Sponsored by CNBC and the prestigious Singularity University, the Exponential Finance 2015 took place in New York City on June 2 and 3.

The Singularity University is an educational center dedicated to high-impact, world-changing applications of disruptive, exponentially accelerating technologies. Exponential Finance 2015 examined how rapidly accelerating technologies such as artificial intelligence, quantum computing, crowdfunding, digital currencies, and robotics are rapidly disrupting businesses throughout the financial industry.

The Singularity University’s news portal Singularity Hub published a conference wrap-up titled “Exponential Finance: Who Will Be the Instagram or Uber of Finance?” Instagram and Uber are examples of what Peter Diamandis, co-founder and executive chairman of Singularity University, calls the disruptive potential of digital technology.

“Instagram was acquired for a billion dollars the same year Kodak went bankrupt,” writes Jason Dorrier. “Uber is a five-year-old transportation company worth $40 billion, and they don't own a single car or bus.”

According to Diamandis, the blockchain will spark similarly disruptive innovations.

“At its core, bitcoin is a smart currency, designed by very forward-thinking engineers,” said Diamandis. “It eliminates the need for banks, gets rid of credit card fees, currency exchange fees, money transfer fees, and reduces the need for lawyers in transitions … all good things. Most importantly, it is an ‘exponential currency’ that will change the way we think about money.”

In his talk at Exponential Finance, Diamandis added that simple and ubiquitous apps based on blockchain technology will change the banking industry and the insurance industry.It’s difficult to predict which companies will become the Instagram and Uber of exponential digital finance. Some of the established big players in the financial industry will probably continue to play an important role

.Using again the analogy with digital photography, while Kodak went bankrupt because it didn’t adapt fast enough, Canon transitioned to become a major player in the digital camera market. But the biggest and most disruptive innovations could come from applications and business models that few anticipate today, CNBC's Bob Pisani pointed out.

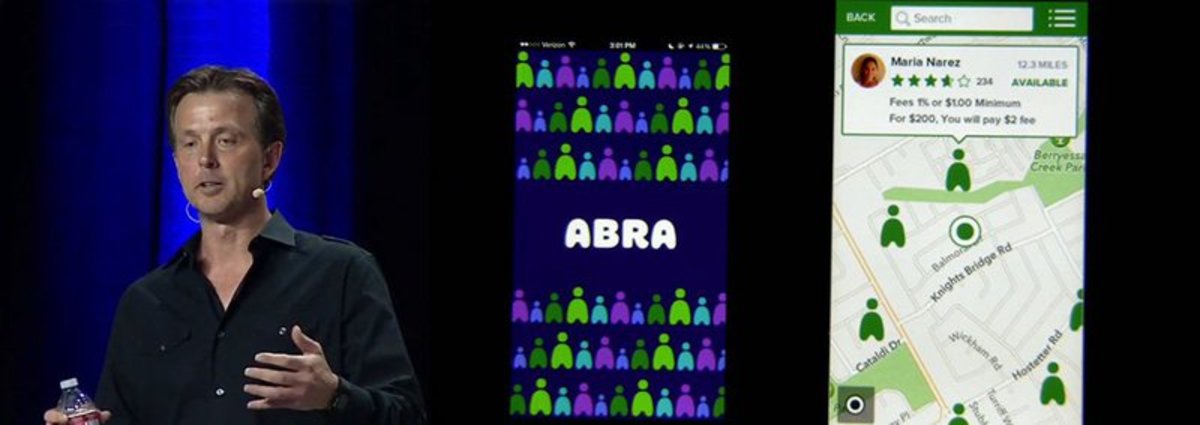

Just a few imagined the iPhone in the '60s, “Reality has surpassed science fiction,” said Pisani.Abra, a blockchain company that wants to take a slice of the $550 billion global remittance market, is showing what can happen when several digital technologies converge in one product. Combining an Uber-like peer-to-peer network with smartphone technology and the blockchain, Abra permits sending cash as easy as sending a text message.

At Exponential Finance, Abra’s founder Bill Barhydt estimated that we're three years away from modern smartphones becoming ubiquitous in the developing world. At that point, it's possible many of the world’s unbanked billions in developing countries will skip traditional finance, a little like how they leapfrogged landlines for cell phones.

Barhydt stated that Abra aims to be the Uber of digital cash. Abra, which allows people to send and receive money without a bank account, is building a global network of “human ATM machines,” empowered end-users who don’t even have to understand Bitcoin to use the underlying blockchain technology embedded in the Abra app.

Barhydt described Abra as “the world's first digital cash-based peer-to-peer mobile money transfer network.” The Abra app allows anyone with a smartphone to send money to any other smartphone anywhere on the planet any time of day. The goal of Abra is to be as “private as traditional cash, but without introducing any financial intermediary.”

"Traditional banking is really good at serving the global 5 percent to 10 percent of consumers who reach a certain income level," Barhydt told CNN Money. "The reality is, the majority of the planet is a cash-based economy, and banking doesn't work for those people."

CNN Money’s take is that Abra makes banking more accessible while completely cutting out the actual bank – and bank accounts may be the next thing to go obsolete.

Blythe Masters, the former J.P. Morgan star who now leads Digital Asset Holdings, a technology company that uses distributed digital ledgers to address operational challenges and settlement latency in both digital and mainstream financial assets, said that financial blockchain applications will be measured in the trillions.

Augur, a fully-decentralized, open-source prediction market platform based on blockchain technology intended to revolutionize forecasting, decision-making and the manner in which information consensus is collected and aggregated, was selected as one of the five finalists in the “Breakthrough” category at the XCS Challenge at Exponential Finance 2015.

A short video on the conference website shows the enthusiastic reactions of many attendees after the conference.

“I feel we’re on the cusp of a step function in technology,” says Catheryne Nicholson, founder and CEO of blockchain API provider BlockCypher.