Bitcoin is stretching gains, looking at price action in the past few trading days. At spot rates, buyers are “hungry” and aiming not only to confirm the rally of the past two days but also to close above March 2024 highs of around $74,000.

Bitcoin “Golden Cross” Forms

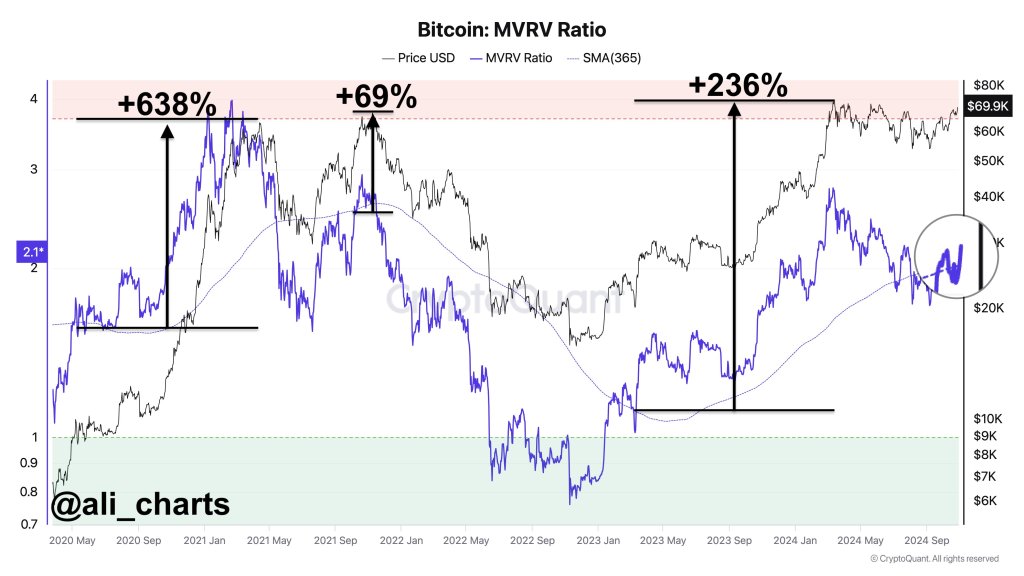

The optimism has been confirmed on-chain. On X, one analyst notes that the market value to realized value (MVRV) ratio has exceeded the 365-day moving average.

Related Reading: Crypto Groups Challenge US SEC on Airdrop Rules In Ongoing Court Case—Details

The MVRV ratio is a metric on-chain analysts use to gauge BTC holders’ average profit (or loss) at every price point. Historically, when the MVRV ratio crosses above the 365-day moving average, it is considered a “golden cross” and has preceded sharp price gains.

If this development evolves as it has, the odds of Bitcoin extending and closing above important resistance levels, in this case, $74,000, will be high. Currently, the impressive rally above $72,000 to as high as $73,000 on October 29 could be a marker of strength, preparing bulls for the next wave of demand.

ll the same, while bulls prepare to break $74,000, how fast it grow and eventually breaks $86,000 will be critical. In a post on X, one on-chain analyst said a close above $86,200 will determine the “fate of bulls.” Once buyers overcome this barrier, they need “strong bullish momentum.” Afterward, the analyst said, prices will evolve like “everyone has been waiting for.”

Over the past few months, especially after the rally to nearly $74,000 in March 2024, BTC holders have been predicting sharp price gains, lifting prices toward $100,000.

As the analyst insinuates, a close above $86,200, the “high-risk upper boundary” based on the Bitcoin short-term analysis and risk evaluation charting off CryptoQuant, could easily see BTC extend to $100,000.

Market Forces Will Determine The Pace Of Growth

How fast BTC explodes to $100,000 will depend on multiple factors. Inflows from institutions will be crucial. Encouragingly, demand is picking up, especially in the case of spot Bitcoin ETF issuers’ netflows on October 29, as seen on SosoValue. Over $870 million of shares were bought.

Related Reading: Bitcoin Nears New ATH Amid Positive Q4 Seasonality: Report

Beyond institutions, parallel market data shows that retailers open leveraged longs on perpetual platforms and buy on the spot, especially on Binance. On Coinbase, however, the spot market is selling on the move up.