Hong Kong is on the verge of a groundbreaking move in the Bitcoin space. According to a recent Bloomberg Intelligence report, the Hong Kong Securities and Futures Commission (SFC) is expected to approve spot Bitcoin ETFs with in-kind creations and redemptions in the upcoming second quarter. This development could significantly alter the landscape of crypto investments, potentially positioning Hong Kong as a leader in the global Bitcoin ETF market.

Noelle Acheson, a prominent voice in the crypto industry and author of the “Crypto is Macro Now” newsletter, weighed in on the potential implications of this move. “The Asian crypto market is much larger than the US crypto market in terms of volume,” Acheson stated.

She elaborated on two possibilities: the existing high volume might indicate that the market is already saturated, or it could suggest a deeper familiarity and comfort with crypto assets in Asia. “Listed ETFs in Hong Kong could channel a significant amount of money into ‘approved’ portfolio allocation,” Acheson added, hinting at the potential for a major shift in investment flows.

Adding to the discussion, Eric Balchunas, a Bloomberg ETF expert, underscored the significance of Hong Kong’s approach to allowing in-kind creations and redemptions for spot Bitcoin ETFs—a stark contrast to the US, which only allows cash creations. “This could help spark AUM and volume in the fast-growing region,” Balchunas commented, pointing out the strategic advantage Hong Kong might gain.

Caitlin Long, the founder and CEO of Custodia Bank, highlighted another key aspect of Hong Kong’s proposed ETF structure: the ability to withdraw Bitcoin directly, which ensures that investors are not just holding “paper bitcoins.” Long expressed her excitement about this development, stating, “If this is true (need confirmation), it’d be HUGE indeed — and it’d be ironic, given that Hong Kong, not the US, would be doing it. Meanwhile, US banks would watch from the sidelines as they’re left in the dust…”

Will Hong Kong’s Bitcoin ETFs Be Bigger Than Its US Peers?

The conversation around the potential of Hong Kong’s Bitcoin ETFs extended beyond industry experts to the wider crypto community. Bitcoin Munger, a renowned analyst on X, argued that the Hong Kong ETFs could serve as a far more bullish catalyst than those in the US.

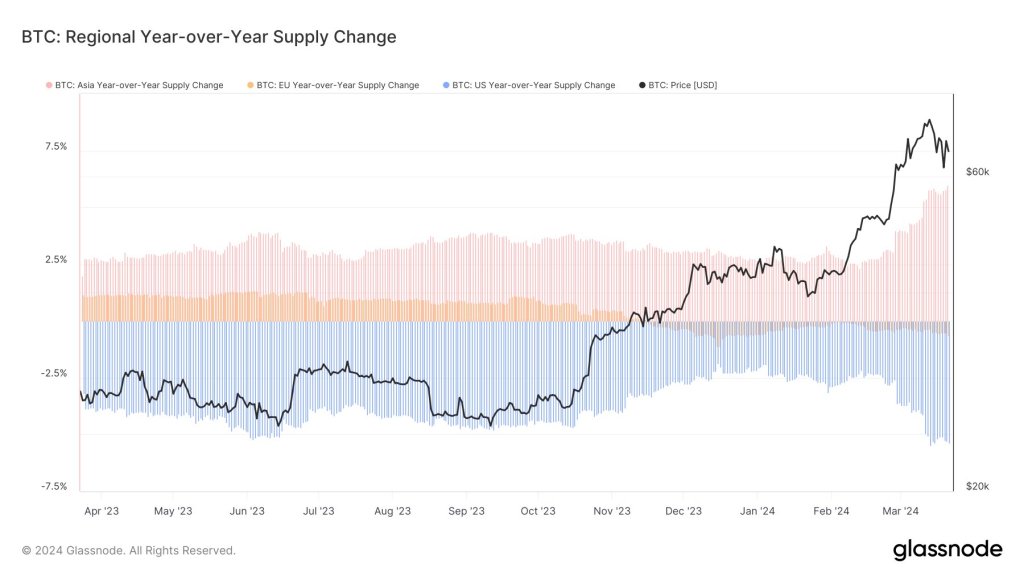

Citing data from Glassnode showing a year-over-year supply change of Bitcoin moving from West to East, he suggested that this trend strengthens the case for Hong Kong’s ETFs outshining their US counterparts. “Coins have been moving from West to East. Makes a strong case that the Hong Kong ETFs are going to be a far more bullish catalyst than the US ETFs,” he remarked.

However, not everyone is convinced of the disproportionate impact of Hong Kong’s ETFs. In a spirited exchange, Eric Balchunas cautioned against overestimating Hong Kong’s market size relative to the US. “Let’s not get crazy now. HK tiny vs US,” Balchunas replied.

Bitcoin Munger retorted by suggesting that the success of Hong Kong’s ETFs might not be fully appreciated yet, and any positive surprises could leave analysts, including Balchunas, taken aback.

When a user raised a pertinent question about the accessibility of these ETFs to Mainland Chinese investors, Balchunas responded negatively, “No not available.” This dampens some enthusiasm, as the significant Chinese market, amidst a real estate crisis and an inclination towards gold, might have been a strong supporter of Bitcoin through these ETFs.

At press time, BTC traded at $70,158.