The realm of cryptocurrency ETFs appears to be now expanding, yet not all digital assets are poised for an easy transition into this financial product. GSR’s recent analysis of the potential for ETFs across various crypto has brought forward insights that place XRP and Cardano in a challenging position for ETF adaptation.

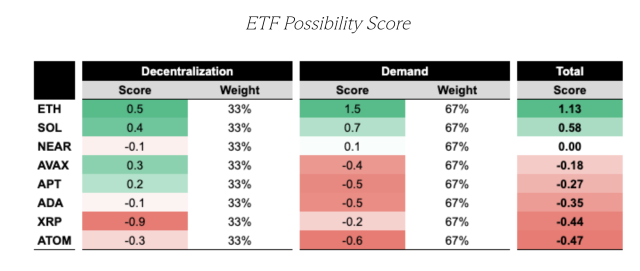

Using a comprehensive scoring system, GSR evaluates the cryptocurrencies on a scale integrating decentralization metrics and market demand indicators.

XRP And Caradano: Never To See The Light of ETF?

Decentralization is critical, examining aspects such as permissionless participation and the diversity of hardware used in the networks.

Key metrics like the Nakamoto Coefficient measure the concentration of operational power within the network, revealing vulnerabilities to potential collusion or control by several entities.

For XRP and Cardano, the decentralization scores were notably low, with XRP at -0.9 and Cardano at -0.1, indicating concerns over their network structures.

In addition to decentralization, demand potential is equally significant, considering market cap, trading volume, and community activity levels. These factors predict how much interest there might be in an ETF based on each cryptocurrency.

Despite their popularity, XRP and Cardano scored -0.2 and -0.5 in demand metrics, placing them behind other cryptocurrencies exhibiting stronger future market demand indicators.

This combination of lower decentralization and demand scores in GSR’s analysis suggests that XRP and Cardano might face substantial hurdles before seeing the launch of their ETFs, especially in a market that is quickly adapting and evolving.

Meanwhile, in contrast to the sluggish outlook for XRP and Cardano ETFs from the GSR report, other cryptocurrencies like Ethereum, Solana, and NEAR are seeing more optimistic evaluations.

Spotlight on Solana And The Other Approved ETFs

Notably, merging the evaluations from the assets, GSR’s methodology for the ETF Possibility Score assigns a weight of 33% to decentralization and 67% to demand in its overall scoring system.

Regardless, VanEck, a significant player in the asset management field, has taken a pioneering step by filing for the first-ever Spot Solana ETF with the US Securities and Exchange Commission (SEC).

This move underscores Solana’s growing stature as a notable competitor to Ethereum. According to Matthew Sigel, VanEck’s head of digital asset research, “With its combination of scalability, speed, and low costs, the Solana blockchain has the potential to provide an enhanced user experience across a wide range of use cases.”

However, the landscape for Bitcoin and Ethereum remains mixed. While Bitcoin spot ETFs have experienced fluctuating inflows, Ethereum’s potential ETF is still pending final S-1 approvals, anticipated to materialize soon.

The market’s reception to these developments has been cautious, reflecting the slow pace of inflows for spot Bitcoin ETFs despite a positive trend over recent days.

Featured image from DALL-E, Chart from TradingView