Liquidity decline caused by BitMEX’s exchange policy is the main reason behind the latest bitcoin (BTC) price crash, latest analysis suggests.

The bitcoin market bloodbath has continued today, with BTC testing the $7750 support a few hours back. It all began yesterday, with the spread widening on BitMEX and futures contracts getting continuously liquidated.

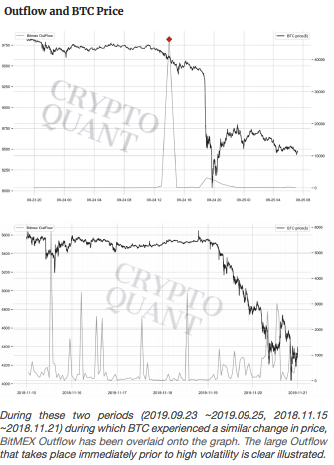

Connecting BitMEX Outflows and BTC Price

Yesterday’s downside BTC price move was well anticipated, but the speed with which it occurred was unexpected. According to reports furnished by CryptoQuant, an on-chain data solutions provider this can be largely attributed to ~$700 million worth of contracts liquidated during this decline.

Bitcoin outflows from BitMEX act as leading indicators for these mass liquidations, and the mass volatility that results. Being the largest bitcoin futures exchange out there, BitMEX is notorious for influencing BTC price action. How exactly the platform’s margin calls activity dealt a loss-laced blow to the top cryptocurrency needs a deeper insight.

Time and again flow models have been used as one of the key metrics for understanding bitcoin price behavior, and the analysis regarding the same is well-established. But standard models of inflow/outflow don’t really fit well with BitMEX.

Bitmex BTC outflows have a pretty pronounced effect on bitcoin’s volatility, which in turn can cause the price to appreciate as well as depreciate, courtesy, the exchange’s special withdrawal policy. While deposits are available round the clock, withdrawals happen only once during the day, at UTC 13:00.

In this constricted time-frame, outflows tend to exceed inflows by large multiples. Following which, a liquidity shortage, and an increase in the spread takes place. These attributes lead to BitMEX margin positions getting exposed to a liquidity shortage and cascading liquidations.

When the bitcoin outflow on BitMEX exceeds a certain point, the potential for these large moves increases significantly. Based on on-chain data, it appears that when more than 5,000 BTC is withdrawn in one day, the exposure to this volatility multiplies manifold.

Now moving on to what happened exactly.

From BTC Outflow to Bitcoin Price Volatility

Taking a quick glance at CryptoQuant’s on-chain data regarding bitcoin inflows and outflows from BitMEX on November 14, 2018, April 19 and September 25 i.e yesterday, it can be seen that there is a clear correlation between price volatility and outflows.

On each of these dates, the price volatility occurred within a short period following the BitMEX daily withdrawal at 13:00 UTC.

Once liquidity dried up, bitcoin price quickly responded. On September 24, on-chain it was recorded that 49141 BTC was withdrawn from the BitMEX wallet. Volatility followed within 5 hours, with the price falling over 8%. Due to the precision of the on-chain data, we can see the exact block in which the BitMEX outflows spiked.

What do you think about BitMEX’s role in causing the bitcoin market to crash? Share your thoughts below.

Images via Shutterstock, CryptoQuant