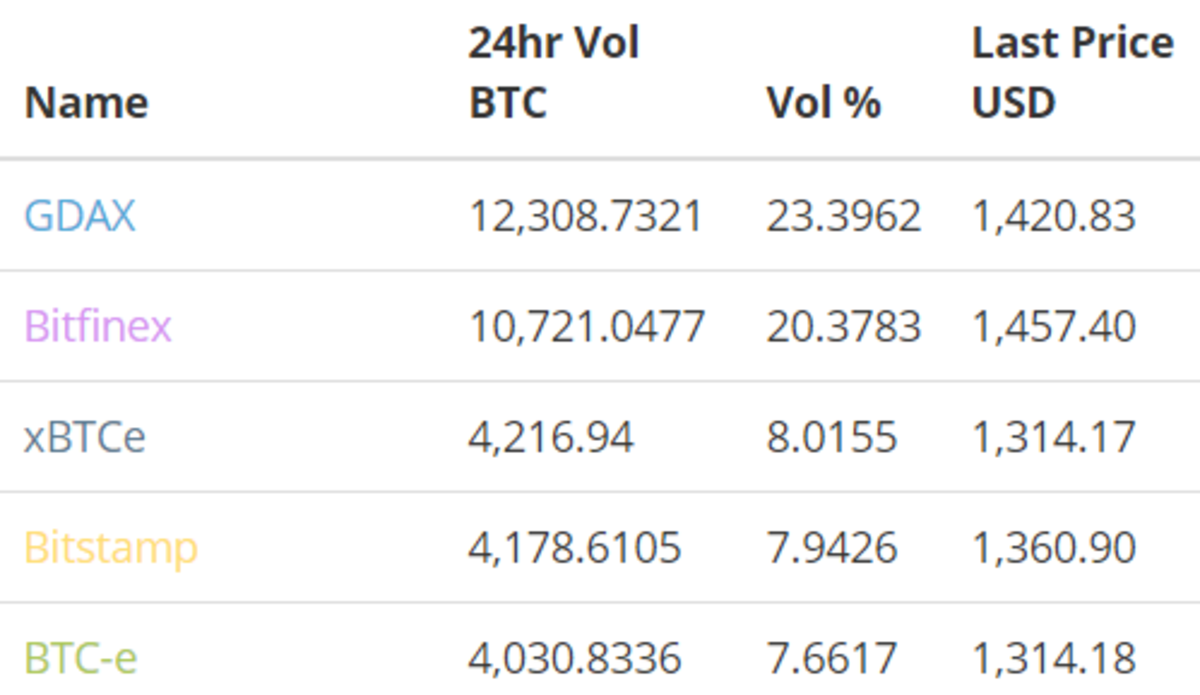

The premium between Bitfinex and the other exchanges continues due to a halt on USD deposits/withdrawals, preventing arbitrage. GDAX/Coinbase, a USD on-ramp, is closing that premium, suggesting that heavy buying is occurring on that exchange.

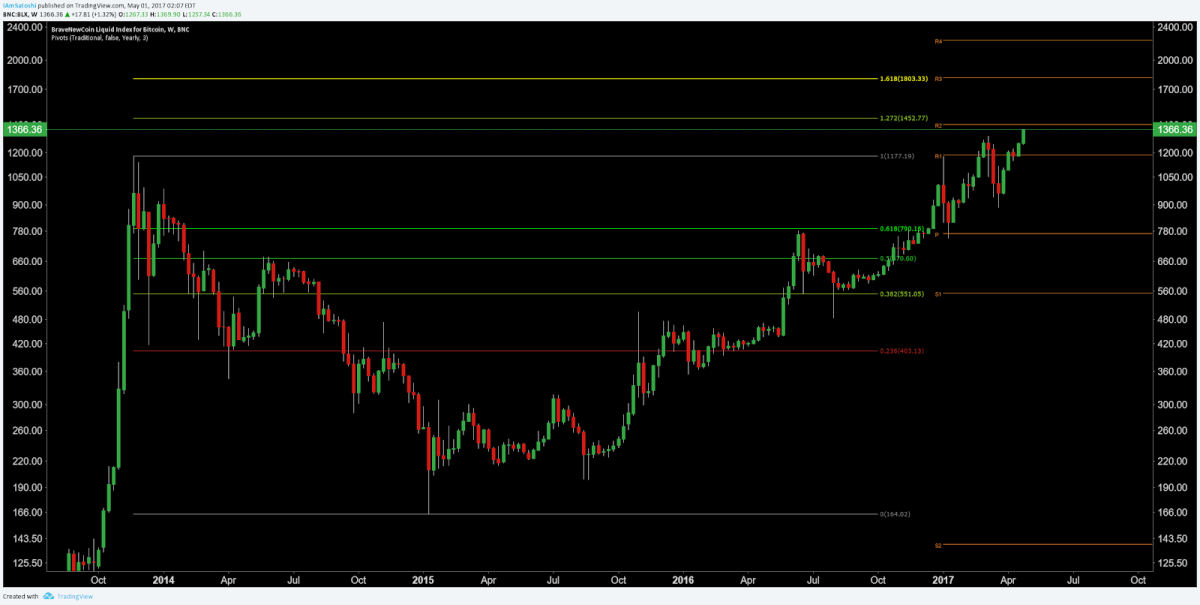

On high timeframes, resistance confluence around $1,410–1,450 and $1,800 become apparent with Fibonacci extensions, drawn from previous ATH to low, and yearly pivots. As bitcoin reenters price discovery mode, with no prior resistance in this zone, these are very real targets that will be reached for until buyers are exhausted.

There is also an old bullish chart pattern, the inverted head and shoulders, with a measured move around $1,475.

We can also see a messy cup-and-handle chart pattern with a measured move of $2,300. This will likely be the blow-off top target should it occur in 2017.

A Few Things to Consider

As we ride this bullish wave, it is still worth thinking conservatively about the future. As a trader, I look ahead to an eventual pullback/correction — how dramatic could it be? So far it seems that the buying will continue indefinitely, and there are plenty of high technical targets ahead, but when the ball drops, where is this going to go? Perhaps more important, which events outside of technicals can make a dramatic drop happen? For instance, Chinese regulatory announcements provided both bullish fuel with yuan devaluation and bearish fuel with increased Bitcoin and trading regulations. It’s events like this that should be considered and planned for prior to their occurrence. Always remember: stairs up, elevator down.

Here are the unresolved issues still looming that could have a significant effect on price:

- Any number of possibilities with Bitfinex regarding USD

- Bitcoin Unlimited (BTU) hard fork remains a possibility with anywhere from 51 to 75 percent of miner support.

- The SEC and the COIN ETF

- SegWit Activation

- An unknown unknown or true Black Swan type of event, such as harsh government regulation in the United States. Least likely.

- Best-case scenario: USD deposits/withdrawals resume, and price on Bitfinex gets arbitraged down in line with the other exchanges.

- Worst-case scenario: Bitfinex is insolvent (extremely unlikely).

- Other scenario: Halt on USD deposits/withdrawals continues indefinitely.

- Best-case scenario: BTU realizes it is in a losing battle, leaves well enough alone and disappears.

- Worst-case scenario: BTU attempts a hard fork anyway.

- Best-case scenario: Approval; priced in to some degree but not completely.

- Worst-case scenario: Another denial, which is already priced in at this point.

- Best-case scenario: UASF brings SegWit online.

- Worst-case scenario: Drags on, unactivated, until timing out in November 2017.

Summary

- New ATHs in price and market capitalization suggest an immediate bullish future.

- A shrinking premium between Bitfinex and GDAX/Coinbase suggests new money is ramping on to digital currency.

- Technicals show resistance between $1410–1450 and $1800.

- Several unresolved issues remain. Have a plan for all possibilities.

Trading and investing in digital assets like bitcoin is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTCMedia related sites do not necessarily reflect the opinion of BTCMedia and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.