North America is becoming an increasingly popular home for bitcoin mining operations, from Georgia to Alberta. Here’s a look at the new expansions.

The phones are ringing off the hooks at the New York offices of BitOoda, a financial services and brokerage firm that advises bitcoin mining companies and investors in the bitcoin space on investment strategies and risk management.

Ryan Porter, head of business development at BitOoda, told Bitcoin Magazine that there’s lots of interest, including from Chinese companies and investors, in the new frontier of bitcoin mining in the U.S. and Canada. “We’re seeing potentially explosive growth in North America in bitcoin mining as the number of inquiries from both mining companies and investors in possible mining operations has picked up significantly in 2019. Some institutional investors who have been waiting on the sidelines are making mining their first foray into bitcoin and many view North America as their best option.”

Porter also added that, in addition to its own bitcoin mining benefits, North America is becoming increasingly popular in relation to the world’s central hub for bitcoin mining.

“With continuing regulatory uncertainty in China and relative stability here, along with plentiful inexpensive power, operators and investors are realizing that North America is a desirable option for bitcoin mining,” he said.

Similarly, Jonathan Hamel, founder and president of Montreal-based Académie Bitcoin, and a close observer of the bitcoin mining sector, told Bitcoin Magazine:

“I believe the reputational risk associated with bitcoin mining is slowly going away. For example, here in Canada, Bitfarms being publicly listed on the [Toronto Stock Exchange] and audited by Ernst & Young, brings a lot of credibility to the industry.”

Bitcoin Mining in the New World

Like the early pioneers, mining companies are turning to the New World, where they hope to find relative freedom from government interference and, in places, plentiful supplies of ready-to-use, cheap power, often in abandoned industrial sites.

In areas like central Texas, there are local economic development officials working with companies like Bitmain to take over sites. The abandoned Alcoa aluminum smelting complex in Rockdale, for example, is already equipped with a built-in power plant and electricity lines.

“As more states and provinces look for markets for abandoned industrial sites with stranded energy, I believe that we're moving towards a normalization/commoditization of the industry,” said Hamel. “That's a good thing for Bitcoin: more locations, more decentralization.”

Use of Renewable Energy for Bitcoin Mining

In June 2019, CoinShares (the cryptocurrency investor service providing advice, tools and services) published its report on mining. On one hand, it assured readers it provided the best available information on bitcoin mining. On the other, it cautioned that bitcoin mining is “a highly private and secretive industry. As a result, our estimates may be subject to significant potential uncertainty.”

Still, CoinShares made the point that cheap energy is a bottom line for mining companies and, as it happens, an economic change from an industrialized to postindustrial economy has left lots of abandoned facilities with power-generating capacity available.

“Our findings reaffirm our view that Bitcoin mining is acting as a global electricity buyer of last resort and therefore tends to cluster around comparatively under-utilised renewables infrastructure,” per the report.

The report concludes that bitcoin mining relies heavily on renewables in comparison to other industrial sectors.

“We calculate a conservative estimate of the renewables penetration in the energy mix powering the Bitcoin mining network at 74.1 percent, making bitcoin mining more renewables-driven than almost every other large-scale industry in the world.”

It also noted that this is “more than four times the global average.”

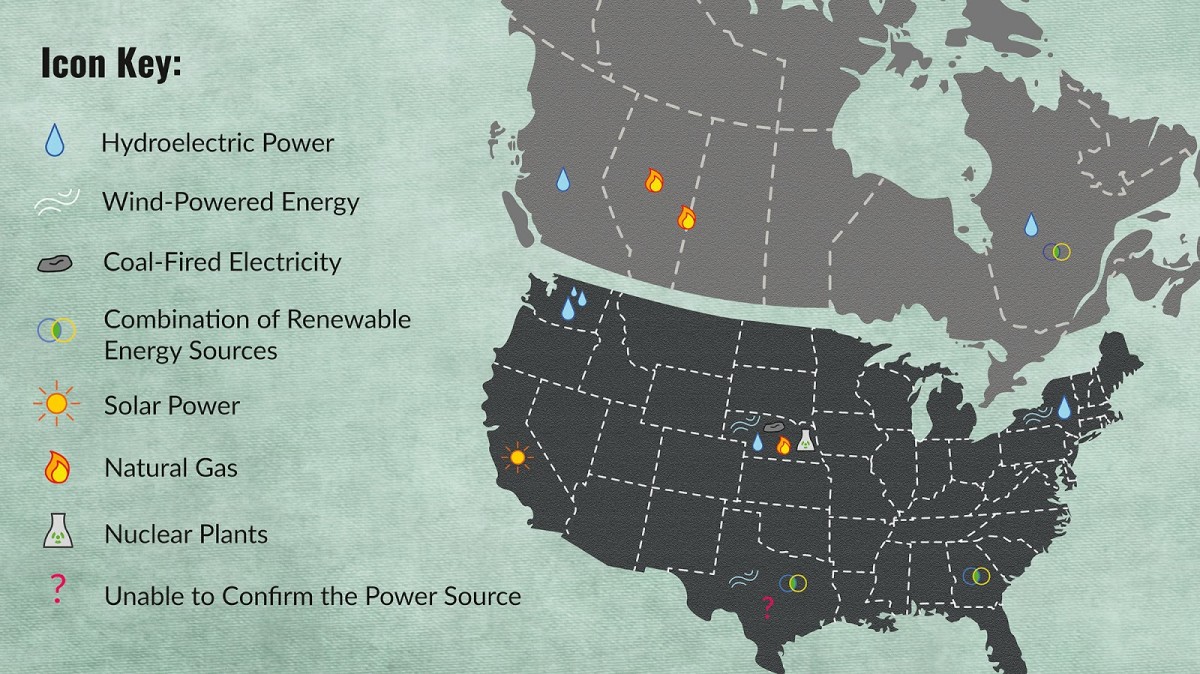

Following is an initial list of some major players in the bitcoin mining industry in North America by state/province.

Bitcoin Mining in the United States: A Mix of Resources

According to the CoinShares report, the two major mining centers in the U.S. are in the states of Washington and New York. The cool climates and rugged terrains, along with powerful rivers like the Columbia and the St. Lawrence, make for plentiful hydroelectric power there.

These two states have been on the front line of the economic change from heavily resource-dependent economies with lots of hydroelectric dams to postindustrial, knowledge-based economies leaving lots of surplus power and infrastructure available for bitcoin mining.

Recent announcements of new bitcoin mining projects have also come from Texas and Nebraska.

Washington State

CoinShares calls Washington State one of the two U.S. “major mining centers,” noting its cool climate and abundance of hydroelectric power from a mountainous interior with hydroelectric dams on powerful rivers like the Columbia River.

Washington State officials are more than happy to negotiate cheap power rates for interior sites once occupied by major forestry and pulp and paper mills, factories equipped with hydro-driven power plants and electrical lines, abandoned when a central state resource economy became uneconomical.

Salcido Group

Salcido Enterprises, one of the first major mining operations, located in Wenatchee, in Central Washington State, has three centers all using renewable, inexpensive hydroelectric power.

The Columbia Data Center, the Cashmere Data Center and the Horizon Data Center are all built on converted industrial sites and use power from dams on the Columbia River to power their mining operations.

Bitmain

Located in East Wenatchee, in Central Washington State, Bitmain is one of the mining companies there refitting abandoned factory infrastructure that uses power from hydroelectric dams and electrical lines (power that is created whether it’s used or not).

According to media reports, Bitmain invested $20 million in the Wenatchee facility with five buildings, each with 1,620 Antminer S9s for a combined total of 12 MWs.

Bitmain has also built an electronics repair center in nearby Malaga, about 7 miles (11 kilometers) from East Wenatchee. It will serve as the firm’s service location for repairing damaged Antminers for Western North America.

With mines in China, East Asia and now in Texas and Washington, Bitmain is tracking to be one of the largest mining companies in the world. A report earlier in 2019 said Bitmain has plans to open 17 mining centers in the U.S.

New York State

New York State is the other major center (along with Washington) of U.S. bitcoin mining, according to CoinShares.

With a similarly rugged terrain, New York has seen a net outflow of manufacturing and resource companies, leaving industrial infrastructure with power plants and lines available for reuse. Along the St. Lawrence River, many dams produce cheap power for residents of towns like Massena and Lake Placid.

Coinmint

Coinmint currently operates three mining facilities. The first two are located in Plattsburgh, New York. Coinmint’s third and largest mining facility is in a former Alcoa Aluminum smelter in Massena, New York. According to its website, at 435 MW, the Massena facility is the largest digital currency data center in the world.

The company is confident of its success there in part because of the abundance of cheap hydroelectric power and wind generation in northern New York.

Texas

Texas has been making news in the bitcoin world lately as a number of major mining operations set up shop in the Lone Star State. Like the rust-belt states, central Texas has taken a hit economically over the last few decades with the end of industrialization and the export of resource and manufacturing investment.

Bitmain

Beijing-based Bitmain worked with local economic development officials from the Rockdale Municipal Development District to launch a new mine in Rockdale, Texas, in collaboration with Canadian blockchain firm DMG Blockchain Solutions.

Bitmain set up on the 33,000-acre, former Alcoa Aluminum smelting site, with much of the infrastructure, including an electricity plant and power lines still intact. It will reportedly be working to increase its power output from the current 25 MW level to a maximum of 300 MW. (Note: Bitcoin Magazine was unable to confirm the power source for this location by time of publication.)

Layer1

Layer1, a San Francisco-based cryptocurrency infrastructure company, is building a full-stack mining facility in West Texas.

With a show of faith from investors, including a Peter Thiel-led $50 million funding round, co-founder Alexander Liegl plans to take advantage of the state’s competitive electricity prices and encouraging policies to upscale their operations.

According to the company, Layer1 will be using mostly wind-powered energy.

Whinstone and Northern Bitcoin

Whinstone US Inc., a Louisiana-based developer of high-speed data centers, and Northern Bitcoin AG, a Germany-based bitcoin mining firm, have announced they will be partnering to open a 100-acre bitcoin mining farm in central Texas.

The new center will build a capacity of 1 gigawatt and will be using a combination of renewable energy sources.

California

Plouton Mining

Located in California's Mojave District, Plouton Mining is hoping to secure its place as a long-term mining operation with its use of solar power.

As North America’s largest solar-powered mining center, it plans to operate next-generation 7nm SHA256 ASIC Bitcoin miners at 400 Ph/s.

Georgia

Blockstream Mining

Georgia joined the North American mining fray recently with its hosting of Blockstream Mining in Adel, Georgia. Blockstream provides economic development for the state and is a customer for a combination of renewable energy sources, according to Blockstream CSO Samson Mow, in a written reply to Bitcoin Magazine.

With its other facility in Quebec, Canada, using readily available hydroelectric power, Blockstream says it has over 300 MW of energy sites in operation with more to come.

Blockstream Mining is also offering colocation services: equipment, space, bandwidth and/or power rental for interested miners who can benefit from inexpensive energy without negotiating separately with local authorities. Currently renting space are the Fidelity Center for Applied Technology and LinkedIn founder Reid Hoffman.

Nebraska

Compute North

Hoping to join the states that benefit economically from mining, Nebraska offered low, subsidized energy rates to lure Compute North to Kearney, Nebraska.

According to Nebraska Power, the district uses a mix of renewables like wind and water but also adds power from coal, natural gas and nuclear plants.

Compute North, like its Texas and South Dakota centers, is a colocation service offering mining services — equipment, space, bandwidth and/or power rental — to interested miners around the world who can benefit from inexpensive energy without negotiating separately with local authorities.

Canada: A Bitcoin Mining Magnet

In Canada, bitcoin mining can be found in British Columbia, Alberta, Newfoundland and Labrador, and Quebec.

Benefiting from a cool climate, Canada has abundant supplies of renewable hydroelectric power left over from a time when resource extraction and processing, in forestry, pulp and paper, and heavy industry, drove the northern economy.

Alberta

Alberta’s oil and gas based economy has been struggling lately, so with an appreciation of innovation and entrepreneurship, it has welcomed miners by offering some of the lowest power rates in Canada

Hut 8

With 94 BlockBox centers in Medicine Hat and Drumheller, Alberta, Hut 8 says it is benefiting from the lowest energy rates in Canada via the Alberta government.

One of the largest bitcoin mining centers in Canada, Hut 8 is publicly listed on the Toronto Stock Exchange. Hut 8 uses natural gas but says it is looking for sites to expand into that have affordable, renewable energy.

Upstream Data

Located on the Alberta-Saskatchewan border, Upstream Data has developed new technology, the Ohmm Mining data centers, to efficiently capture and reuse the natural gas by-products from oil refining which would normally go to waste, vented into the atmosphere.

It not only mines, but helps other companies take advantage of this inexpensive capture technology.

Quebec

Quebec has gone back and forth with its support of bitcoin mining, but its sheer volume of available hydroelectric power dams and power lines from a time of aggressive industrialization, in combination with a cool northern climate, make it ideal for mining. As a result, the government is negotiating cheaper power rates for interested miners.

Blockstream

Blockstream is entering the North American market with two centers, one in Quebec using hydroelectric power and the other in Adel, Georgia, using “a mix of renewable energy sources,” according to Blockstream’s CSO Samson Mow.

Both facilities offer colocation services — fully-equipped spaces for miners to rent.

Bitfarms

With five separate mining sites in Quebec, Bitfarms is one of the largest mining operations in North America.

Benefiting from Quebec’s plentiful surplus electricity from hydroelectric dams, the company has mining sites in five locations: Sherbrooke, Farnham, Saint-Hyacinthe, Cowansville and Magog.

Bitfarms is publicly listed on the Toronto Stock Exchange and is audited on a regular basis by Ernst & Young. Recently, Bitfarms released its earnings for Q3 2019, which, it claims, reveal it to be the most profitable publicly-traded bitcoin miners in the world.

British Columbia

Left over from the once prosperous forestry, pulp and paper, and traditional mining industries, B.C. (like Quebec) now has lots of available hydroelectric power with facilities and hydro lines ready to go.

DMG

DMG uses what it calls “clean hydroelectric power” for its flagship location near Castlegar in southern B.C.

In addition to its fixed location, a 20,000-square-foot facility, DMG has built fully automated containers for deployment in remote locations.

DMG offers consulting services to help other cryptocurrency data center companies build their facilities and setup operations.

The Future of Bitcoin Mining in North America

With bitcoin mining operations taking root in locations across North America, from British Columbia to Georgia, it is rapidly becoming an epicenter for the entire Bitcoin sector. As the operations described above continue to expand and flourish, the region’s slice of the industry is only set to expand.

As it does, Ryan Porter at BitOoda has his work cut out for him just answering calls from interested miners and investors.

“With the continued uncertainty in China and a growing interest in renewable sources of power like hydroelectric dams, I expect North America will continue to attract new mining and mining investment for the foreseeable future,” said Porter.