In the XRP lawsuit between Ripple Labs Inc. and the US Securities and Exchange Commission (SEC), the regulatory body has submitted a detailed reply to Hon. Sarah Netburn, United States Magistrate Judge for the Southern District of New York. This document, titled “Reply in Further Support of its Motion to Compel,” marks a significant escalation in the SEC’s pursuit of comprehensive discovery from Ripple, and is poised to potentially reshape the dynamics of this high-profile case.

XRP Lawsuit: SEC Demands Financial Docs

The SEC’s reply counters Ripple’s objections to the SEC’s demands for the production of audited financial statements spanning two years, the unveiling of post-Complaint Institutional Sales contracts, and responses to an interrogatory related to pre-Complaint Institutional Sales. Ripple’s defense, which labeled the SEC’s motion as “untimely” and purported that the requested data was irrelevant to the Court’s decision on remedies, is dismantled in the SEC’s submission.

The SEC, within its argumentative framework, emphasizes the timeliness and procedural validity of its discovery requests. It addresses Ripple’s assertion regarding the scope of discovery, highlighting the evolving nature of the litigation and referencing specific court documents to demonstrate the contemplation and subsequent endorsement of extended discovery periods.

The SEC stated, “Judge Torres endorsed this approach,” citing court documents that underscore the iterative and adaptive discovery process that has characterized the litigation. Central to the SEC’s argument is the asserted relevance of Ripple’s financial condition and its post-complaint Institutional Sales contracts.

The SEC effectively marshals legal precedents to buttress its standpoint, notably invoking the case of SEC v. Rajaratnam to underline the pertinence of a defendant’s wealth in determining penalties. The SEC’s reply read, “The Second Circuit explicitly rejected this argument, holding that ‘in calculating the size of a penalty necessary to deter misconduct, the extent of a defendant’s wealth is a relevant consideration.'”

In dissecting the implications of Ripple’s post-Complaint Institutional Sales contracts, the SEC’s narrative underscores the strategic importance of these documents in illuminating Ripple’s future intentions regarding XRP sales. The SEC positions these contracts not just as retrospective records, but as prospective indicators that might signal the likelihood of future regulatory transgressions.

The SEC’s document clarified, “The discrete post-Complaint contracts the SEC seeks are probative evidence as to this argument,” subtly indicating the potential of these documents to reveal patterns or intentions that may bear on future compliance or non-compliance with the court’s rulings.

SEC Targets Ripple’s Core Business

Pro-XRP lawyer Bill Morgan’s provided his perspective on the SEC’s strategic positioning via X. According to him, the SEC needs to show the Judge that ordering discovery of the post complaint contracts will not lead to a mini-trial of the status of post contract sales as Ripple argues.

“The SEC says it is not seeking a mini-trial or any determination on the legality of post complaint sales to institutions (including ODL customers). It asserts it does not need to do so to obtain an injunction they could stop those sales continuing”, Morgan remarked.

Moreover, the lawyer suggests that Ripple can argue in front of the court that it intends to structure future XRP sales (previously ODL) so that the company does not fall “within the scope of the summary judgment institutional sales category.”

Thus, Morgan expects that these filings will “not lead to a mini-trial, but there is a lot at stake with this issue. A wide injunction could do a little of harm to Ripple’s ODL business. I think there will be discovery ordered of these post complaint contracts.”

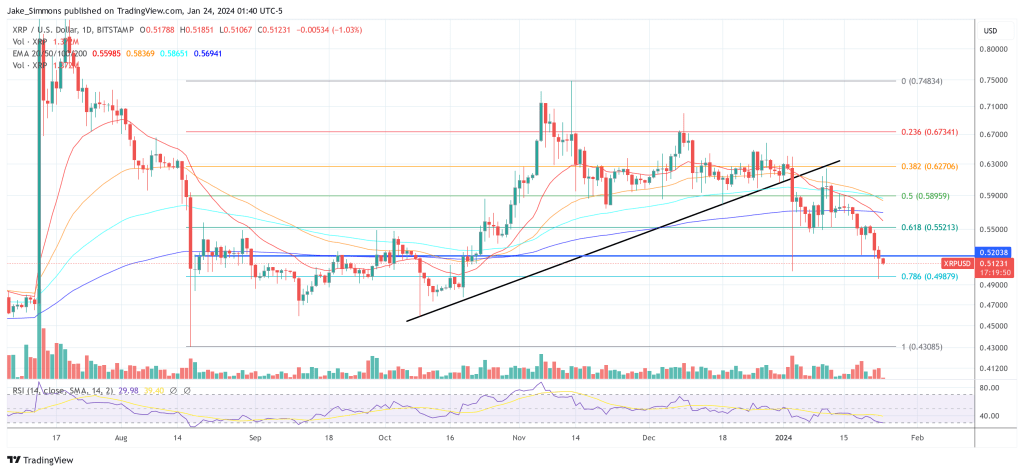

At press time, XRP traded at $0.51231.