This is an opinion editorial by Ansel Lindner, an economist, author, investor, Bitcoin specialist and host of “Fed Watch.”

Ghost money has a long history but only recently became part of the bitcoin vernacular via premier eurodollar expert, and bitcoin skeptic, Jeff Snider, Chief Strategist at Atlas Financial. We've interviewed him twice for the Bitcoin Magazine podcast “Fed Watch” — you can listen here and here, where we talked about some of these topics.

In this post, I will define the concept of ghost money, discuss the eurodollar and bitcoin as ghost money, examine currency shortages and their role in monetary evolution, and finally, place bitcoin in its place among currencies.

What Is Ghost Money?

Ghost money is an abstracted ideal currency unit, used primarily as a unit of account and medium of exchange, but whose store-of-value function is a derivative of a base money. Other terms for ghost money include: political money, quasi-money, imaginary money, moneta numeraria or money of account.

To many economic historians the most famous era of ghost money is the Bank of Amsterdam starting in the early 17th century. It was a full reserve bank, used double-entry bookkeeping (shared ledgers) for transactions, and redeemed balances at a fixed amount of silver. Ghost money existed on their books, and the money in their vaults.

The financial innovation of an abstracted ideal currency unit evolved because coins are never the same weight or fineness. Coins in circulation tended to get worn quickly, dented or clipped and even if the coins were in mint condition, sovereigns tended to debase the coins on a regular basis (by the year 1450, European coins only had 5% silver content). Ghost money is a currency abstraction based on a fixed measurement of a money (its store-of-value), but does not need to reference actual coins in circulation, just an official measurement.

To put it in terms Bitcoiners are familiar with, this layer of abstraction gave commodity money new security properties and payment features.

Security wise, ghost money avoids the problem of debasement to a degree (we could call this debasement resistance), because the unit-of-account is a fixed weight and fineness set by a bank, not the sovereign. For example, the Bank of Amsterdam set the guilder at 10.16 g fine silver in 1618. Coins in circulation at the time tended to differ widely, coming from all over Europe. There were even direct attacks on banks in the form of flooding the local economy with debased coins, as happened in the 1630s with the importation of coins of less silver content from Spanish Netherlands north to Amsterdam.

Ghost money also allows new features, like the ability to transact over long distances, in large sums, carrying only a letter, greatly reducing transaction costs. It also allowed longer-term bonds at lower interest rates because the unit-of-account is more stable. The pricing of shares (a new innovation at the time), also could be valued in stable currency units.

In general, ghost money leads to thinking of value in a stable abstract unit. This has far reaching effects that are hard to overstate when it comes to large long-term investments, like massive infrastructure projects, that just so happened to get going in the preindustrial era as well. Eventually, the thinking in stable abstract currency units would lead to all the financial and banking innovation we see today.

Ghost money is rightly thought of as a derivative to the money itself, one which replaced the insecure aspects of the physical coins, without getting rid of the underlying form of money. It would more properly be called “ghost currency," because it is simply a stable derivative, an idealized currency, used for accounting.

Everything has a trade off, and ghost money is no exception. Abstracting the currency away provided debasement resistance from the sovereign, but it also enabled the banks to more easily create credit denominated in that idealized unit (fractional reserve lending), shifting the money printing task from sovereigns to banks. Expanding credit in the private sector according to market desires can lead to economic booms, but the trade off is the following bust.

Currency Shortages

In an article from Jeff Snider, he pairs the use of ghost money with the concept of monetary shortage to explain the rise of modern banking, and the beginning of the evolutionary process toward the current eurodollar financial system and even bitcoin.

“Any money-of-account [ghost money] alternative is the resourceful yet natural human response to these specific conditions.”

He sees ghost money as a natural market-driven practice, with a primary driving force being monetary shortage. Ghost money can add elasticity to the money supply as I stated above through credit expansion. He points to the 15th century's Great Bullion Famine and the 1930's Great Depression as two very important epochs in ghost money's history. These were periods of inelasticity in the supply of currency, which incentivized efforts to search out new supplies via financial innovation (ghost money) or searching for new sources of money itself (silver and gold in the Age of Exploration and the eurodollar credit expansion in the 1950s and 1960s).

More than anything, though, what might have driven money-of-account forward to its preeminent position was something called the Great Bullion Famine. Just as the 20th century seemed to pivot in one direction then the other, from the deflationary money shortages of the Great Depression to decades later the overwhelming monetary changes underneath the Great Inflation, so, too, did Medieval economics suffer one to then pivot into its opposite.

Ghost money’s Golden Age, forgive the pun, coincided with the Bullion Famine. Quasi-money is often one solution to inelasticity; commercial pressures are not easily surrendered to something like a lack of medium of exchange. People want to do business because business, not money, is real wealth.

“The role of money, separated from any store of value desire, is nothing more than to facilitate such business[.]” — Jeff Snider

Snider frames ghost money as a market tool that happens to also provide a route to increasing the elasticity of money in times of currency shortage. In other words, when the supply of money does not expand at a sufficient rate, the ensuing economic difficulties will drive people to find ways to expand that money supply, and ghost money is a ready-made solution via fractional reserve.

Snider’s views put him squarely in the monetarist camp, along with Milton Friedman and others. They see in "the quantity of money the major source of economic activity and its disruptions." Inelasticity is both the primary culprit of depression and the primary mover of financial innovation.

The Eurodollar As Ghost Money

“Necessity, basically, the mother of invention even when it comes to money [...]But if the eurodollar was the private (global) economy’s response to restrictive gold, what then of the eurodollar’s post-August 2007 restrictions upon the very same? Where’s the ghost money of the 21st century to replace the preeminent ghosts of the 20th?” — Jeff Snider

Snider frames the eurodollar system as a natural innovation response to the inelasticity that prevailed in the Great Depression. In the 1950's when Robert Triffin began speaking about this paradox, the market was busy solving it through ghost money and credit. The eurodollar system is simply a network of double-entry bookkeeping and balance sheets, using the global idealized currency unit at the time, U.S. dollars (backed by $35/oz of gold).

But is the eurodollar in its current form, still ghost money? No — it is credit-based money, but it looks almost identical.

Remember, ghost money is an idealized unit of money (in the past it was silver or gold). Credit is also denominated an idealized unit-of-account, a second order derivative, if you will. Through the dominance of ghost money, thinking in an abstract currency unit became common, and the psychology of the market changed to center around this new financial tool.

The difference between the current eurodollar, which is a pure credit-based system, and credit in a ghost money system is found in the store-of-value function. Ghost money's store of value is from a base money (silver or gold or bitcoin). The eurodollar today, on the other hand, is divorced from base money completely, and backed by something new. A dollar today is an idealized measurement of debt denominated in dollars. It's a circular, self-referential definition in the place of base money:

“Money-of-account [ghost money] was one such alternative which also blurred the lines between money and credit; in one sense, using ledgers to settle transactions even between merchants was under the strictest definition credit rather than a monetary substitute. But that was the case only insofar as eventually this paper IOU would have to be disposed of by bullion or specie.

Subprime mortgages and their ancient equivalents became possible where specie was in overabundance, yet perhaps counterintuitively far less likely if not completely impractical using only ghosts untethered to hard money.” — Jeff Snider

In other words, untethering ghost money from its hard money can simulate the overabundance of money. We are wrong though to continue to call this untethered money, ghost money. What is it a ghost of? Once you remove the store-of-value/hard-money tether, it is now a new form of money.

I also must add that if untethered ghosts can simulate overabundance of currency, it can also simulate a currency shortage at the other extreme, which is exactly what we see today.

The eurodollar started out as ghost money until 1971 when the gold peg was severed, either by market evolution or official declaration. It became a new form of money, pure credit-based money.

Is Bitcoin Ghost Money?

Snider stated that "quasi-money is often one solution to inelasticity," not that all solutions to inelasticity are quasi-money. Yet, that is what he’s doing when he extrapolates that because bitcoin is providing new monetary liquidity in a time of eurodollar shortage, that bitcoin is ghost money.

Currency shortages can be solved by introducing a whole new money, and as the old money suffers from shortage, the new money, with an all-new store-of-value anchor, can become the primary unit-of-account. This is not a ghost money process, it's a money replacement process, something the Monetarists’ model cannot contend with.

“This forms the basic argument of so-called Bitcoin maximalists who see particularly the Federal Reserve but really all central banks as having set loose to ‘money printing’ excesses. They’re killing their currencies by creating too much, and cryptos are the offered antidote to ‘devaluation.’ No.It is, point of fact, the opposite.

Just like the bullion famine, what crypto enthusiasts of all kinds are reacting to — and basing their buying of digital currencies on — is the central bank response to an otherwise severe and constraining monetary shortage.” — Jeff Snider

Snider is right. I have to give him props on opening a lot of people's eyes on this. We do have deflationary pressures today, but bitcoin is a hedge against inflation and deflation as a counterparty-free asset. It just so happens the overriding force in the economic environment today is a deflationary pressure of a credit collapse, which simulates currency shortage. While more quantity but increasingly less productive debt is money printing, meaning there is inflation, it also increases the debt burden relative to circulating currency. It creates a debt-to-income problem that manifests as a monetary shortage.

“Digital ghost money for a new age of shortfalls.” — Jeff Snider

Snider sees bitcoin as a new ghost money, where I see new money. Ghost money is no threat to replace the monetary standard, because it is a derivative of that standard, like stablecoins. U.S. dollar stablecoins will not replace U.S. dollars. They are a perfect example of ghost money.

As Snider said above, quasi-money (ghost money) is only one solution to a currency shortage, yet he labels all solutions as ghost money regardless of makeup.

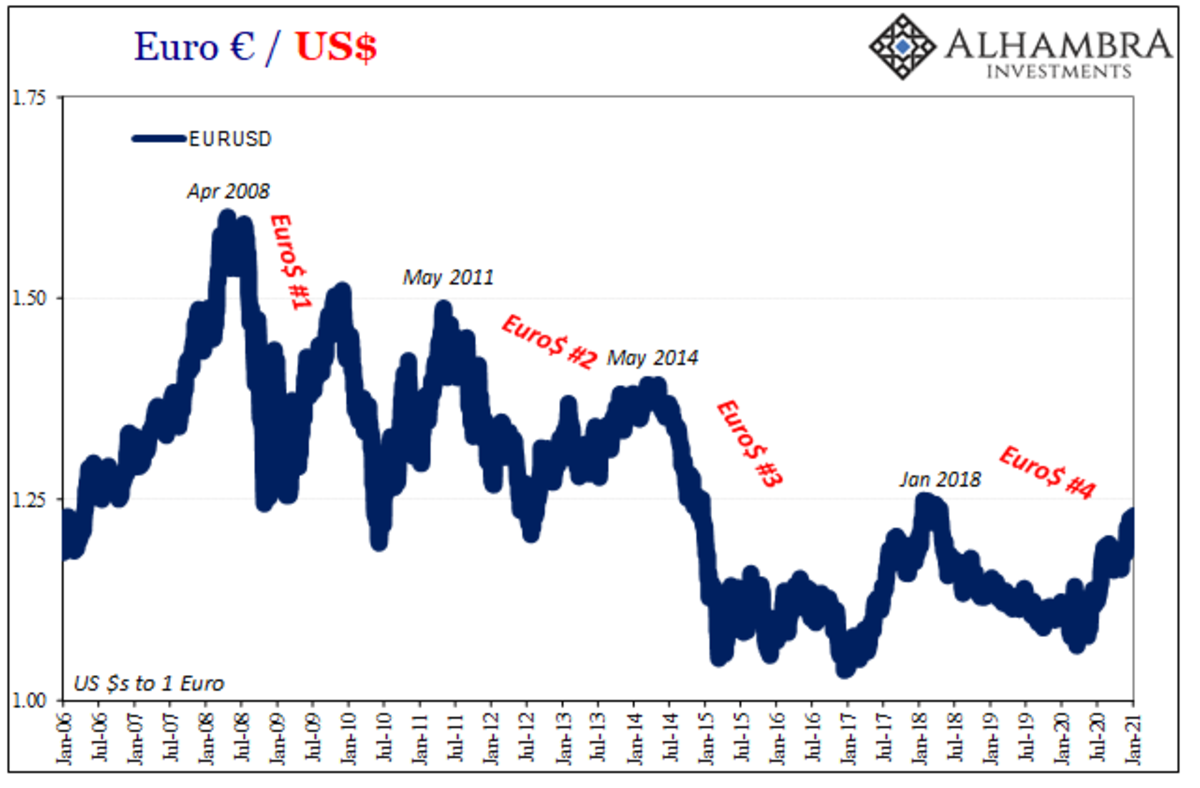

Snider offers evidence in the form of his eurodollar cycles and their timing with bitcoin cycles.

“In 2017’s bitcoin bubble, exactly the same. Its price in dollars went parabolic along with a clear bubble in digital offshoots, now-forgotten ICO’s, the frenzy never lasted long because the premise behind its price surge was entirely faulty. Once the dollar instead caught its Euro$ #4 bid, renewed acute shortage, bitcoin’s price sunk like a rock.” — Jeff Snider

They do match pretty well with bitcoin tops. Below is the best chart I could find of his with dates. However, many of his other charts have different dates for these cycles.

Source: Jeff Snider

Source: TradingView

Pretty convincing, but it shouldn’t be a surprise — demand for bitcoin is a part of the larger global market for money. Bitcoiners would definitely agree. When dollar supply is tight during these eurodollar events, bitcoin loses a bid. However, if bitcoin truly were just a ghost money derivative of the eurodollar, it would not set higher highs and higher lows each cycle.

The reason bitcoin can set those new highs each time is because bitcoin is a new money, and is slowly becoming entrenched next to the eurodollar not as a ghost money of it.

Turning back to the Great Bullion Famine, it was followed by the explosion of ghost money, but what followed that expansion is even more interesting. What happened in the 18th century in regards to ghost money and new money? Britain went to a gold standard in 1717 (officially in 1819). It changed money from which the store-of-value function was derived.

The gold guinea (7.6885 grams of fine gold) was not a new ghost money. As I argued above, the eurodollar itself, initially a response to the currency shortage in the first half of the 20th century, evolved eventually into a new store-of-value in a pure credit-based money.

But what if we bring Snider's position full circle, when he claims that the eurodollar is still ghost money today, a position gold bugs have argued for years. What if we are still on a quasi-gold standard, because central banks hold most of the gold. (Ron Paul famously asked Ben Bernanke why the Federal Reserve held gold if it was demonetized. His response, "it's tradition, long-term tradition.")

This interpretation of the current eurodollar system would then make it a ghost of a ghost, ultimately based on the same store of value. It would also make the current incarnation of the eurodollar just the end-phase of another ghost money experiment, ready to be replaced by a new money, the same way the British gold standard replaced the international silver standard.

Either way you take it, that the current eurodollar is a new money because it is a pure credit-based money, or that it is the ghost of a ghost still connected psychologically to a gold standard, both these positions support one conclusion. The ultimate end of the process Snider outlines — starting from a currency shortage, to dealing with inelasticity through ghost money, and finally back to economic health — is a new form of money.

Bitcoin is a new store of value to undergird the financial system as it desperately tries to throw off the currency shortage restraints at the end of an epic global credit cycle. Bitcoin is not a ghost of the old, it is the unconstrained new.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.