According to some Bitcoin bears, we’re a long way from the floor — but that hasn’t stopped the world’s ultra-rich from buying the dip, including George Soros and the Rockefeller family.

‘Essentially Worthless’

Recent news has suggested some big-time institutional investors are taking an interest in Bitcoin and other cryptocurrencies ignoring the Bitcoin bears.

According to Capital Economics, a London-based investment research firm, the world’s largest cryptocurrency by market capitalization is set to get slaughtered in the coming months, regardless of its correlation to the S&P 500 index.

Reads a note from Capital Economics on Thursday:

Bitcoin’s correlation with equity prices has strengthened recently, but we think that this will be just temporary. We still think that bitcoin is essentially worthless, meaning that it is likely to fare much worse than other assets in the coming months.

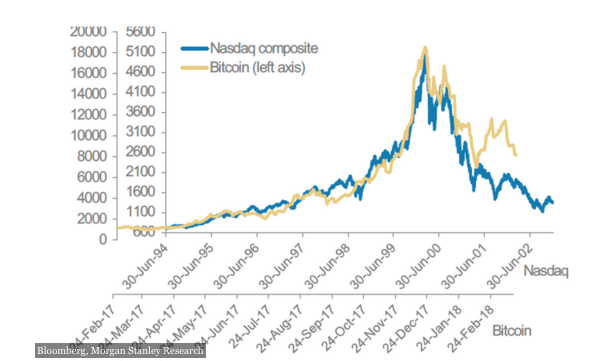

As noted by Investopedia, the firms’ researchers argue that “bitcoin’s correlation with the equity market has been largely coincidental,” resulting primarily from dramatic crashes following major news-worthy events — such as major banks banning cryptocurrency purchases via credit cards, regulatory fears, and advertising bans from Facebook and Twitter.

Though the traditional stock market is currently struggling in the midst of fears of an impending global trade war, Capital Economics does not believe such an event would serve to benefit Bitcoin and cryptocurrency — which, by nature, aim to provide economic freedom from governments and an alternative to centralized financial institutions.

Rather, the London-based firm claims Bitcoin will collapse further as more and more investors recognize it’s lack of intrinsic value. Notes Capital Economics:

We expect equity markets to fall as investors cotton on to the fact that rising U.S. interest rates will slow economic growth. But the main factor driving down the price of bitcoin is likely to be a realization that it is simply not a credible long-run alternative to conventional currencies.

Apparently, the world’s ultra-rich haven’t gotten the memo.

On April 6, Bitcoinist reported that controversial Hungarian-American investor, business magnate, and political activist George Soros has officially signed off on Soros Fund Management’s permission slip to trade cryptocurrencies.

Following suit, Venrock, the Rockefeller family’s official venture capital arm, has officially joined forces with Brooklyn-based cryptocurrency investment group CoinFund to invest in cryptocurrency and related projects.

In Europe, meanwhile, the crown prince of Lichtenstein has also revealed an interest in buying Bitcoin and other cryptocurrencies as an investment.

Do you think the bottom is in for Bitcoin, or do you agree that the world’s most valuable cryptocurrency by market capitalization is essentially worthless? Let us know in the comments below!

Images courtesy of Bloomberg/Morgan Stanley Research, Wikipedia Commons.