On-chain data shows that Bitcoin miners are making 12.4% of their revenue from the fees after transaction counts hit an all-time high.

Bitcoin Miner Revenue Share Of Transaction Fees Has Surged Recently

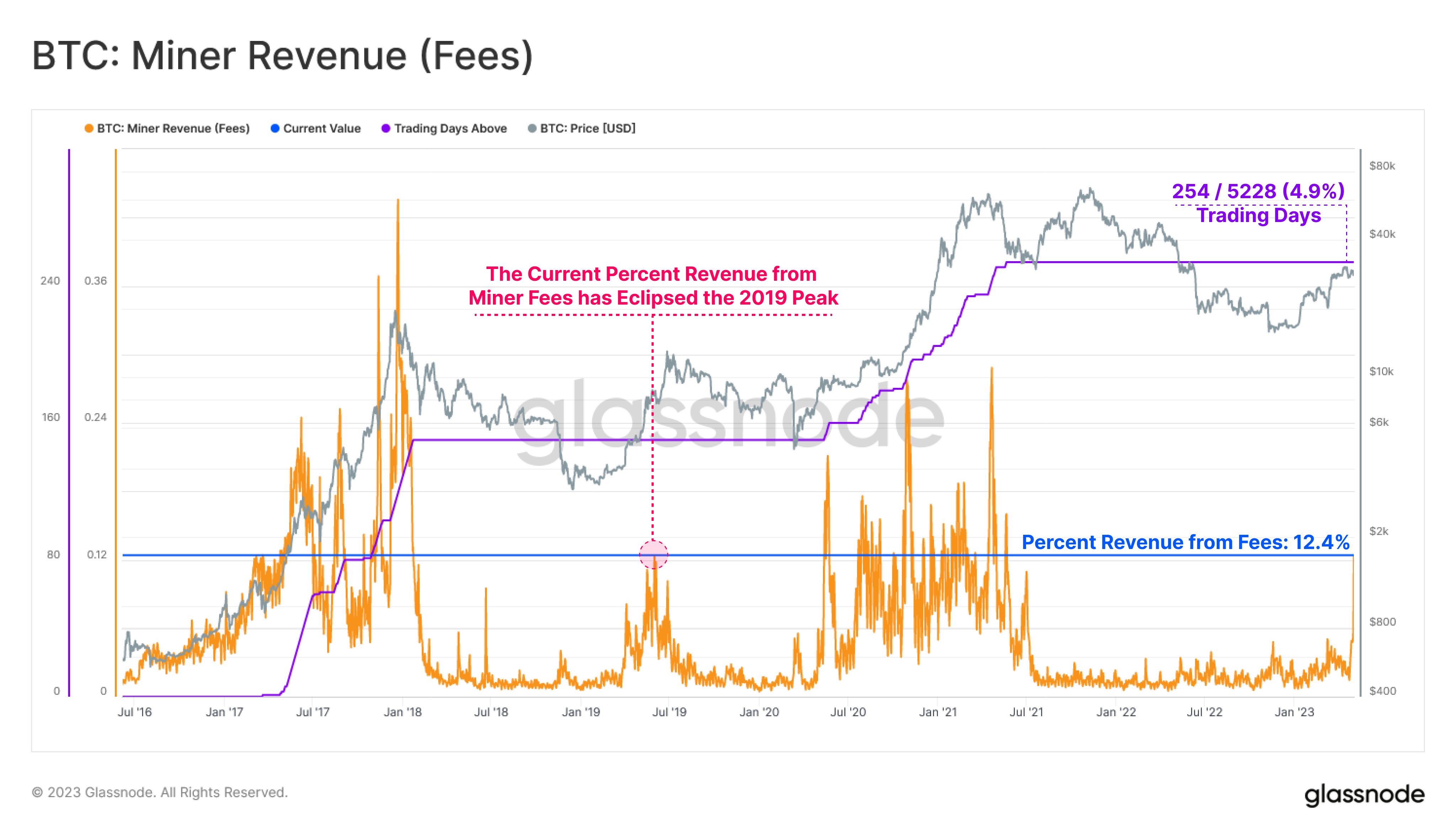

According to data from the on-chain analytics firm Glassnode, only 254 trading days in the entire history of the cryptocurrency have seen the transaction fees contribute a larger share to the total revenue of these chain validators.

There are mainly two components to the revenue that miners generate: the block rewards and the transaction fees. The block rewards are what this cohort receives as compensation for mining blocks on the Bitcoin network. These rewards always have a fixed value, with the exception of the halving events, following which they are permanently cut in half.

The transaction fees, on the other hand, can be highly variable, since it’s on the users of the blockchain to attach as much amount as they see fit. Generally, in periods of relatively little traffic on the network, the fees remain low. This is because there is enough capacity on the chain that their transfer should go through relatively quickly even with low fees.

However, things get different when the network becomes active. Miners can only handle a limited amount of transactions at once, so they start prioritizing transfers with a larger amount of fees. In order to compete with other users in getting their transactions through faster, senders begin attaching high fees.

In times like these, the average fees can naturally spike, and so, the percentage of the miner revenue that they make up for surges. Recently, such market conditions have again formed.

The below chart shows how the current percent revenue from the fees for the miners compares with levels seen throughout the history of Bitcoin.

As displayed in the above graph, the Bitcoin miner revenue from the transaction fees has observed a pretty large spike recently. These high fees have come as the total number of transactions on the network has hit a new all-time high value.

The source of this sudden volume of transfers seems to be mainly because of the explosion in popularity of the “Inscriptions,” BTC tech that’s akin to Non-Fungible Tokens (NFTs) on other blockchains. In particular, text-based Inscriptions have seen a very high demand recently.

As a result of this high activity on the network, the fees are now making up 12.4% of the miners’ revenue. From the chart, it’s visible that there have been very few instances where the metric has seen spikes higher in magnitude.

To be precise, only 254 trading days in the entire history of the cryptocurrency (or 4.9% of the trading lifetime of the asset) have observed the miners raking in a higher percentage of revenue from the fees, showing how rare this situation is. Certainly, the miners would be welcoming this development induced by the Inscriptions.

BTC Price

At the time of writing, Bitcoin is trading around $29,000, down 1% in the last week.