Editor's Note: This is an opinion piece by Andrew Quentson; the views and opinions expressed are those of the author.

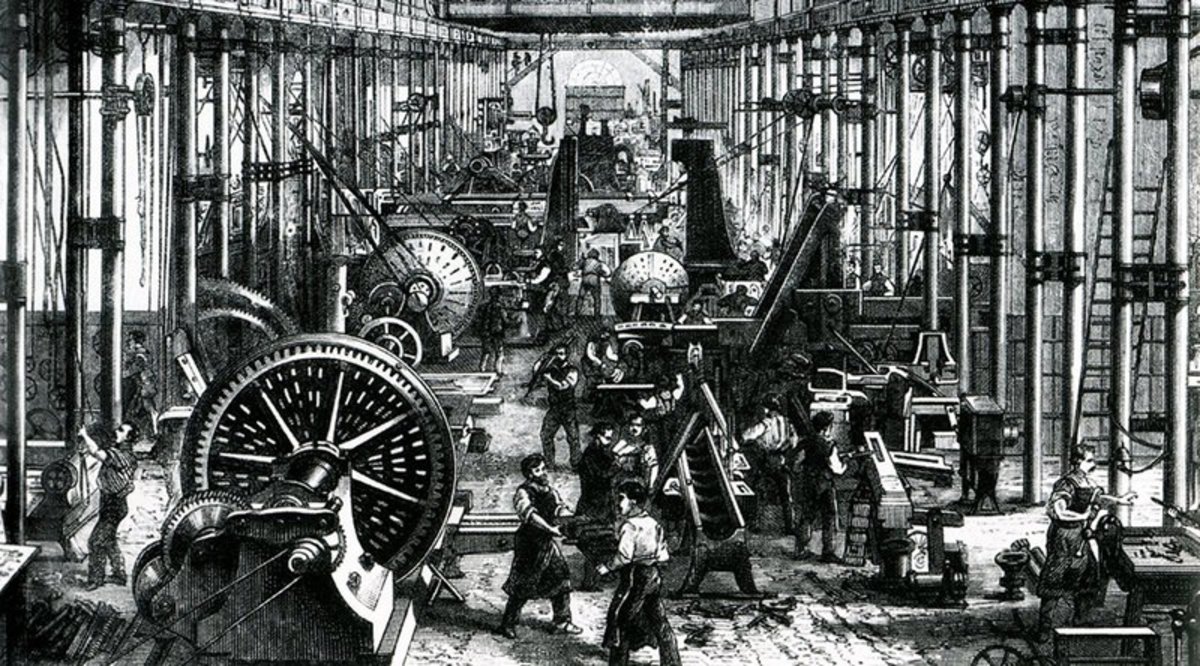

Is a fourth industrial revolution underway? Advancements in information-sharing technology, including data analytics, cloud computing, wireless sensors, smart contracts, decentralized autonomous organizations and blockchain technology seem to be fuelling not just a disruption but a revolution, fuelled by the invention of Bitcoin and blockchain tech.

According to a recent report, almost 90 percent of 800 experts surveyed by the World Economic Forum (WEF) believe that the Internet of Things (IoT) will reach a tipping point of 1 trillion connected devices in a decade. Moreover, 58 percent of the experts believe that 10 percent of global gross domestic product will be stored on blockchain technology by 2025.

From smart young men and women in their basement garages to pioneering giants such as Intel, a race is underway to make possible what seems futuristic: traffic managing itself, lights operating on their own, cars communicating with each other, charging stations buying products from manufacturers, refrigerators ordering your dinner ‒ and that’s only the low-hanging fruit.

The first industrial revolution followed the invention of steam power in 1784; mass production sparked the second revolution of the 1870s; and the invention of electronic and IT systems in the 1970s led to the third revolution. The fourth revolution showing signs of being well underway could be identified as that of the “cyber-physical systems.”

The Rise of the Intelligent Machines

What has slowly been building for two decades has started to gain steam due to the invention of digital currencies such as Bitcoin and Ethereum. Sometimes referred to as programmable money, these currencies and systems allow machines to have their own Bitcoin addresses, which function much like bank accounts due to Bitcoin’s permissionless nature. In combination with other technologies, “bank account power” gives machines, in effect, a level of intelligence that allows them to manage and allocate funds according to stated rules.

A new study describes a business model for these machines, one currently practiced by a handful of startups such as Slock.it. In describing the need for intelligent machines to have access to data, and the issues that arise when they encounter difficulties due to centralized providers’ account requirements, the study suggests a solution in the creation of decentralized autonomous organizations (DAOs). To fund DAO creation, a token is issued and then freely traded, with its value reflecting the productivity of the DAO. In this way the machine can access the data directly and pay for it digitally.

In its foundation, the DAO is simply code. But this code allows it to speak by sending or receiving information, act by making payments, and even think – albeit what we have told it to think – by analyzing data and making decisions, according to the rules, on the amount that is to be invested and the nature of such investment.

Billions Are Pouring In

According to a May 2015 report by CNN Money, a small number of well-capitalized Silicon Valley companies were a year ago sitting on hundreds of billions of dollars due to the uncertainties of the recent recession. However, as new opportunities arise, they are now apparently starting to invest more as they position themselves for what a Cisco report estimated in 2013 to be an almost $15 trillion IoT market in the next decade.

Fintech, a subset of IoT and itself an umbrella term for technology-empowered financial innovation with blockchain tech a front-seat driver, experienced more than 60 percent growth in the first quarter of this year with global investment rising to $5.3 billion.

The sleeping giants are once again moving. Intel quietly went to China and, signalling a shift in pace, asked their manufacturers to focus on IoT products. HP announced a new partnership to study “intelligent transportation.” IBM opened a completely new IoT research center in combination with the University of South Carolina. Meanwhile, Microsoft is keen to introduce developers to Azure IoT, with some taking advantage of the opportunity to ensure their beer is cool and refreshing.

While many components are needed to build this new future, permissionless, programmable money is the energizing fuel. For the first time, digital currencies allow machines to exchange value, trade, negotiate, buy and sell. Previously, giant centralized institutions acted as gatekeepers, requiring permission for access to their infrastructures, thus making it difficult, if even possible, for machines to hold money. Bitcoin has helped change that.

One of the genius aspects of Bitcoin is that it turns money into pure and free information, thus transforming physical cash and gold into the natural habitat of machines which are experts at managing, storing, manipulating and communicating information.

However, like the laying of the railroads or the Internet cables, we are still at the infrastructure-building stage. Some suggest that advancements in technology are now becoming exponential, and, according to the WEF study, will hit a tipping point in the next 10 years, transforming the world in the process and giving rise to a full-blown revolution of intelligent machines.