Despite facing strong resistance at the $73,000 price level, leading to a notable price drop on Thursday after a remarkable week of upside movement, traders and investors are still betting on Bitcoin, demonstrating a persistent demand for the crypto asset.

Bitcoin In Extreme Greed Territory Again After Fews Months

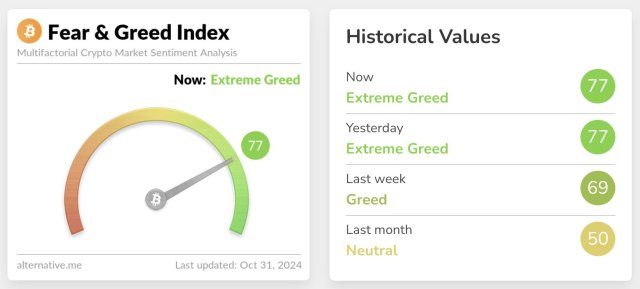

Investors’ sentiment around Bitcoin has witnessed a sharp increase as BTC’s Fear and Greed index has moved into extreme greed levels, signaling an optimistic outlook for the crypto asset. Jason Pizzino, a macro trader and investor, reported the development in a recent post on X, which may suggest an overvaluation of the asset.

The macro expert pointed out that for 2 days in a row, Bitcoin was within the extreme greed zone, marking its first time since June this year. He further warned that this market sentiment may persist throughout the next few months as seen in the past market trends.

Specifically, the Fear and Greed index is a tool for examining BTC’s superiority over other digital assets by assessing variables like volatility, momentum, and social media trends. It has been a reliable indicator that offers investors insights on when to sell and buy BTC.

According to Pizzino, near the peak in February and April were the last time Bitcoin experienced prolonged periods of extreme greed, suggesting renewed confidence and optimism in BTC. Even though there was still a lot of price activity during this period, Pizzino claims development is a “top signal.”

This increase in market sentiment reflects a constant rise in confidence among retail and institutional investors, triggering an upward direction for the price of Bitcoin. While this shift in enthusiasm often implies that investors are anticipating more gains, there is a risk of overbought conditions.

In the meantime, the expert has urged investors to be wary of those promoting the large inflows of the historical Spot Bitcoin Exchange-Traded Funds (ETFs) presently or Michael Saylor’s current comments about BTC, claiming everything was the same 8 to 10 months ago.

BTC In A Bearish Territory Amidst Extreme Greed

Despite the strong optimism around BTC, the crypto asset has fallen to the $69,000 threshold, showing signs of an extended decline. Given that this drop comes after a week of upward movement, it has sparked speculations about its short-term potential.

However, with the surge in trading volume in the past 24 hours by over 21%, there is the possibility of a brief price rebound as the bulls seem to be gradually regaining control of the market.

The decline has also led to a dip in Bitcoin’s dominance in the market, which has fallen to 58%, previously situated close to 60%. This slight decrease in market dominance during waning performances in BTC raises the potential of diversification towards altcoins.