Crypto asset investment products experienced net outflows of $240 million over the past week, according to the latest report from CoinShares.

The trend reflects ongoing investor caution amid global economic headwinds, particularly surrounding recent US trade tariff announcements, which have raised concerns about future economic growth.

Bitcoin and Ethereum Lead Weekly Outflows

According to the CoinShares report, Bitcoin saw the most significant capital movement, with $207 million in outflows. This figure brings Bitcoin’s year-to-date net inflows to $1.3 billion, indicating that while short-term sentiment may be cautious, longer-term positioning remains intact.

Ethereum followed with $37.7 million in outflows, continuing a trend of declining interest in major altcoins. Other digital assets also recorded outflows, including Solana and Sui, which lost $1.8 million and $4.7 million respectively.

However, some less prominent tokens bucked the trend. Toncoin (TON), for example, attracted $1.1 million in new capital, suggesting selective optimism among investors despite broader negative flows.

Meanwhile, regardless of these positive inflows from some tokens and smaller negative flows from the larger cryptocurrencies last week, the aftermath on price performance has been quite similar the following week.

Particularly, at the early hours of Monday, Bitcoin, Ethereum and all other major cryptocurrencies saw a notable bloodbath in price performance.

While BTC dropped by nearly 10% seeing a slide below $75,000, ETH and other crypto plunged by nearly 20% with ETH specifically dropping below $1,500 for the first time since October 2023.

The sell offs from BTC and ETH and other major crypto assets in the market led to a 9..6% plunge in the global crypto market capitalization.

Mixed Regional and Sectoral Activity

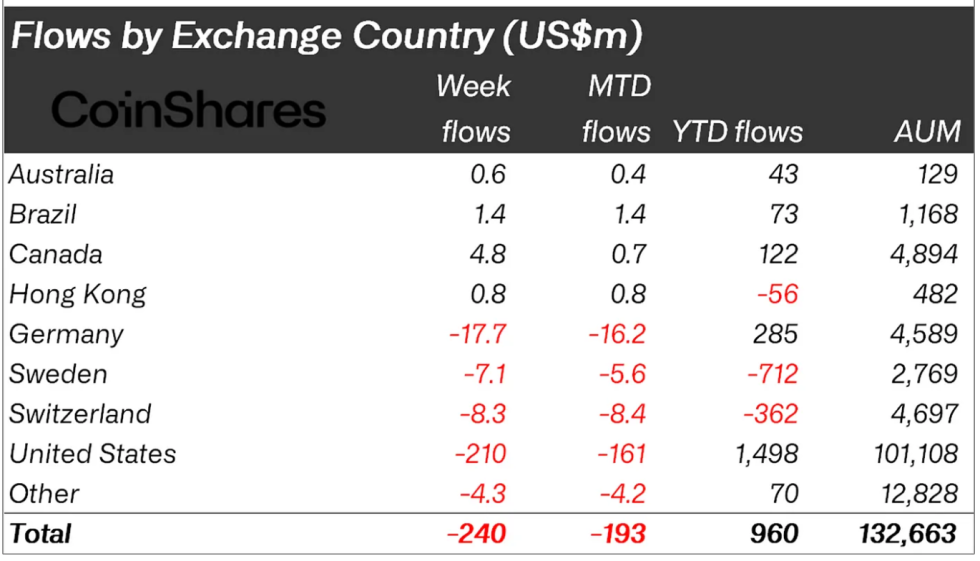

Furthermore, the report highlighted that US and German investors accounted for the bulk of capital withdrawal, with $210 million and $17.7 million in outflows respectively. In contrast, Canadian investors appeared more optimistic, contributing $4.8 million in inflows during the same period.

Blockchain-focused equities also saw renewed interest, recording $8 million in inflows for the second consecutive week. CoinShares noted that some investors may be viewing recent price declines in these assets as potential entry points, aligning with a broader strategy of diversification within the digital asset space.

Meanwhile, despite the negative flows, CoinShares Head of Research James Butterfill noted that total assets under management (AUM) remained relatively stable.

As of this week, AUM stood at $132.6 billion, representing a slight increase of 0.8% week-on-week. Butterfill contrasted this resilience with traditional financial markets, highlighting that MSCI World equities declined 8.5% over the same period. Butterfill wrote:

This resilience is especially notable compared to other asset classes, such as MSCI World equities, which saw an 8.5% decline over the same period, underscoring the robustness of digital assets amid economic uncertainty.

Featured image created with DALL-E, Chart from TradingView