As the price of Bitcoin continues its steep correction in 2018, Bitcoin miners find themselves fighting over scraps.

Hunger Games

The price of Bitcoin has fallen roughly 70% from its all-time high of nearly $20,000 in mid-December. Early Tuesday morning, the price of one Bitcoin nearly touched $6,000, before bouncing back to $7000.

While this sharp decline in price potentially signals a buying opportunity for some savvy investors looking to grab some of the dominant cryptocurrency at a steep discount, Bitcoin miners are left feeling the pain.

Over the last two years, the computational power needed to successfully complete a block has risen 18-fold. A 21-fold price increase over the same time, however, had helped Bitcoin mining remain profitable against rising energy costs. Today, that’s simply not the case.

Mining Bitcoin has suddenly turned into a dog-eat-dog fight for survival. According to analysis made by Bloomberg, only the largest miners utilizing top-of-the-line equipment bought at wholesale prices are turning profits amid the recent market downturn – and even then, only barely.

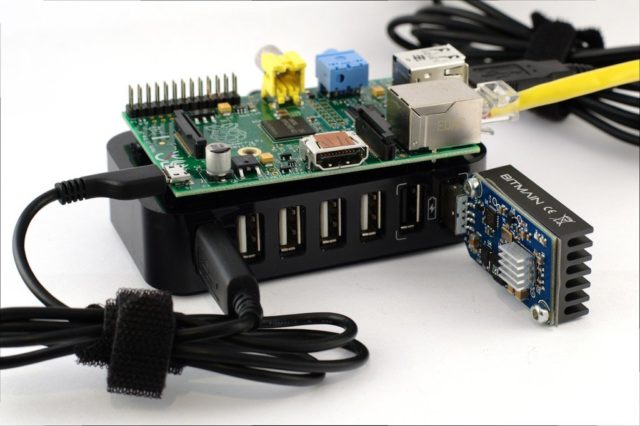

A Chinese miner running a top-of-the-line Bitmain Technologies Ltd.’s Antminer S9 at 13.5 TH/s, for example, would be pulling in roughly $80 a week in profits – assuming Bitcoin remained at its 50-day moving average of $13,200. Unfortunately, it did not. Instead, it has fallen to levels nearly half that price.

These days, the average miner is losing money, and even mining syndicates like Antpool are down 90% when compared to Bitcoin prices at the 50-day moving average.

Bloomberg New Energy Finance analyst Sophie Lu claims the industry’s most efficient miners can continue to operate profitably down to the level of $3,000 per Bitcoin but adds that “there are definitely some miners who are already out of the money.”

Thus, there are currently only two ways for Bitcoin miners to put their bottom lines firmly back in the green – the price of Bitcoin either has to get back on the up and up, or other miners have to call it quits. With fewer miners comes less competition, but history has shown most Bitcoin miners are reluctant to pull the plug on their operation, no matter how small.

With established Bitcoin miners already fighting for survival, FBG Capital’s Zhou Shuoji says now is probably not the best time to get involved in the industry, stating, “If you buy mining equipment now, it’s no longer profitable.” However, in a market prone to drastic swings in price action, it could become profitable again very soon.

Do you mine Bitcoin? If so, have you found the recent market downturn has made Bitcoin mining more costly than its worth? Let us know in the comments below!

Images courtesy of AdobeStock, Pixabay