Fresh inflows for Bitcoin and Ethereum spot-traded funds (ETFs) in the United States suggest a probable change in market mood. Bitcoin ETFs registered notable investment flows on September 10, therefore undoing a run of withdrawals. Though they present different set of issues, Ethereum ETFs too stopped their five-day outflow streak.

These inflows arrive at a period when institutional crypto interest is still a mixed bag. Ethereum seems to be losing ground even when Bitcoin is drawing more money. Together with worldwide crypto ownership statistics, this pattern paints a complicated picture of future market direction.

ETFs Based On Bitcoin Lead The Way

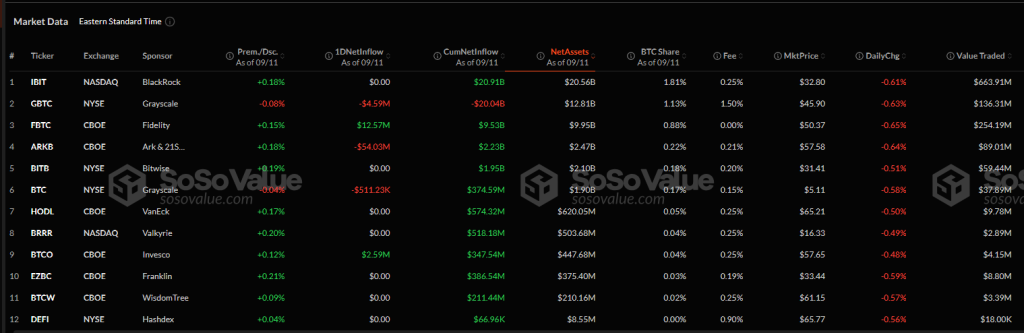

Based on data, on September 10, Bitcoin’s spot ETFs attracted nearly $117 million — which is a whopping 400% increase — over the $37.29 million recorded the day before. This development follows eight straight days of withdrawals, which had pushed back the overall assets under management by more than $1.18 billion.

With $63 million in inflows, Fidelity’s FBTC led for two straight days; followed by Grayscale Bitcoin Mini Trust and ARK 21Shares, with $41 million and $12.7 million, respectively.

The total trading volume for the 12 Bitcoin ETFs tumbled 55% to $712 million with inflows from $1.61 billion the previous day. While the inflows might look promising, the drastic decline in trading activity does merit some investor caution.

Interestingly, these figures are in sync with the 2024 Global State of Crypto study from Gemini, which indicates that crypto ownership has been consistent despite the volatility in the markets. Whereas France experienced a surge from 16% to 18%, the survey observed that 21% of Americans and 18% of Britons were holding crypto. In contrast, Singapore recorded a slight drop from 30% to 26% in ownership.

Ethereum ETFs Travel A More Difficult Route

While the scenario for Ethereum ETFs is less clear-cut, Bitcoin ETFs are displaying robust flows. Ethereum spot ETFs had net flows of $11.4 million on September 10, therefore breaking a five-day run of heavy outflows. With $7 million in inflows, Fidelity’s FETH lead the charge; BlackRock’s ETHA came second with $4.3 million. Still, the seven Ether ETFs left showed no flows.

Although these inflows are positive, Ethereum still faces more difficulties. WisdomTree withdrew its application for a spot Ethereum ETF with the US Securities and Exchange Commission after VanEck announced the closing of its Ethereum Strategy ETF. These actions point to a drop in institutional confidence in Ethereum-based products when taken alongside a cumulative net outflow of $562 million in Ether ETFs to date.

Global Opinion And Future DirectionThe scene of cryptocurrencies worldwide is displaying various patterns. Although ownership of cryptocurrencies is still high in big markets like the United States and the United Kingdom, some areas, like Singapore, show indications of declining interest. The recovery of the market depends on the tenacity of long-term investors, so Gemini’s research underlines that these elements could also propel future expansion in addition to regulatory development and spot ETFs.

Featured image from CBC, chart from TradingView