This is an opinion editorial by Dan, cohost of the Blue Collar Bitcoin Podcast.

A Preliminary Note To The Reader: This was originally written as one essay that has since been divided into three parts. Each section covers distinctive concepts, but the overarching thesis relies on the three sections in totality. Part 1 worked to highlight why the current fiat system produces economic imbalance; Part 2 and Part 3 work to demonstrate how Bitcoin may serve as a solution.

Series Contents

Part 1: Fiat Plumbing

Introduction

Busted Pipes

The Reserve Currency Complication

The Cantillon Conundrum

Part 2: The Purchasing Power Preserver

Part 3: Monetary Decomplexification

The Financial Simplifier

The Debt Disincentivizer

A “Crypto” Caution

Conclusion

The Financial Simplifier

Our current financial system is extraordinarily complicated, and this complication inhibits the participation and success of those who are less financially literate. Preparing for the financial future is overwhelming for many (if not most) everyday folks. One might ask why our current system is so complex, and part of the answer harkens back to something covered in Part 1 and Part 2 of this essay. We’ve established that a centralized monetary system with fiat as its base invariably leads to increased monetary manipulation. A prominent form of monetary manipulation is influencing interest rates. Short-term interest rates set by central banks are one of the most important inputs in both domestic and international markets (the most influential of which is the federal funds rate set by the U.S. central bank, the Federal Reserve Board). These centrally controlled rates dictate the cost for capital at the base of the system, which eventually seeps upward and impacts virtually every asset class, including treasury and credit markets, mortgages, real estate and eventually equities (stocks). I’ll once again defer to Lyn Alden to sum up the reasoning behind, and impact of, short-term interest rate manipulation:

“This rate [the federal funds rate] trickles up to all other debt classes, strongly affecting them, but indirectly. So, as the Federal Reserve raises or lowers this key rate, it eventually affects treasury bonds, mortgages, corporate bonds, auto loans, margin debt, student debt, and even many foreign bonds. There are other factors that affect interest yields on various debt, but the Federal Funds Rate is one of the most important impacts. The Federal Reserve reduces this rate when it wants to produce ‘easy money’ to stimulate the economy. A low interest rate for all types of debt encourages consumers and businesses to borrow money and use it to consume or expand, which benefits the economy in the short term.”1

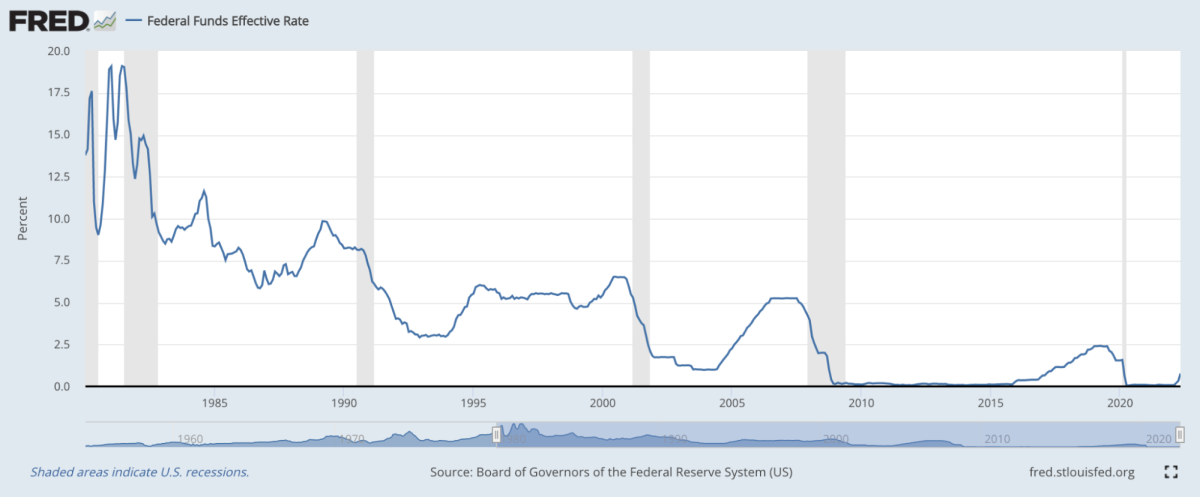

In an attempt to boost economic activity and/or mitigate short-term economic discomfort, central banks around the world have demonstrated a historical susceptibility to lower interest rates well beyond where they would have settled naturally. Today, we are staring down the barrel of a 40-year decline in short-term rates to nothing. Below is a chart displaying the movement of the federal funds rate over the last 40 years:

Chart Source: St. Louis Fed

In many parts of the world, rates have even gone below zero into negative territory, i.e., negative interest rates. My guess is that if you had told a bond trader 30 years ago that there would one day be trillions of dollars worth of negative nominal-yielding debt instruments, they would have laughed you out of the room — yet here we are. And although causes are multifaceted, it’s hard to deny that prevalent monetary policy, in the form of interest rate manipulation and enabled by fiat fundamentals, is at least partially to blame.

Image/Article Source: The Motley Fool

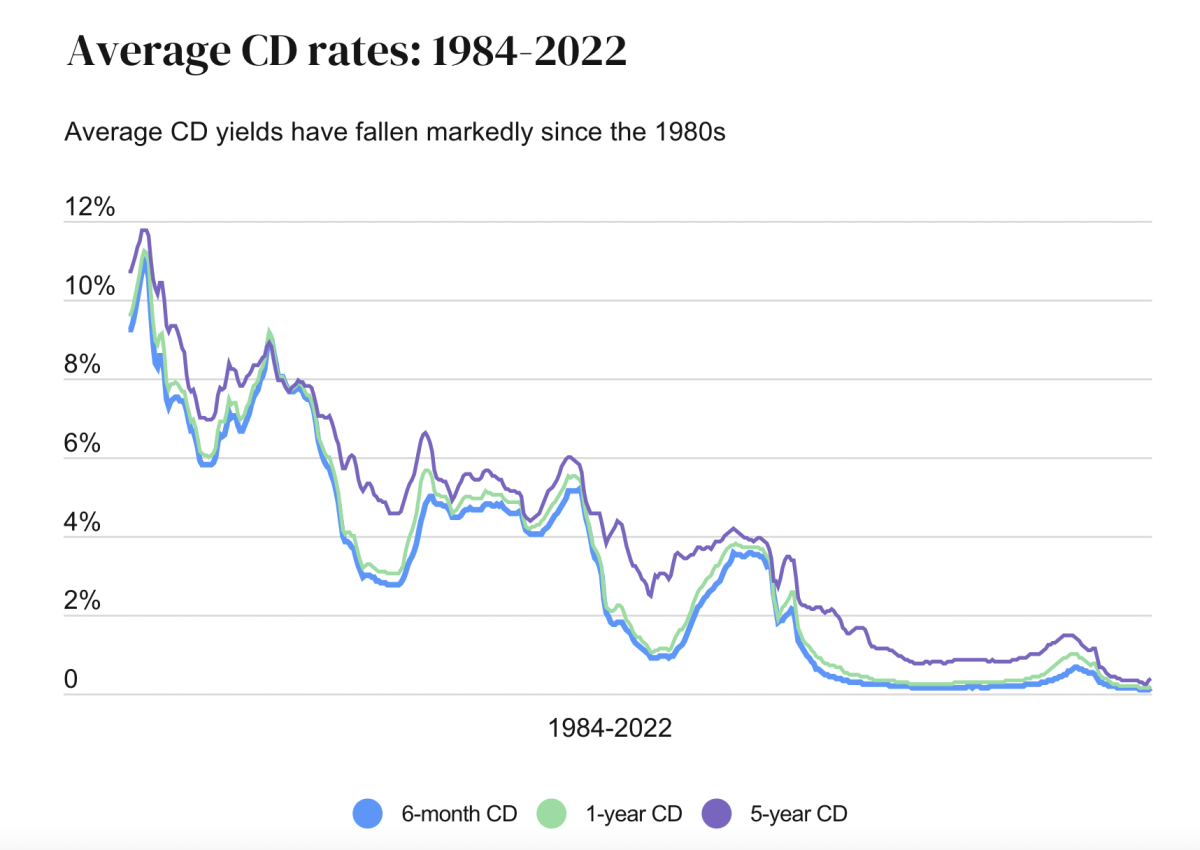

Because the short-term central bank interest rates (“risk-free rates”) are artificially suppressed, risk-free returns (or yields) are also suppressed. Consequently, savers and investors looking to grow their capital must get more creative and nimble as well as take on more risk. In 1989 a person could lock money in a certificate of deposit (CD) at their local bank and get a high nominal (and serviceable real) yield. But as the chart below demonstrates, times have changed — immensely.

Chart Source: Bankrate.com

When we consider today’s massive debt levels and correlated risks of debasement, and then combine the fact that low-risk returns on capital are historically diminished, we uncover an issue: low-risk investments actually become risky over time as purchasing power gets depleted. Savers need returns to simply keep up with inflation; they must take on more risk to keep up. The point here is that an inherently and increasingly inflationary money supply demands that people look to escape the money they are paid in. They must go elsewhere to maintain and grow wealth — cash is trash and real yields on assets that were once profitable are now persistently negative. With low-risk yield opportunities diminished, those who want to preserve and grow the buying power of their capital are confronted with three main options:

- Be increasingly agile in managing their own portfolio. They must learn to speak fluent “financialeze” if you will.

- Rely on a professional to handle the complicated financial landscape for them.

- Utilize passive investment vehicles (for example index funds), which expose them to broad, systemic risks. (I am certainly not against passive investing and indexing — I do much of it myself — but the problem is these strategies have largely become synonymous with saving.)

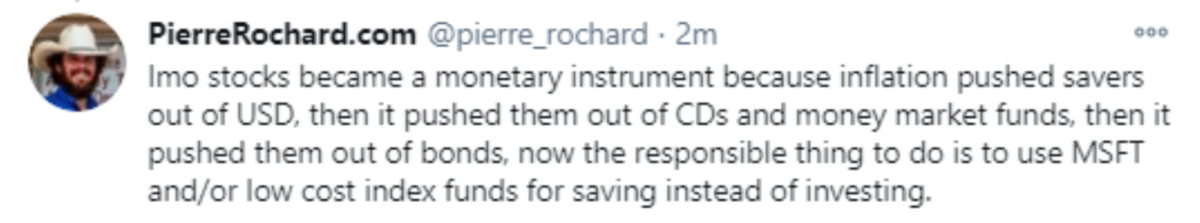

An old tweet by Pierre Rochard highlights this well:

Image/Tweet Source: “Bitcoin Is The Great Definancialization” by Parker Lewis

These aforementioned dynamics have led to an engorged financial sector filled with endless planners, managers, brokers, regulators, tax professionals and intermediaries. The finance and insurance sector has grown from around 4% of GDP in 1970 to close to 8% of GDP today.2 An enormous amount of slop has been tossed into the pig pen, and the hogs are feeding. Can you blame them? Don’t misunderstand me; I am not against the financial sector in totality, and I do believe that even if Bitcoin is the monetary standard of the future, financial services will remain prevalent and important (although their role will change, they will look much different, and I believe more consumers will demand transparency and auditability like proof of reserves3). But what does seem clearly imbalanced is the sheer size of today’s financial sector. In his article “The Great De-Financialization”, Parker Lewis wonderfully summarizes the impetus behind this dynamic:

“Financialization has turned retirement savers into perpetual risk-takers and the consequence is that financial investing has become a second full-time job for many, if not most. Financialization has been so errantly normalized that the lines between saving (not taking risk) and investing (taking risk) have become blurred to the extent that most people think of the two activities as being one in the same. Believing that financial engineering is a necessary path to a happy retirement might lack common sense, but it is conventional wisdom.”

Imagine if there was a place where people were simply able to store, preserve and grow their hard-earned capital without risk or need of expertise? This sounds startlingly simple and some would say far-fetched — in fact, many money managers would shudder at such a prospect, since a complicated investment landscape is a key driver of their usefulness. Gold once served this purpose, and in certain times and places of the past a blacksmith or farmer could reliably maintain purchasing power in a precious metal. But as the centuries wore on and economies of scale grew larger and more global, the velocity of money grew exponentially and the weaknesses of traditionally hard monies like gold became a hindrance — namely the weaknesses of portability and divisibility.4 This dynamic necessitated nascent monetary technologies and gave rise to paper currencies backed by gold, then eventually backed by nation-state promises — fiat as we know it today.

An investigation of Bitcoin invariably thrusts the learner into an exploration of the characteristics of money itself. For many, this journey leads to the recognition that Bitcoin harnesses and improves on gold’s timeless store of value strength: scarcity, while also rectifying (and many would argue perfecting) gold’s shortcomings of portability and divisibility. Bitcoin mitigates the inherent limitations of traditionally sound stores of value while also harboring the potential to meet today’s monetary velocity needs as a medium of exchange. For this reason it has entered the contemporary financial whirlwind as a great decomplexifier. It introduces a natively digital token with immediate cash finality, while simultaneously assuring holders of a fixed supply by way of a decentralized ledger.

BTC is also the first ever digital bearer asset, and it can be self-custodied with no counterparty risk. This is a tremendously underappreciated feature, especially in high-debt environments where the financial stack is based on increasingly vulnerable promises.5 Architecturally, Bitcoin may be the best money our species has ever had, and unlike gold, it’s built for the 21st century. If you own Bitcoin, you are mathematically, cryptographically and verifiably guaranteed to maintain a certain size stake in the network — your piece of the pie is set in stone. This single digital asset is equipped to buy gum at the grocery store while simultaneously resting at the very base of the financial system in sovereign wealth funds, in both cases with no intermediary or counterparty risk. Bitcoin is a form of money that can do it all.6

As a result, Bitcoin simplifies the investment landscape for the average individual. Instead of perpetual confusion regarding appropriate investment strategies, average wage earners can allot at least a portion of their capital to the best savings technology ever discovered — a network specifically designed to counter the assured debasement of existing fiat units and the risks of exposure to investments like equity, fixed income and real estate (if that risk is unwanted by savers).7 Some laugh when Bitcoin is described as a “safe haven asset,” but it is important to remember that volatility and risk are not the same thing.8 BTC has been incredibly volatile while also generating more alpha than almost any asset on the planet over the last decade.

At this date and time, Bitcoin is largely a “risk-on” asset, coupled to the NASDAQ and broader stock market, but I agree with hedge fund manager Jeff Ross when he states:

“At some point in the future, Bitcoin will be seen as the ultimate ‘risk-off’ asset.”9

As liquidity in the Bitcoin network continues growing exponentially, I believe we will see more and more capital flood into BTC rather than cash, treasuries and gold during periods of economic uncertainty and distress. The game theory suggests that the world will wake up to the best and hardest form of money available, and therefore economic participants will increasingly denominate goods and services in it. As that trend continues, Bitcoin is likely to become an all-weather asset with the ability to perform in a variety of economic environments. This is the beauty of an inherently deflationary10 store of value that can also function as a unit of account and medium of exchange. Bitcoin could become a one-stop shop for the everyday wage earner — something they may one day get paid with, buy goods and services with, and store wealth in without fear of purchasing power depletion. The Bitcoin network is developing into the ultimate financial simplifier, depriving centralized policymakers the ability to siphon capital out of the hands of those who don’t know how to play the financial game. Bitcoin is monetizing in a parabolic fashion before our eyes, and for those motivated and privileged enough to recognize the fundamentals driving it, this protocol represents an unparalleled wealth preservation mechanism — a direct foil to the fiat Ponzi. As a result, middle and lower class basement dwellers, knee-deep in leakage, who elect to protect themselves with Bitcoin will very likely find themselves above grade in the long run.

The Debt Disincentivizer

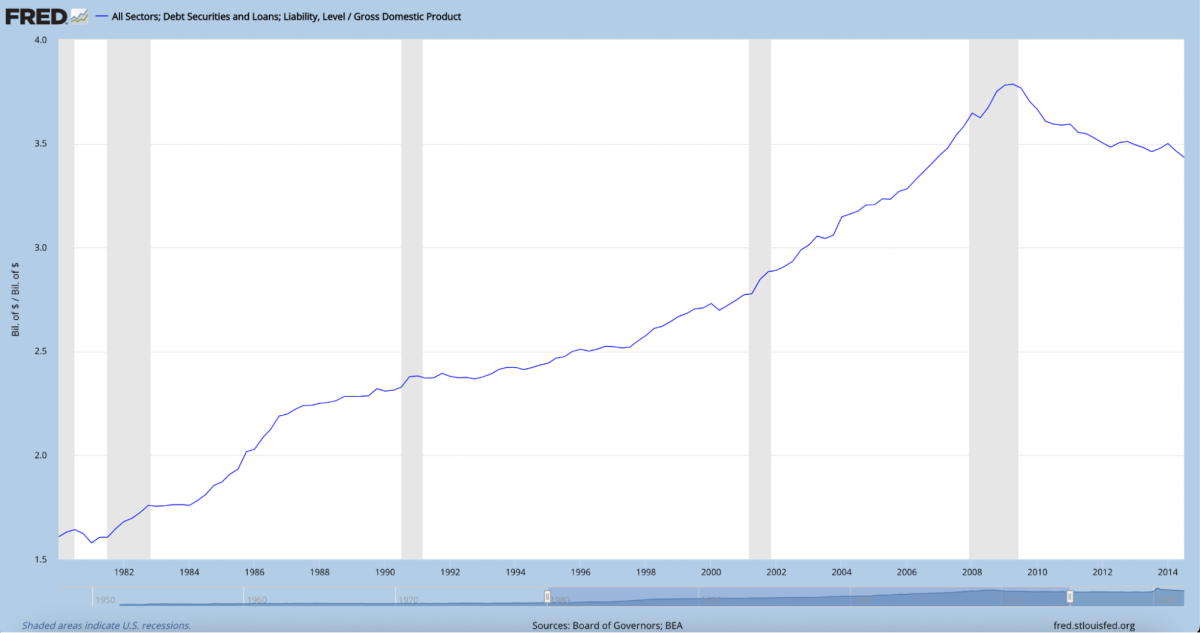

In Part 2 we established that the economy as a whole is heavily indebted, but let’s take another look at debt as compared to gross domestic product (debt/GDP). The chart below trends all types of U.S. debt (total debt) as a multiple of GDP:

Chart Source: St. Louis Fed

Total U.S. debt is currently 3.5 times that of GDP (or 350%). In comparison, debt was just over 1.5 times that of GDP in 1980, and prior to the Global Financial Crisis, total debt was 3.7 times that of GDP (just slightly higher than where it is today). The system tried to reset and delever in 2008, but central banks and governments didn’t fully allow it and debt remains preposterously high. Why? Because financial policymakers have relied on overused expansionary monetary policies to avoid a deflationary crisis and depressions (policies such as direct interest rate manipulation, quantitative easing, and helicopter money).<FN11> To keep debt from unwinding, new money and/or credit is required. Think about this in terms of the individual: without increasing their income, there is only one way someone can service debts they can’t afford without going bankrupt — take out new debt to pay the old. At a macroeconomic level, unsound money enables this game of “debt balloon” to go on for some time, since the fiat money printer repeatedly assists in mitigating systemic insolvency and contagion. If air is consistently blown into a balloon and never allowed to exit, it simply keeps getting bigger … until it pops. Here’s Lyn Alden summarizing the precariousness of a financial system increasingly built on debt and credit:

“The credit-based global financial system we have constructed and participated in over the past century has to continually grow or die. It’s like a game of musical chairs that we have to keep adding people and chairs to in order for it to never stop. This is because cumulative debts are far larger than the total currency supply, meaning there are more claims for currency than there is currency. As such, too many of those claims can never be allowed to be called in at once; the party must always go on. When debt is too big relative to currency and starts to get called in, new currency is created, since it costs nothing other than some keystrokes to produce.”12

Society has become increasingly accustomed to monetary stimulation. These monetary and fiscal tactics have certainly pulled some growth forward, but much of that expansion is contrived and insubstantial. A steady dose of monetary amphetamine has contributed to a societal addiction to bloated debt and cheap money access. Due to consistent and anticipated backstopping at the monetary foundation, all participants — from nation-states to the private sector to the individual — have been structurally enabled to take on more debt and buy more with the credit created while avoiding some of the consequences of poor capital allocation. As a result, malinvestment abounds.

Debt comes in vastly different qualities. Some forms are productive and others are unproductive. Unfortunately, the middle and lower classes tend to be engrossed in much of the latter.13 I often drive around looking at homes and cars in driveways wondering, “How in the blue blazes does everyone afford all this crap?” The older I’ve gotten, the more I’ve recognized that the answer is simple: they can’t. A huge percentage of people are levered up to their eyeballs as a result of buying all kinds of unnecessary stuff they can’t afford. We live in an incessant consumer culture where middle-class folks often deem it normal to live an upper-class lifestyle; ergo, they end up with minimal free cash flow to save or invest for the future, or worse, buried beneath mounds of suffocating debt. In his essay “Bitcoin Is Venice,” Allen Farrington states:

“Those who do not own hard assets are increasingly tending to drown in debt from which they will realistically never escape, unable to save except by speculation, and unable to afford the inflation in the essential costs of living that does not officially exist.”14

Individuals who find themselves in debt up to their eyeballs are certainly at fault, but it’s also important to factor in that debt is artificially inexpensive and money artificially abundant. Seemingly infinite student loans and low single-digit mortgages are, at least partially, the downstream result of exorbitant fiscal and monetary incautiousness. Moving away from a system built on debt means there will be, well … less debt. Ready or not, Bitcoin may thrust the 21st century economy into withdrawal, and although the headaches and tremors may be uncomfortable, I believe sobriety from inordinate credit will be a net positive for humanity in the long run. Prominent entrepreneur and tech investor Jeff Booth has described the innovation of Bitcoin as such:

“The technology of Bitcoin allows you to build a system, peer to peer, that doesn’t require debt for velocity of money. And what I just said is probably the most important thing about Bitcoin.”15

I risk being misunderstood here, so allow me to clarify something before I move on. I am NOT saying debt is inherently bad. Even in a perfectly architected financial system, leverage would, and should, exist. One of my lifelong best friends who is a professional bond trader put this well in one of our personal correspondences:

“Debt has been transformative for the growth of technologies and the betterment of the middle class. Debt allows people with good ideas the ability to create those technologies now, as opposed to waiting for them to have all the money saved up. That connects those that have excess cash with those that need it, so both win.”

What’s said there is in many ways accurate, and the availability of debt and credit has furthered the overall economy and/or led to helpful advancements being pulled forward. Even so, my suggestion is that this has been overdone. An unsound monetary base layer has allowed leverage to expand for too long, in too large a quantity and in a worrisome variety. (The variety of leverage I’m referring to here was discussed at length in Part 1, namely a substantial amount of credit risk has transferred from the financial system to the balance sheets of nation-states, with the error term in the debt equation being the fiat currency itself.16)

If Bitcoin becomes a reserve asset and underpins even a portion of the global economy (the way gold once did), its decentralized mint and immutable fixed supply could call the bluff on an artificially cheap cost of capital, making borrowing significantly more expensive. It’s important to recognize that Bitcoin is built to be the central bank. Rather than market participants waiting with baited breath to see what color smoke emerges from meetings of appointed Federal Reserve officials, this protocol is constructed to be the arbiter of monetary decision making — monetary physics if you will. Satoshi Nakamoto begged an interesting question for humanity: Do we want a set of monetary rules that a few can alter and everyone else has to play by? Or do we want a set of rules everyone has to play by? In a hyperbitcoinized (and significantly less centralized) monetary future, the levers impacting the cost and quantity of money would be removed (or at least significantly shortened) — the price of money could be restored.

Within a potentially harder digital monetary environment, behavior would be dramatically altered. Inexpensive money changes financial conduct. Artificially suppressed risk-free rates trickle through the entire lending landscape, and cheap money enables excess borrowing. To provide a tangible example, consider that a mortgage interest rate of 6% rather than 3% increases monthly payments on a home by 42%. If the cost of capital is accurately priced higher, uproductive leverage will be less prevalent and the detriments of dumb debt will be more visible. People simply won’t be incentivized to “afford” so much stupidity.

Additionally, Bitcoin could (and already is) magnifying the consequences of debt default. When a person takes out a loan, capital is pledged by the borrower to protect the interests of the lender; this is called collateral. The collateral pledged to lenders in today’s financial system is often far from their possession — things like borrower income statements, investment account totals, homes, cars, even cash in the bank. When someone is unable to make payments on a mortgage or loan, it can take months or years before the lender gets restitution, and the borrower can often play “get out of jail free cards” such as foreclosure and bankruptcy. Compare this to Bitcoin, which allows for 24/7 by 365 liquidity in a digital, immediately cash final, global money. When someone takes out a loan and pledges Bitcoin as collateral — meaning the creditor holds the private keys — they can be immediately margin called or liquidated if their end of the bargain isn’t upheld. Responsible creditors in the already existent and exponentially growing Bitcoin borrowing and lending landscape often describe Bitcoin as “pristine collateral,” some reporting close to 0% loan losses.17 It seems inevitable that more and more lenders will recognize the protections an asset like Bitcoin provides as collateral, and as they do, borrowers will be held to greater account. When loan payments aren’t made or loan-to-value ratios aren’t upheld, restitution can be immediate.

Why is this a good thing someone might ask? I view this as a net-positive because it may help disincentivize unproductive debt. Bitcoin is the ultimate accountability asset — a leverage destroyer and a stupidity eliminator. Financial success is rooted in sound behavior, and borrower habits are bound to improve in a Bitcoin world where incentives are restructured and poor decisions show real and immediate consequences. This will help steer everyday folks away from unproductive debt and lengthen financial time preferences.

From nation-states to corporations to the individual, flimsy fiat fiscal and monetary policy has enabled bad habits — bailouts, stimulus, manufactured liquidity, contrived stability and injudicious capital allocation proliferate without sufficient financial accountability. An applicable analogy commonly used in the Bitcoin space is that of forest fires. When towns and housing developments unwisely spring up over vulnerable landscapes, forest fires are extinguished immediately and substantial burns aren’t permitted. This is akin to today’s economic environment where recessions and lockdowns are quickly drenched with the fiat monetary fire hose. We must heed the warnings of mother nature — uncontrolled fires still inevitably materialize in these vulnerable areas, but now the fire load has built up significantly. Instead of routine burns properly restoring and resetting ecosystems, these rampant infernos get so hot that the topsoil is destroyed and the environment is dramatically harmed. This dynamic echoes what’s occurring in today’s markets as a consequence of artificial intervention. When financial fires start in the 21st century, the magnitude of these events, the efforts needed to thwart them, and their harmful aftermath have all been magnified. If Bitcoin serves as the arbiter of global monetary accountability (as I believe it one day may), our species will learn to better avoid dangerous economic landscapes altogether.

Bitcoin is a new monetary sheriff in town, and although its inflexible rules may be distressing for some, I believe it will contribute to cleaner economic streets and ultimately lead to greater prosperity and egalitarianism. The ability to bail out the individual, the institution or the system as a whole may diminish, but this pain is well worth the gain as the restitution of sound money in the digital age will drastically improve price signals and create a cleaner playing field. This is destined to benefit the middle and lower classes, as generally speaking, they lack the awareness and/or ability to change the rules of the existing financial game in their favor.

A “Crypto” Caution

21st century financial plumbing is certainly dysfunctional, but when we go to replace the leaky pipes, we must ensure we are doing so with well-built, watertight and durable hardware. Unfortunately, not all the parts in the “cryptocurrency hardware store” are created equal. The landscape of cryptocurrencies has grown almost endlessly diverse with thousands of protocols in existence. Despite a relentless cohort of venture capital funds, Redditors and retail investors salivating over the newest altcoins, bitcoin has proven repeatedly it stands in a league of its own.

Image Source: “Bitcoin Versus Digital Penny Stocks” by Sam Callahan

Bitcoin’s simplistic and sturdy design, unreplicable origin, profound and increasing decentralization, and distinctive game theory have all contributed to an exponentially growing network effect. It seems increasingly unlikely Bitcoin will face substantive competition as a digital reserve asset or store of value. Altcoins come in endless varieties — at their worst they are outright scams; at their best they are attempts to fulfill potential market needs of a more decentralized financial future. In all cases they are FAR more risky and unproven than bitcoin. When one makes a decision to buy another cryptocurrency besides BTC, they must come to terms with the fact that they are passing on a protocol that is currently filling an enormous hole in global markets, with what is arguably the largest addressable market in human history.

An exploration of altcoins could be an essay of its own, but in my humble opinion the opportunities I’ve outlined above regarding bitcoin apply to it specifically, not cryptocurrency generally. At the very least, I encourage new participants to seek to understand Bitcoin’s design and use case first prior to branching off into altcoins. The following excerpt from the piece “Bitcoin First” by Fidelity Digital Assets sums this up nicely.

“Bitcoin’s first technological breakthrough was not as a superior payment technology but as a superior form of money. As a monetary good, bitcoin is unique. Therefore, not only do we believe investors should consider bitcoin first in order to understand digital assets, but that bitcoin should be considered first and separate from all other digital assets that have come after it.”18

Conclusion

If this essay accomplishes nothing else, I hope it motivates the reader to learn. Knowledge is power, but it doesn’t come without work. I implore all readers to do personal investigation. Don’t trust me, verify on your own. I am nothing more than one very limited and evolving perspective. I do believe Bitcoin is a remarkable tool, but it isn’t simple. It can take hundreds of hours of research before its implications click, and thousands before real understanding is reached (a journey I am still very much on). Don’t run before you walk — when it comes to saving and investing, one’s allocation size and understanding should ideally mirror each other.

With the disclaimers complete, I feel all market participants (the middle and lower classes in particular) should consider allocating a portion of their hard-earned capital to this protocol. In my view, there is one clearly unwise allocation size when it comes to Bitcoin: zero. Bitcoin is a monetary beast, driven by attributes and game theory that make it unlikely to disappear and its arrival coincides with an environment that clearly illuminates its use case. It appears the fiat experiment that began in earnest in 1971 is decaying. A tectonic shift is happening in money, and positioning yourself on the right continent may have dramatic implications. Today’s increasingly brittle financial system requires more and more intervention to remain intact. These manipulations have a tendency to benefit incumbent institutions, wealthy individuals, powerful participants and already severely indebted nation-states, while disenfranchising the everyday man and woman.

Leaking and corroded pipes are being continuously repaired and jerry-rigged in the economic residence of the middle and lower classes, flooding an already wet basement. Meanwhile, a brand new home with pristine, durable and watertight plumbing is being architected next door. The door to this new home is open, and all individuals, particularly average wage earners, should consider moving a portion of their belongings there.

Acknowledgements: Beyond the plethora of people quoted or referenced in this essay, appreciation and credit go to many others for editing and improving this piece: my podcast cohost (and fellow firefighter) Josh, who sharpens my ideas every week and has walked before me every step of the way in my Bitcoin education journey; also Ryan Deedy, Joe Carlasare, DazBea, Seb Bunny, my friend Kyle, my anonymous bond trading buddy, my wife (a spelling and grammar guru), as well as Dave, Ryan, and Jim from the firehouse.

End Notes

1. From Lyn Alden’s article “Why Investors Should Care About Interest Rates and the Yield Curve”

2. Source is Parker Lewis’ “Bitcoin Is The Great Definancialization”

3. For more on proof of reserves, see Nic Carter’s Proof of Reserves page

4. Robert Breedlove does a fantastic job explaining the characteristics of money and how they pertain to gold and Bitcoin in the podcast episode “BTC001: Bitcoin Common Misconceptions w/ Robert Breedlove”

5. For more on this theme, check out “Why Gold And Bitcon Are Popular (An Overview Of Bearer Assets)” by Lyn Alden

6. If this seems far-fetched, remember Bitcoin is open source and programmable like the internet protocol stack itself. Without compromising its core consensus rules, applications and technologies can be built on top of it to meet future monetary and financial needs. This is being done currently on second layers like the Lightning Network.

7. These aforementioned asset classes are not inherently bad. Investment and lending are key drivers of productivity and growth. However, because today’s money is decaying, saving and investing are becoming synonymous, and even those who want to avoid risk are often forced to take it on.

8. Jim Crider is the first person I heard describe this distinction within the following podcast episode: “BCB029_Jim Crider: The Black Sheep of Financial Planning.”

9. From podcast episode “BCB046_Dr. Jeff Ross: Treating Septic Markets”

10. The word “deflation” is controversial, complex, and multifaceted. When I use it here, I am not speaking to a transient or momentary economic event or period; rather, I am using it to describe the potential for inflexible monetary supply in which buying power inherently grows over decades and centuries (think gold and other hard assets). I agree with Jeff Booth that “the free market is deflationary” and that technology inherently allows us to do more with less. In my view, we need a currency that better allows for this. Jeff Booth explores this idea in detail within his book “The Price of Tomorrow.”

11. From “Principles for Navigating a Big Debt Crisis” by Ray Dalio

12. From “The European Central Bank Is Trapped. Here’s Why.” by Lyn Alden

13. Extreme indebtedness is not unique to the middle class — all of society is over-leveled from the top to the bottom; however, due to lack of knowledge, education, and access, it’s my contention that the lower classes have a propensity to use debt less advantageously.

14. Allen Farrington now has a book by the same title: “Bitcoin is Venice.”

15. From Jeff Booth comments at Bitcoin 2022 Conference during a macroeconomics panel.

16. Credit goes to Greg Foss for this concept. He explores this in detail within his essay “Why Every Fixed Income Investor Needs To Consider Bitcoin As Portfolio Insurance” (specifically on page 23).

17. See podcast episode “BCB049_Mauricio & Mario (LEDN): The Future of Financial Services”

18. From “Bitcoin First” by Chris Kuiper and Jack Neureuter

This is a guest post by Dan. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.