The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The sell-off in the bitcoin market continued as the $30,000 level was briefly breached yesterday. The ugly price action has many market participants worried that the bull market has concluded, and it is very possible that for the time being bitcoin will consolidate in a range around $30,000.

Let's take a look at what the derivatives markets are telling us.

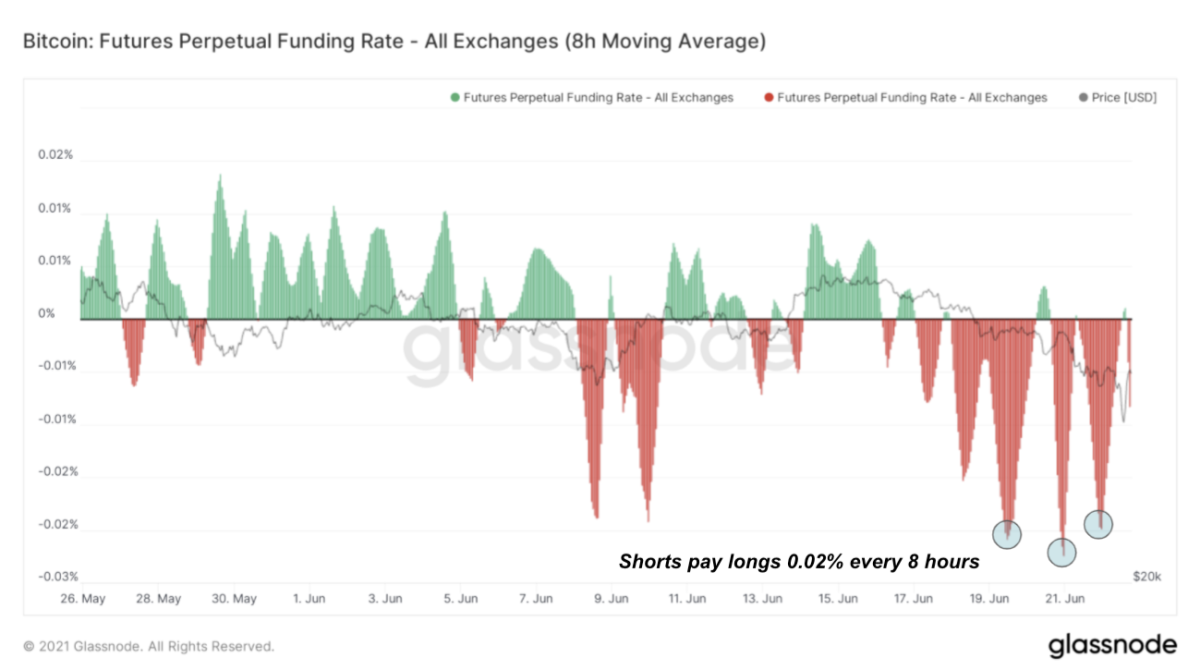

Perpetual Futures Funding

Traders on bitcoin derivatives exchanges have flipped notably bearish, even as bitcoin approached the $30,000 level, as shown by the negative funding.

For context, with funding at -0.02%, short positions pay long positions about 22% annualized just to hold a position. It is notable whenever bitcoin perpetual futures contracts have negative funding for sustained periods of time, meaning that large holders of the best performing asset are bearish.

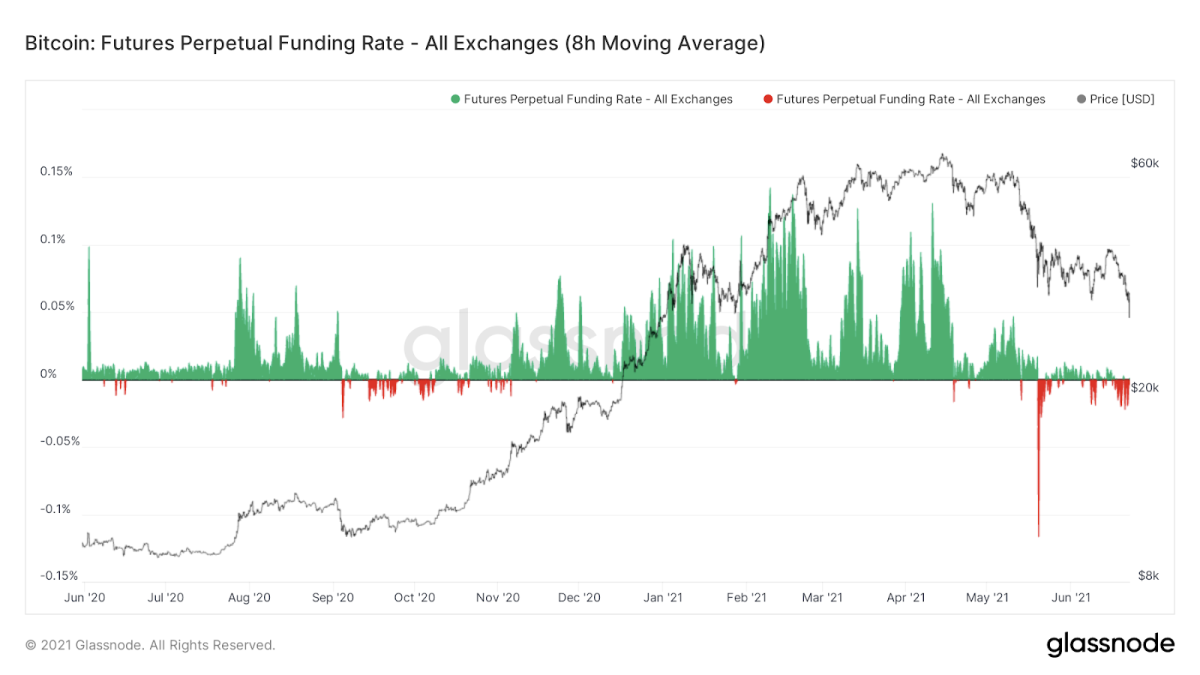

Below is the funding rate on bitcoin perpetual futures over the last year.

If one is looking for a solid contraindication to allocate a large amount of funds, negative funding and a futures curve in backwardation are two things to look for.

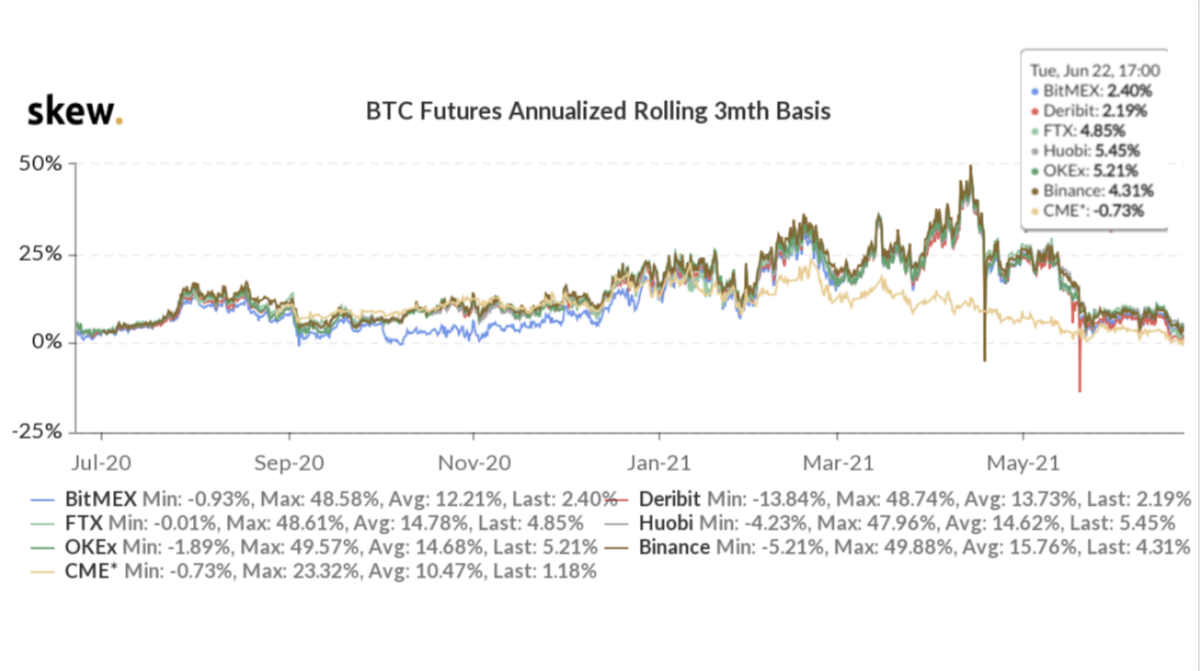

Annualized yields on three-month bitcoin futures are currently still in contango, but have contracted significantly from the April high and are currently around 5% for bitcoin-enabled exchanges, with the cash settled CME futures contract in backwardation.

What should be taken away from the negative funding on perpetual futures contracts and the very depressed contango yields on BTC futures is that the reflexivity of the bitcoin bull run is no longer present.

In the early months of 2021, Grayscale was buying hoards of bitcoin, MicroStrategy was hosting a virtual conference with thousands of businesses about bitcoin as a reserve asset, and traders/speculators were margin longing their bitcoin positions using bitcoin as collateral.

In hindsight, the ability to net near 50% annualized returns while holding a market neutral position (neither exposed to the upside nor downside of bitcoin) marked the local top, as there was not a sufficient amount of new capital flowing into the asset to capture the massive arbitrage opportunities present during the months of March and April.